Riyadh unveils its much-anticipated reform programme, IMF downgrades regional outlook as oil prices rally, and GCC states reaffirm support for Cairo

Saudi Deputy Crown Prince Mohammed bin Salman al-Saud

Saudi Deputy Crown Prince Mohammed bin Salman al-Saud

Saudi Arabias cabinet approves 2030 economic plan

A special session of Saudi Arabias cabinet on 25 April approved the much-anticipated Vision 2030 economic plan for the kingdom, setting out Riyadhs roadmap for sweeping economic reforms and its strategy for the next 15 years. Following the approval of the draft plan, the Council of Economic Affairs and Development was mandated to establish the framework and mechanisms to implement the programme. At the session, the cabinet stated that all ministries and other related government bodies will be required to take the necessary measures to implement the Vision 2030 plan.

IMF cuts global growth forecast on oil and political risks

The Washington-based IMF has cut its world economic growth forecast for the fourth time in a year, saying the global economy is vulnerable to shocks such as sharp currency devaluations and worsening geopolitical conflicts. In its World Economic Outlook report, published on 13 April, the fund forecast global economic growth of 3.2 per cent in 2016, down from a forecast of 3.4 per cent in January. The fund highlighted a worsening economic slowdown spillover from China, and the impact of low oil prices on emerging markets as increasing worries. It also listed persistent economic weakness in Japan, Europe and the US as contributing negative factors for global growth. For the Middle East and North Africa region, 2016 growth estimates were cut to 3.1 per cent, down from 3.6 per cent.

Doha oil producers meeting ends without agreement

Oil prices fell back in late April from a 2016 high of $46 a barrel, following three weeks of gains. Brent crude reached a high despite an ongoing global glut and the failure of the oil producers meeting in Doha on 17 April to agree a production freeze.The failure to reach an agreement was blamed on Irans decision not to attend the summit and Saudi Arabias reluctance to freeze production unless its regional rival did the same. Brent crude has recovered from a low of $27 a barrel in January. US oil services company Baker Hughes reported on 22 April that the US rig count had fallen to 343, the lowest number since November 2009. More than 700 US rigs were drilling for oil in April 2015.

Saudi banks downgraded

Kingdom Tower in Saudi Arabia

Kingdom Tower in Saudi Arabia

US-based Fitch Ratings on 12 April downgraded Saudi Arabias long-term ratings due to lower estimates for oil prices in the next two years. The countrys long-term foreign and local currency issuer default ratings (IDR) were downgraded to AA- from AA, with Fitch maintaining its negative outlook for the kingdom. The agency revised its assumptions for crude prices down to $35 a barrel for 2016 and $45 a barrel for 2017. US-based Standard & Poors (S&P) on 2 April downgraded five banks in Saudi Arabia, including National Commercial Bank. The IMF projects Saudi real GDP growth in 2016 of about 1.2 per cent and 1.9 per cent in 2017.

UAE to register first current account deficit in decades

The UAE is expected to register its first current account deficit in 37 years in 2016, the IMF said on 13 April. The fund indicates the countrys current account balance will have a shortfall of $3.17bn in 2016, equivalent to nearly 1 per cent of its nominal GDP. The UAEs current account balance stood at $79bn in 2012, and fell to $13.5bn in 2015. Government revenues, mainly from oil royalties and hospitality taxes, declined by 28.5 per cent, or AED157bn ($43bn), between 2014 and 2015 to reach AED393bn. This is expected to drop further, albeit more moderately, to AED324bn in 2016, before easing to about AED348bn in 2017. Nominal GDP is expected to decline to $325bn in 2016, compared with $345bn the previous year. This represents a much slower decrease of 6 per cent, compared with 14-16 per cent in 2015. Nominal GDP growth is expected to recover in 2017 to 9 per cent.

Saudi Arabia-Egypt Causeway from Google Maps

Cairo cedes Red Sea islands to Riyadh

Cairo on 9 April announced it had reached an agreement with Riyadh to redraw the Red Sea maritime border between the two countries and cede sovereignty over two islands to Saudi Arabia. The agreement hands sovereignty of the Tiran and Sanafir islands to the kingdom and was signed during a five-day state visit to Egypt by Saudi Arabias King Salman bin Abdulaziz al-Saud. Ownership of the uninhabited islands, which sit at the entrance to the Gulf of Aqaba, has long been disputed, with both Cairo and Riyadh claiming them, although they were under Egyptian control. Egypt and Saudi Arabia also unveiled plans for a Red Sea bridge connecting the two countries.

