The political turmoil of the past three years has weighed heavily on the real estate sector in Egypt; rents have fallen and there has been no growth in sales prices

Soon after being asked to form a new cabinet, Egypts Prime Minister Ibrahim Mahlab set out his priorities for government. The need to restore security and attract more investment were the two main issues he identified at a press conference on 25 February, but among a host of other items he also mentioned the need to develop real estate finance.

As a former housing minister, Mahlab ought to know the problems in Egypts real estate market well enough, but given how quickly prime ministers and presidents have come and gone of late, there can be little certainty he will have time to do much about them.

Affordable housing

The current authorities in Cairo do, however, have some friends with deep pockets. On 9 March, Hasan Abdullah Ismaik, CEO of the UAEs Arabtec Holding, announced a deal to develop 1 million affordable housing units at 13 sites around the country. Arabtec says the £E280bn ($40bn) cost will be funded by Egyptian and foreign banks, and although the contractor did not name them, it would not be surprising if the Abu Dhabi government or the UAE federal authorities were the ultimate source of much of the financing.

Affordable housing is certainly badly needed, but the reality in other parts of the property market is that there is too much supply, particularly in the capital. Tourists and expatriate businessmen have stayed away because of the turmoil and any substantial and lasting improvement will require political stability.

The continuing problems are clear to see almost anywhere in Egypt. In the fourth

quarter of last year alone, rents for villas in New Cairo declined by 12.5 per cent to $3,500 a month, while apartment prices dropped by 18 per cent to $900 a month, according to data from US property consultancy JLL (formerly Jones Lang LaSalle).

In 6th of October City, villa rents remained steady, but average apartment prices fell by 28 per cent to just $630 a month.

Sales prices have proved more resilient. The average sales price for apartments and villas in areas such as New Cairo and 6th of October City remained steady in the final quarter of 2013, but there has been no real growth for more than two years.

The political turmoil also helps to explains the dire situation faced by hotels across the country. According to UK consultancy EY, average room rates in Cairo fell to $81 a night in December, down from $88 for the same month a year earlier. That made Cairo by far the cheapest of all the Middle East capitals surveyed by EY. Unfortunately for hoteliers in the city, they also had the lowest occupancy rate, at 26 per cent, meaning room yields were just $21 a night in December. Prices in the Red Sea resorts of Hurghada and Sharm el-Sheikh were even lower, at $25 and $44 a night respectively last year, but occupancy levels were at least higher, at 60 per cent in both places.

Yousef Wahbah, Middle East and North Africa head of transaction real estate at EY, says Cairo had the largest drop in revenues per room in 2013 out of all the markets it surveys around the region. Average room yields fell by more than 41 per cent compared with 2012, due to the twin issues of political uncertainty and security concerns.

New hotels are still being added, however. In the final quarter of last year, the 350-room Le Meridien opened its doors at Cairo International airport, taking the citys total supply to 27,700 rooms across 161 properties. The Nile Ritz-Carlton, a remodelling of the existing Nile Hilton hotel, is due to open by the end of March, and the St Regis Cairo is due to open in September 2015.

Political situation

Ayman Sami, head of JLLs Egypt office, says room rates are unlikely to fall further, but any growth hinges on the political situation.

We would not expect to see any further softening in room rates or yields in Cairo as the current rates are already extremely low, says Sami. In our view, the hotel market is close to the bottom of the cycle and the next move is likely to be towards higher occupancies and room rates. The timing of this improvement will be related to the security situation in the coming months. The upcoming parliamentary and presidential elections could result in further demonstrations and protests. The scale of these and the response of the security authorities will have a major impact on tourism levels and therefore hotel performance.

In contrast to the additional hotel rooms, no new grade A office space was added in the final quarter of 2013 and the total stock in Cairo remains at 819,000 square metres, most of which is outside the city centre. Some 127,000 sq m of new space was scheduled to be completed before the end of December, but many schemes were hit by construction delays. That work has been carried forward into this year and as a result, some 177,000 sq m of office space is due to come to the market in 2014.

