Survey shows incidences up in Middle East

The proportion of companies in the region that report suffering from economic crime in the past two years has increased from 21 per cent in 2014 to 26 per cent in 2016, according to UK-based PwCs Middle East Economic Crime Survey.

This is below the global rate of 36 per cent.

However, the rise may be due to growing awareness and better auditing in the organisations surveyed.

There has been a lot more awareness in the past two years and peoples understanding of what is ethical or not has changed, says Tareq Haddad, partner for forensic services at PwC. Organisations have improved their systems, but the level of economic crimes discovered by accident is much higher than the global average.

Catching crimes

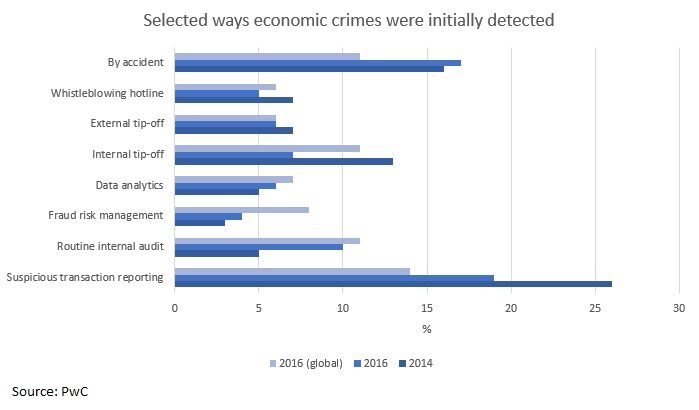

About 10 per cent of economic crimes were uncovered during an audit, compared with 5 per cent found during audits in 2014. Suspicious transactions accounted for the discovery of 19 per cent of economic crimes, while 17 per cent were found by accident. Globally, 11 per cent of economic crimes are uncovered by accident.

Selected ways economic crimes were initially detected

A further 20 per cent of companies did not know if they had been affected by economic crime, while one-quarter had never carried out fraud risk assessment.

Opportunity was the biggest driver of economic crime, according to PwC, with 63 per cent of respondents identifying it as the biggest risk factor.

If controls are loose, this is going to increase, says Haddad. It is important to reduce opportunities.

The cost of such crimes can be high; 10 per cent of the cases uncovered cost the organisations more than $5m. However, this represents a 2 per cent dip on 2012 figures.

Estimated losses through economic crime

Of the infractions reported, 63 per cent were asset misappropriation, 24 per cent involved bribery and corruption, and 25 per cent procurement fraud. Most respondents (83 per cent) said they would rather lose a sale than pay a bribe.

Selected types of economic crimes reported

Cybercrime

Cybercrime has become a high-profile issue. Although the survey found a decrease in reported incidences from 37 per cent in 2014 to 30 per cent in 2016, John Wilkinson, partner and leader of the Middle East forensic services team at PwC, says it is beginning to have more impact, Jurisdictionally, it is more complicated as it tends to be cross-border, he says. It is very challenging to protect yourself on a legal basis, so organisations need to be more vigilant.

Both Saudi Aramco and Qatars RasGas suffered high-profile cyber attacks in 2012.

Any increase is partly due to economic crimes that used to be cash-based moving to computer transactions, and partly due to poor preparation by companies, as only one-third have a response plan in place. About 21 per cent of firms told PwC they did not know if they had been a victim of cybercrime.

Many organisations are catching up and building systems to respond, says Haddad. Hackers are steps ahead and Middle East organisations are vulnerable to reputation damage and theft of information and assets. They are not well protected, but there has been a lot of investment recently.

The PwC survey covered 290 companies in 12 Middle Eastern countries.

You might also like...

Qiddiya tenders site office package

25 April 2024

Kuwait’s oil sector could be disconnecting from politics

25 April 2024

Kuwait launches oil and gas project portal

25 April 2024

Aramco receives proposals for offshore LTA pool

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.