> Adnoc to explore hydrogen potential in India

> Siemens Energy makes headway with hydrogen

> Australian firm and Jordan hold hydrogen talks

> Saudi Arabia moves on $5bn hydrogen project

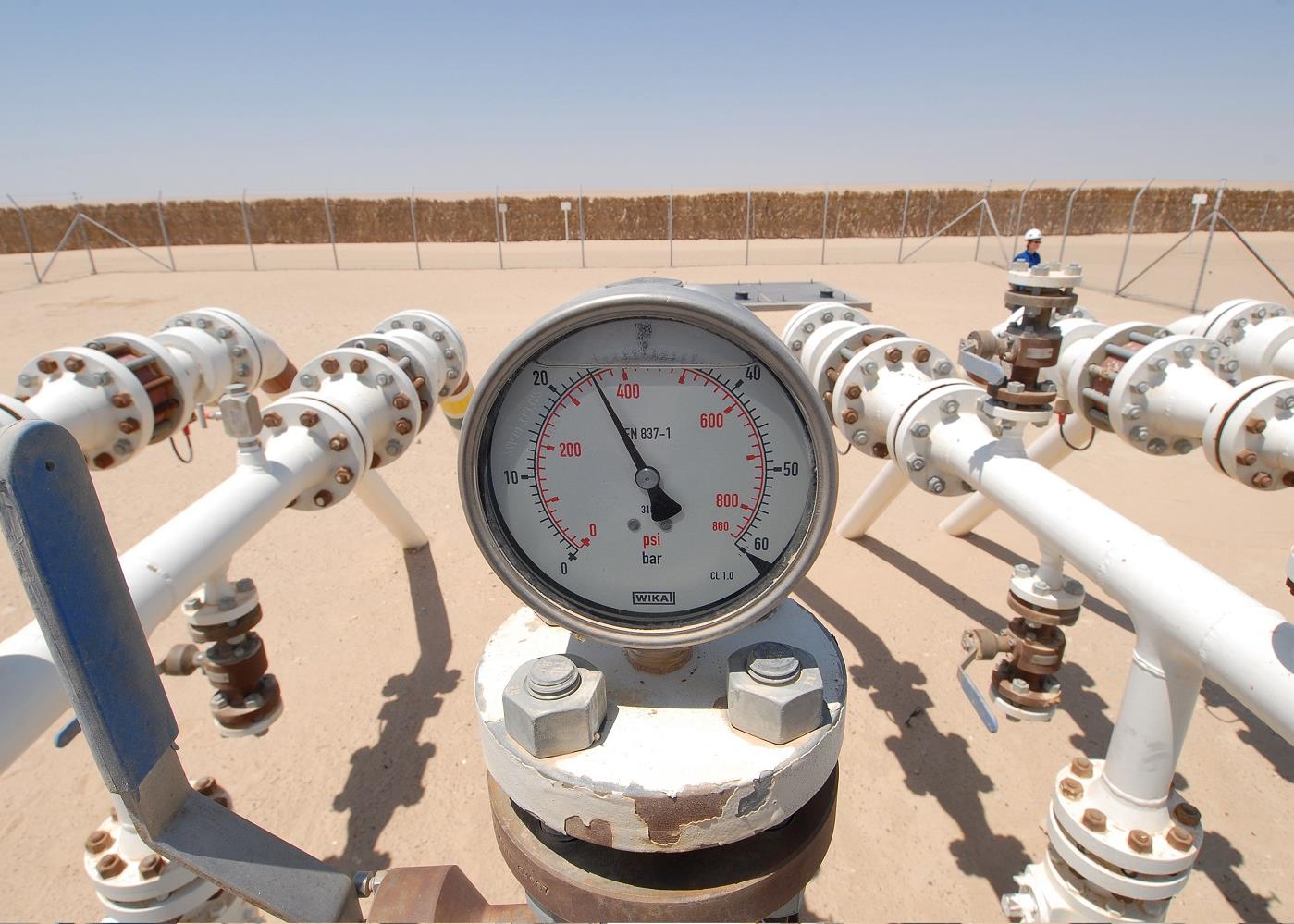

The hydrogen supply chain is far from being global yet. While the most practical and effective way to transport hydrogen is in its gaseous form via pipeline networks, the latter are relatively scarce, localised in and around large industrial basins and not optimally positioned globally.