Commercial demand

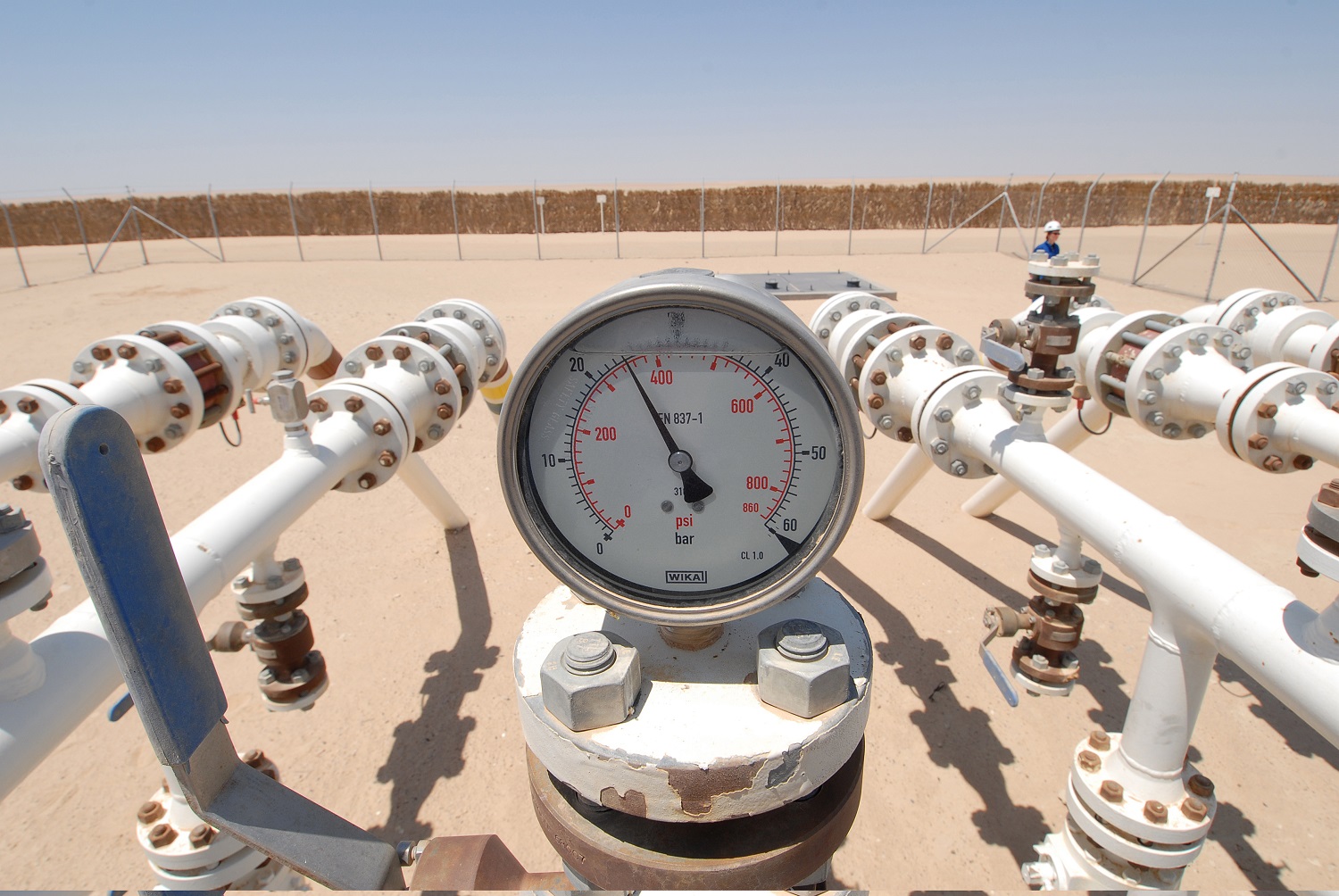

The lack of new space did at least help occupancy levels to rise slightly towards the end of 2013, and vacancies declined from 26 per cent in the third quarter to 22 per cent in the final quarter of the year. Prime office rents in the more sought-after Nile City Towers remained stable at about $35 a sq m. In other areas, rents were also steady, at $18-25 a sq m in New Cairo and $18 a sq m in West Cairo. JLL says it is aware of potential demand for more than 90,000 sq m of office space from foreign firms that are slowly finding their nerve once again. It says the most significant amount of demand is coming from companies in the oil and gas

sector, followed by pharmaceuticals, chemicals, telecoms and IT.