Saudi Arabia and Egypt to set up $16bn fund

Egypt and Saudi Arabia have signed a series of investment and economic infrastructure development deals, including setting up a SR60bn ($16bn) investment fund to help revive Egypts ailing economy. The Saudi-Egyptian Investment Fund is being established between the kingdoms Public Investment Fund (PIF) and the entities belonging to it and the government of Egypt. Among the other economic pacts, a memorandum of understanding (MoU) was signed between the PIF and Egypts Ministry of International Cooperation to establish an economic free zone in the Sinai area. The two Arab nations have also signed agreements to develop a $2.2bn power plant with a generation capacity of 2,250MW, set up agriculture complexes in Sinai and develop a canal to transfer water, according to UK news agency Reuters, which cited a statement from the presidency.

Riyadh identifies almost 150 state assets for sale

Saudi Arabia has identified about 146 state-owned entities that could be privatised or sold to the public as Riyadh looks to monetise assets to meet budget shortfalls amid low oil prices and shrinking revenues. The list, prepared by the Economy & Planning Ministry, includes subsidiaries of core government ministries and government-related entities (GREs). A final list of state assets planned for privatisation is still under development. Riyadh intends to sell stakes to private investors or offer shares in these entities through initial public offerings (IPOs).

Riyadh curbs powers of religious police

Saudi Arabia has barred its religious police from pursuing suspects or making arrests, curbing the powers of an institution that was central to the enforcement of the kingdoms strict morality rules. Members of the Committee for the Promotion of Virtue and the Prevention of Vice (CPVPV) will not be allowed now to pursue, question, request identification from or arrest suspects. CPVPV is now directed to report suspected crimes to the police or drug authorities. Members are also required to show identity cards while carrying out official duties, according to the statement.

Iran says it can hit pre-sanctions crude output in two months

Iran is on target to increase its oil production to pre-sanctions levels in the next two months, according to the countrys deputy oil minister. Since completing the nuclear deal in January, Tehran has been reclaiming the market share it lost during four years of sanctions against oil exports. Iran was producing less than 4 million barrels a day (b/d) and exporting 2.2 million b/d in late 2011, before the sanctions on exports were introduced. According to Opec estimates, citing secondary sources, the Islamic Republic produced an average of 3.29 million b/d in March, compared with an average of 2.84 million b/d in 2015.

Iran targets nine new nuclear power plants by 2025

Iran is planning to build nine nuclear power plants by 2025, the Atomic Energy Organisation of Iran (AEOI) said on 9 April. The body said the nine facilities would enable the country to meet its target for atomic energy to contribute to 10 per cent of total power production. In 2014, Russia agreed to build up to eight nuclear reactors for Tehran to pursue its nuclear power programme. The agreement will involve Russian companies building two nuclear reactors, with scope for an additional six reactors if required. Russian state nuclear power provider Rosatom commissioned Irans first nuclear power plant at Bushehr in 2013.

Saudi Arabia is worlds third-largest military spender

Saudi Arabia recorded the worlds third-largest military spending in 2015, according to the Stockholm International Peace Research Institute (Sipri). The worlds largest spender was the US, with $596bn, while China spent $215bn. In fourth place was Russia, with $66.4bn of spending. The UAE ranked 15. MEED reported in February that the London-based think-tank International Institute for Strategic Studies (IISS) estimates that defence budgets across the Middle East accounted for 6.5 per cent of regional GDP in 2015.

US mulls military support in Yemen war

The US is considering its response to a request made by the UAE for military support to assist a new offensive targeting Al-Qaeda in the Arabian Peninsula (AQAP). The UAE has asked for US help on medical evacuation and combat search and rescue as part of a broad request for American air power, intelligence and logistics support. This new development coincides with the ongoing UN-brokered peace talks among the warring factions, which are being held this week in Kuwait. A ceasefire came into effect on 10 April to give way to the discussions aiming to defuse the year-long war.

Riyadh agrees terms on $10bn loan

Riyadh has agreed terms with a group of international lenders for a $10bn loan, its first sovereign debt in at least 15 years.The government has agreed to pay lenders about 120 basis points above the London interbank offered rate (Libor), including margin and fees for the facility. The loan, which is expected to be signed before the end of April, will have a life span of five years. Saudi Arabia has not borrowed from international capital markets since at least 1999.