Most hydrogen production is concentrated in petrochemical basins and corridors, for example along the US’ Gulf of Mexico coastline; in Northern Europe, linking Dunkirk, France to Goteborg, Sweden; and between Jubail and Yanbu in Saudi Arabia.

Guidepoint’s European Hydrogen Backbone report estimates that Europe will need to invest up to €65bn ($77.9bn) by 2040 to expand the existing pipeline grid into a 23,000-kilometre network capable of transporting 1,100TWh-worth of hydrogen energy to support the industry on the continent.

All in all, it will require trillions of dollars to expand the world’s hydrogen infrastructure to distribute blue and green hydrogen from production locations to end-use markets.

Using existing pipelines

The use of existing natural gas pipelines to transport blue hydrogen is a scenario that would be ideal, but has limitations.

The use of existing natural gas pipelines to transport blue hydrogen is a scenario that would be ideal, but has limitations.

Converting pipelines will be almost as costly as laying new ones. They will have to be surface treated to avoid embrittlement, whereby hydrogen weakens the metal, eventually leading to cracks, leaks and even catastrophic breakages.

Another problem will be replacing the sensors and electronic systems along the pipeline with explosive-atmosphere compatible devices.

A more practical idea is to blend hydrogen with natural gas and transport the resulting mixture in existing gas pipelines. Piggybacking on existing gas networks stands on its own merits economically as it readily enables the transportation of hydrogen at a limited incremental cost. However, for material compatibility and energy density reasons, one cannot reasonably go beyond 20-25 per cent hydrogen in methane.

This solution is convenient when the end usage of hydrogen is in a power plant, or a steel or cement mill, but if hydrogen is to be used in a high purity application, one will have to invest in a comprehensive gas separation system at the destination point.

Common technologies for this are pressure swing absorption and selective ceramic membranes, but again, the higher the purity required, the higher the capital intensity and energy consumption.

Hydrogen storage is another critical piece of the supply chain, both to convert renewable power into hydrogen for later use, and to facilitate transport by sea or where pipelines are absent. There are three conventional ways of storing hydrogen: in its gaseous form, compressed at high pressures; in its liquid form at -253°C; or trapped in metal hydrates, such as lithium aluminum hydride or magnesium hydride.

Storage issues

The first two methods of storage significantly increase the energy density of hydrogen per unit volume, which is ideal for mobility and energy storage applications, but both methods are energy intensive and rely on advanced equipment.

For example, 4kWh of energy are needed to liquefy 1kg of hydrogen, equivalent to the energy needed by an electric car to travel 25km. Storing hydrogen at 700 bar meanwhile requires expensive composite type-4 pressure vessels.

Metal hydrates are the most compact way of storing hydrogen, but they only capture a single digit percentage of hydrogen per unit volume and are generally quite heavy, making them difficult to use in small and large mobility applications.

To overcome these issues, the use of chemicals in liquid form as hydrogen carriers is emerging as the most practical and economically viable alternative. Liquid ammonia is at the top of the list, owing to its hydrogen storage density per volume of 108 kg/m3, typically equivalent to storing 1.5 times more hydrogen than liquefied hydrogen at a given fixed volume.

Liquid ammonia is also relatively easy to transport and does not require sophisticated equipment. It can be stored and transported at -33.3°C at atmospheric pressure or at 20°C at 7.5 bar. Another advantage is that ammonia is widely used in the chemical industry, with existing infrastructure that can be leveraged for the greater good of the hydrogen economy.

Several Gulf states have pledged to become ammonia champions by the turn of the decade. In September last year, Saudi Aramco exported an industrial scale shipment of 40 tonnes of blue ammonia to Japan in a world first. At Neom, a $5bn, 4GW plant is being constructed that will produce 1.2 million tonnes a year of green ammonia, primarily for export to Asia and Europe.

In March, Adnoc and Korea’s GS Energy agreed to explore ways to grow Abu Dhabi’s blue hydrogen economy and carrier fuel export position. Again, ammonia will be the preferred carrying medium.

The same month, India’s ACME inked a memorandum of understanding to develop a facility capable of generating 2,200 tonnes a day of green ammonia at Oman’s Duqm Special Economic Zone for supply to Europe, the US and Asia.

Such initiatives are hugely positive, but given the capacity challenges, the region will need many more like them, and developments of even greater scale, to position the region as a vital link in global green hydrogen supply chains.

You might also like...

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

Algeria signs oil deal with Swedish company

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.