The fact that some investments are being made and there are tentative signs of demand from some quarters offers a glimmer of hope for the real estate sector, but it would be unwise to be too optimistic. Sami points out that there are fewer demonstrations on the streets these days, saying 2014 could mark the beginning of the recovery of the Cairo real estate market, providing the progress that has been made on the political roadmap during late 2013 is continued.

Foreign support

For now, however, the only people that appear willing to invest heavily are from the Gulf. The UAE, Saudi Arabia and Kuwait have been providing billions of dollars in aid to the country after the army overthrew the leadership of Mohamed Mursi in July 2013, and where those governments are leading other private firms are following, as the deal with Arabtec shows.

Among other investors, Dubais Emaar Properties claims its local subsidiary, Emaar Misr for Development, is the largest single foreign investor in Egyptian property, with a project portfolio worth about £E43.3bn. Its schemes include mixed-use developments such as the 3.8 square-kilometre Mivida and the Uptown Cairo district, as well as the Cairo Gate shopping complex on the Desert Road north of Alexandria.

But for such schemes to do well in the longer term, they will need tourists, foreign businessmen and other expatriates to return. That will require political stability, which, for now, looks elusive.

Key fact

There is potential demand for more than 90,000 square metres of office space from international firms

Source: JLL

Retail sector: Rents fall as new supply reaches market

One area of Cairos property market that appears particularly active is the retail sector. In the final quarter of 2013, some 190,000 square metres of new shopping space was added, the largest increase in supply for three years. The total stock of mall space across the city is now 963,000 sq m.

The new additions include Emerald Mall and Cairo Festival City in the New Cairo district, which opened in October and November respectively. Almost a quarter of the space at the Festival City site, developed by the UAEs Al-Futtaim Group, is taken up by Egypts first branch of Swedish furniture retailer Ikea. Other retailers that have taken up space there include French supermarket Carrefour and UK retailer Marks & Spencer. More than 50 per cent of all the space is now trading, according to JLL, and that is expected to rise significantly as the year goes on.

The amount of shopping space added in the fourth quarter would have been even larger had it not been for delays at District Mall, close to the airport, and Amer Groups Porto Cairo Mall, both of which are now scheduled to open this year. In addition, Arkadia Mall in the centre of the city is due to reopen, having been damaged by fire in 2011. Some 350 of the 500 shops at the mall have been leased, according to JLL. Other developments that have yet to be completed include Mall of Egypt in 6th of October City, which is due to open in 2015. It is being developed by the UAEs Majid al-Futtaim and will have 400 shops spread over 162,500 sq m of gross leasable area.

In all, some 376,000 sq m of new shop space is in the pipeline for this year, although some of this may be delayed. All this new supply has, perhaps inevitably, led to a softening of rental prices. Average rents for shop space in regional and super-regional malls around Cairo fell by 8 per cent in the final quarter of 2013 and currently range from $720 to $1,320 a sq m a year, according to JLL. Overall, the vacancy rate across the city is about 25 per cent. JLL says ongoing nervousness among consumers is contributing to slow sales for some retailers. Those doing best include convenience stores and food and beverage sellers.

Landlords have reportedly been willing to ease rents and tenancy conditions for retailers in light of the political turmoil, and more malls are now leasing out space for a base rent plus a percentage of turnover.

Questions about the strength of consumer demand are likely to continue for some time, however, given the Egyptian economys poor performance. According to London-based Capital Economics, unemployment was 13.4 per cent at the end of last year and the economy is expected to grow by 2.8 per cent this year far below the 4-5 per cent needed to bring the level of joblessness down.

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time to revise MGS package bids

18 April 2024

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.