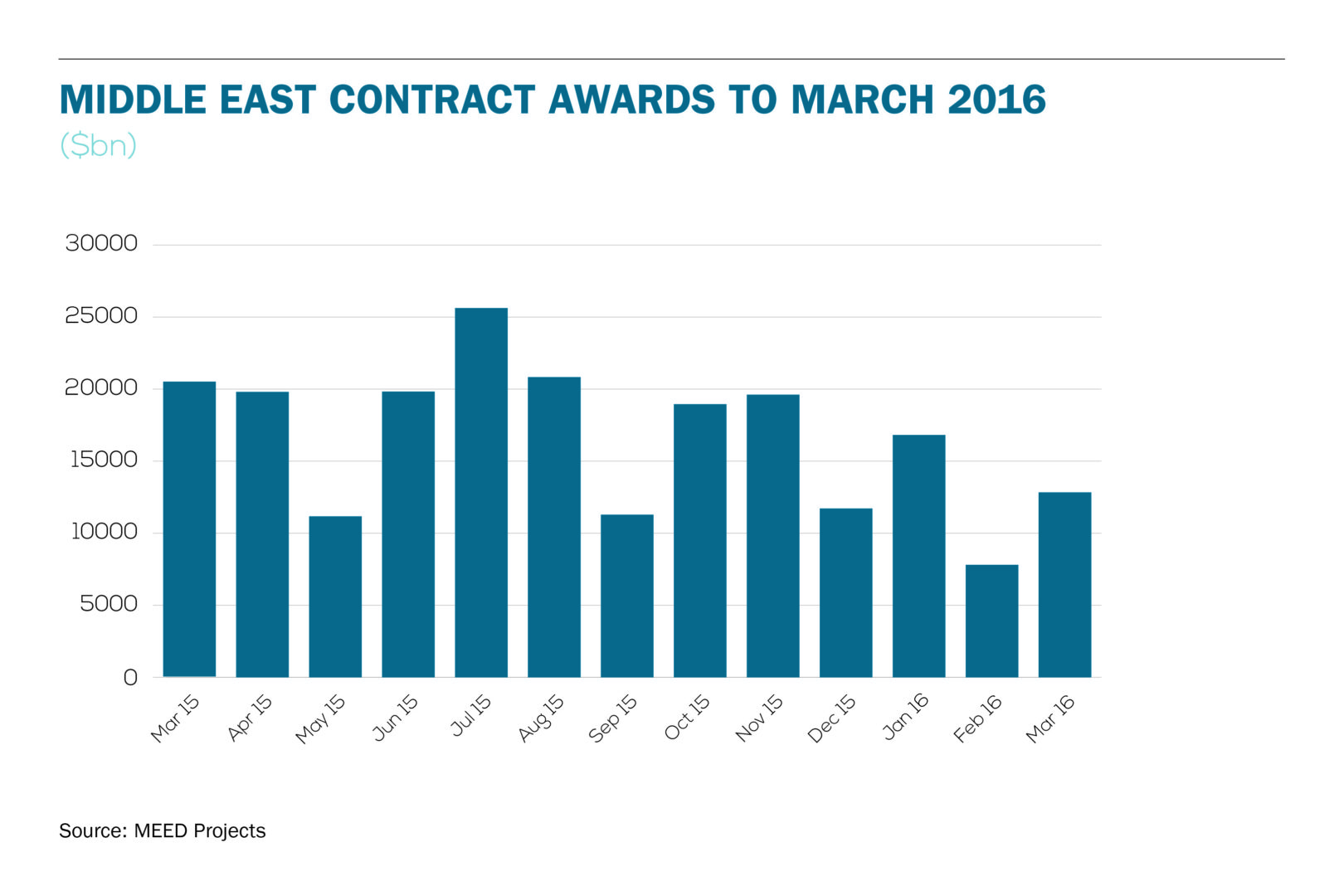

Middle East contracts awarded: March 2016

A total of 44 major project contracts with a combined value of about $12.8bn were awarded across the Middle East and North Africa (Mena) region in March 2016. Iran Railways tops the list, with the award of the contract to build the 930-kilometre Tehran to Mashhad High Speed Railway to China National Transportation Equipment & Engineering Company. The second-biggest award of the month went to a consortium of South Koreas Hyundai Engineering and Hyundai Engineering & Construction for the $2.9bn contract to build Kuwait National Petroleum Companys (KNPCs) planned liquefied natural gas (LNG) import terminal. Saudi Arabia and the UAE remained hotspots for the construction industry, with a value of awards totalling $1.5bn and $1.3bn respectively in March.

