More falls could follow for the index tracker

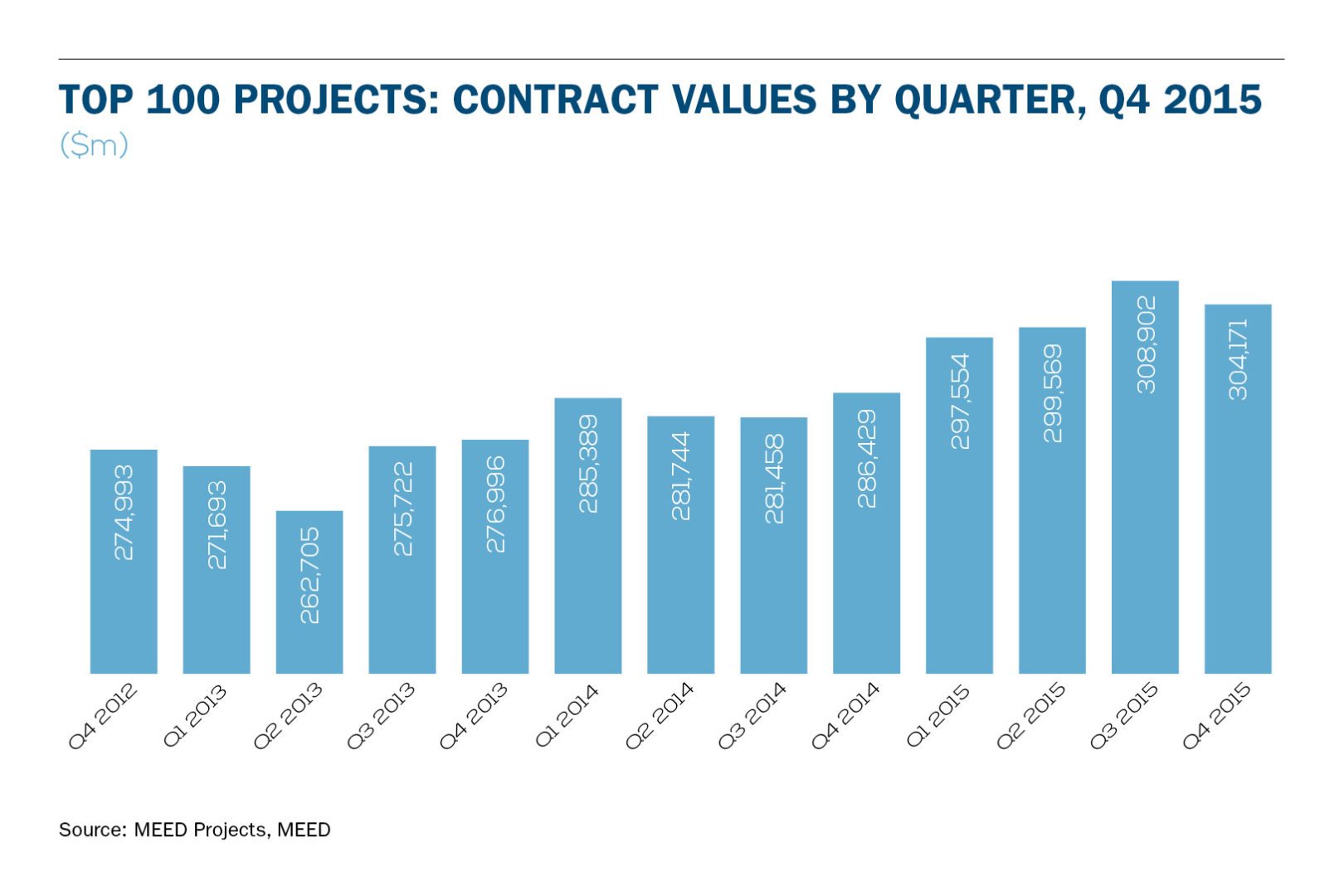

The Top 100 Projects index dipped in the final quarter of 2015, falling 1.5 per cent to around $304.2bn.

Although a small drop, with the projects market in the region struggling, this could be the beginning of sustained falls in the index. Typically, the top 100 projects index tracks behind the market itself, because it focuses on contracts that have been awarded.

Approximately $84.6bn-worth of contracts in the index are due for completion by the end of 2016, almost 29 per cent of the total value of the Top 100. The average value is $3.5bn. Schemes entering the top 100 index over the year had an average value of $2.75bn.

While inevitably there will be schemes that miss their completion date, the lower average value of newer schemes indicates the index is likely to fall further by the end the year.

The value of contracts underway in the top 100 in Saudi Arabia fell below $100bn. Project awards in Saudi Arabia slowed significantly in the second half of 2015, with awards on all bar a few schemes being stopped completely in October.

As the largest projects market in the region, decisions in Saudi Arabia are watched closely. The kingdom has announced a scaled-back budget for 2016, with the kingdom projecting that actual spending will be SR840bn, due to the continued low oil price, and is expected to award fewer contracts this year.

Last year the kingdom awarded $49.9bn in contracts; although higher than the awards for 2014 just this was the lowest level since 2008. This year, Saudi Arabia has a pipeline of about $101bn, although the final figure is expected to be far lower. MEED Projects has estimated that the final awards value will be between $41-54bn.

With the oil price expected to remain low throughout the year, and analysts such as Goldman Sachs predicting it could fall as low as $20, the regions projects market is likely to remain subdued as governments and clients push ahead with critical, rather than nice-to-have schemes. Funding will also become a major issue, as oil-exporting governments attempt to mitigate against falling revenues.

With a young population in many countries, the need for improved public infrastructure is becoming an increasingly urgent need, and one for which a number of governments have ring-fenced funding. In addition to education and healthcare facilities, power generation and transport continue to be significant areas in the projects market.

Transport was the biggest area with the top 100 throughout 2015, with $98.4bn of schemes in the index, the majority being for rail and metro projects. There are a number of rail schemes penciled in for awards this year, in particular in Mecca.

In mid-December, before the kingdoms budget was announced, executives said the scheme would push ahead this year, with five awards (including one for the bus network) worth SR33bn ($8.8bn) being made for Mecca in the first quarter.

However, the budget allocation for infrastructure and transport spending was more than halved in the budget, to SR23.9bn. It is not yet clear if this reduction will impact timelines for the Mecca schemes.

In 2015, overall about $44.4bn-worth of awards were made in the power sector according to regional projects database tracker MEED Projects. Although down on the 2014 total of $52.5bn of awards, both years are significantly higher than for awards made during the past decade.

Within the top 100 index, which includes awards down to the value of $1.6bn, there are 12 schemes split across 17 contract awards, worth almost $42.5bn. Egypt in particular pushed on with power schemes in 2015, following commitments made during the Egypt Economic Development Conference (EEDC) in Sharm el-Sheikh in March.

The biggest awards were for the three combined cycle plants. During the EEDC, the government signed a contract with Germanys Siemens to build the 4.8GW Beni Suef plant, worth about $2bn. It later signed contracts to develop the Burullus and New Capital combined cycle plants, each with a capacity of 4.8GW and worth $2bn.

There are around $31bn-worth of power projects at the main contract prequalification or bid stage, so 2016 could also see a significant number of awards made.

Top 100 data tables, Q4 2015

You might also like...

Arada awards $167m Masaar construction contracts

16 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.