West Texas Intermediate contract trading at $81 a barrel

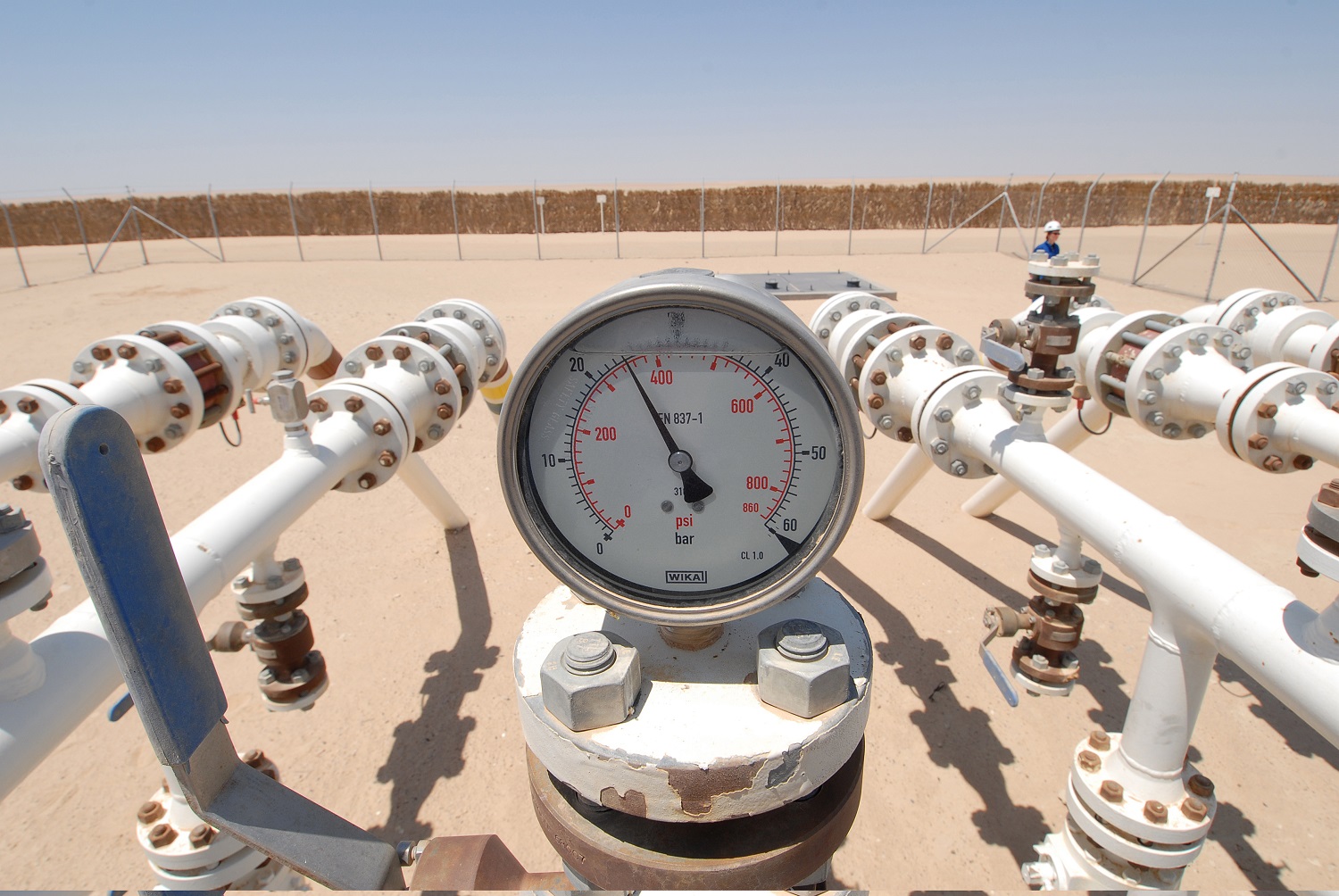

Crude oil prices fell during the week ended 15 March as inventories in the US, the world’s biggest energy consumer, grew by more than 7 million barrels.

The US’ benchmark May West Texas Intermediate (WTI) contract was trading at $81.26 a barrel on 25 March, down $0.90 from a week before, but up from $80 a barrel earlier in the day.

In Europe, the May Brent contract was trading at $80.30 a barrel, largely unchanged from a week before.

The fall in value for the US contract came after the country’s Energy Information Administration (EIA) released a report on 24 March which showed a 7.2 million barrel rise in crude oil stocks a week before. Inventory levels hit 351.3 million barrels on 16 March.

Analysts at Barclays Capital, the investment arm of the UK bank, say that the stock increase was largely due to traders bringing floating storage – crude oil stored on oil tankers in international waters – onshore. They forecast an average price of $85 a barrel for WTI in 2010.

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time to revise MGS package bids

18 April 2024

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.