Monitor Middle East contract awards every month.

Middle East contract awards, March 2016

FURTHER READING

Abu Dhabi to prequalify more than 30 for solar IPP

Concentrated solar power

Concentrated solar power

Abu Dhabi is planning to prequalify more than 30 companies to participate in the bidding process for its planned 350MW solar independent power project (IPP). According to sources close to the scheme, the request for proposals (RFP) will be issued imminently, with about 34 firms likely to be prequalified, although the final number may change slightly.

Eight groups will be prequalified to bid alone as a managing member of a bidding group, with seven to be invited to bid as managing member in addition to being part of a consortium. The remaining 19 companies will be invited to bid as consortium members. Abu Dhabi Electricity & Water Company (Adwec) had appointed Germanys Fichtner as the technical adviser for the scheme. US-based Akin Gump Strauss Hauer & Feld has been appointed as legal adviser and the UKs Alderbrook Finance will provide financial advisory services.

Dubai shortlists two metro bidders

Dubai Metro Route 2020 station

Dubai Metro Route 2020 station

Dubais Roads & Transport Authority (RTA) has shortlisted two bidders for the contract to design and build the new metro link connecting to the Expo 2020 site. MEED understands the two bidders are:

- Acciona (Spain) / Gulermak (Turkey) / Alstom (France)

- Obayashi (Japan) / Consolidated Contractors Company (CCC; Athens-based) / Mitsubishi Heavy Industries (Japan)

New Dubai tower to be taller than Burj Khalifa

Dubai creek harbour tower

A new super-tall tower planned in Dubai will be higher than the 828-metre Burj Khalifa, the worlds tallest tower, according to Mohamed Alabbar, chairman of UAE developer Emaar Properties.

Designed by Spains Santiago Calatrava, it will be the centre piece of Emaars Dubai Creek Harbour development. It will be a notch taller than the Burj Khalifa, said Alabbar on 10 April, adding that the building will cost about $1bn to construct and will be completed in time for the 2020 Expo.

Saudi Aramco awards four offshore oil and gas contracts

Offshore oil and gas rig

Offshore oil and gas rig

State oil firm Saudi Aramco has awarded four contracts on offshore oil and gas assets estimated to be worth more than $1bn combined, according to sources familiar with the bidding process.

US-based McDermott picked up three deals, while Italys Saipem won the other. The two companies signed the Contract Release Purchase Orders (CRPO) with Aramco on 19 April.

Four international groups were vying for the contracts after entering the Long-Term Agreement (LTA) programme with Aramco in 2015.

French firm wins Ras Laffan wastewater contract

Ras Laffan, Qatar

Frances Veolia has been awarded a contract to build a wastewater treatment plant for Dolphin Energys natural gas production and processing facilities in Ras Laffan. Veolia Water Technologies was awarded the contract by Qatar Engineering & Construction Company to build the wastewater treatment plant.

The scheme is scheduled for completion in September 2017.

Bechtel wins main contract on $3.5bn Bahrain aluminium expansion

Bahrain approves $3.5bn Alba expansion

US engineering group Bechtel has won the main contract on Bahrains planned $3.5bn aluminium smelter expansion, according to project owner Aluminium Bahrain (Alba).

Alba awarded the engineering, procurement and construction management work to Bechtel for its line 6 expansion project, which will see the US company design and construct a sixth potline and support industrial services.

The project will make Alba the worlds largest single-site aluminium smelter, boosting the sites production capacity by 540,000 tonnes a year (t/y) to 1.5 million t/y. The sixth potline will have 424 pots that will use the proprietary EGA DX+ Ultra technology.

Firms submit bids to build Omans third oil refinery

Galfar awarded Duqm refinery site preparation work

Duqm Refinery has received bids from companies vying for the main engineering, procurement and construction (EPC) packages on its project to build Omans third oil refinery. Duqm Refinery, a 50:50 joint venture of Abu Dhabi-based International Petroleum Investment Company and state-run Oman Oil Company, plans to establish a 230,000 barrel-a-day (b/d) refinery at the port on the sultanates central coast.

Technical EPC bids were submitted for both packages on 21 March, according to sources familiar with the scheme.

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.