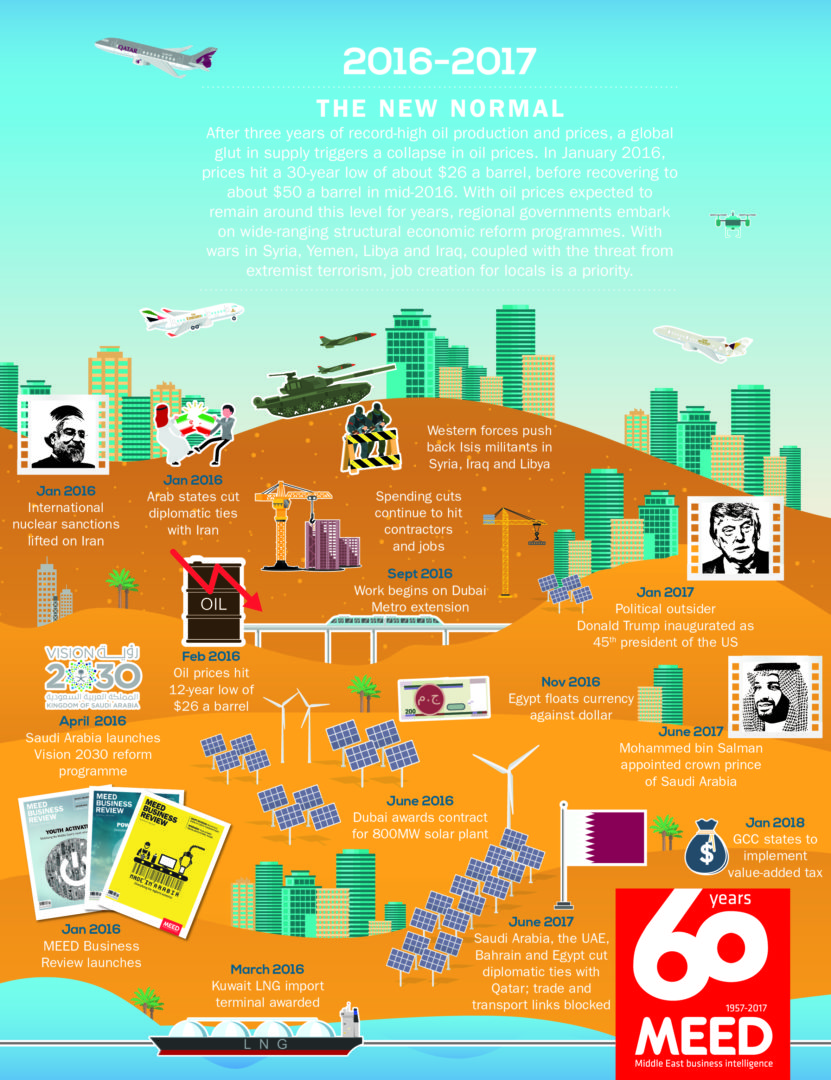

After three years of record high oil production and prices, a global glut in supply triggers a collapse in oil prices. In January 2016, prices hit a 30-year low of about $26 a barrel, before recovering to about $50 a barrel in mid-2016. With oil prices expected to remain around this level for years, regional governments embark on wide-ranging structural economic reform programmes. With wars in Syria, Yemen, Libya and Iraq, coupled with the threat from extremist terrorism, job creation for locals is a priority

MEED 2016 infographic latest

MEED 2016 infographic latest

From 2011 to mid-2014, rising demand and fears of supply disruptions pushed oil prices and production to record levels, delivering cash windfalls into the GCC that producers recycled into infrastructure programmes.

The Gulf producers were not the only ones benefiting from the oil boom. Output soared from non-Opec producers and spending grew on unconventional sources, particularly US oil shale. By the middle of 2014, global demand slowed and the worlds energy markets were facing an oil glut. Prices crashed, losing 55 per cent over the following six months.

Led by Saudi Arabia, Opec producers responded by increasing output to drive down prices and remove high-cost oil shale producers from the market, while at the same time maintaining domestic investment programmes by drawing down reserves, and running budget deficits. But by the start of 2016, oil prices hit 30-year lows and it was becoming apparent that they were going to stay low.

Governments changed tack, launching fiscal consolidation drives aimed at cutting spending and reducing budget deficits. Capital spending was slashed and the value of contract awards fell 37 per cent in 2016; 60 per cent in Saudi Arabia. Meanwhile, a freeze on contractor payments in Saudi Arabia triggered a painful cash-flow crisis.

At the same time, governments started to chart a new course for development, unveiling reform programmes aimed at privatising state services and leveraging private sector investment. Previous reform drives had failed as oil prices recovered. This time it appeared that oil had found a new normal and the region had to adapt.

The economic downturn coincided with rising regional tensions. Increasingly insecure about growing Iranian influence following the lifting of nuclear sanctions in January 2016, Saudi Arabia started to assert itself across the Arab world. The civil wars in Yemen, Syria and Iraq along with strife in Egypt and Bahrain became part of a power struggle between Riyadh and Tehran.

In May 2017, Saudi Arabia, the UAE, Bahrain and Egypt cut diplomatic ties with Qatar and closed transport routes. Doha had for years annoyed other GCC members with a foreign policy often at odds with its neighbours. With regional tensions rising, Riyadh and Abu Dhabi wanted Qatar to decide on which side of the regional schism it sat.

You might also like...

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

Algeria signs oil deal with Swedish company

19 April 2024

Masdar and Etihad plan pumped hydro project

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.