As governments rein in spending, certain sectors will need to be ring-fenced from cuts

The party is well and truly over. After three years of record spending, the regional projects market is set to slow dramatically in 2016 as the burden of lower oil prices takes effect.

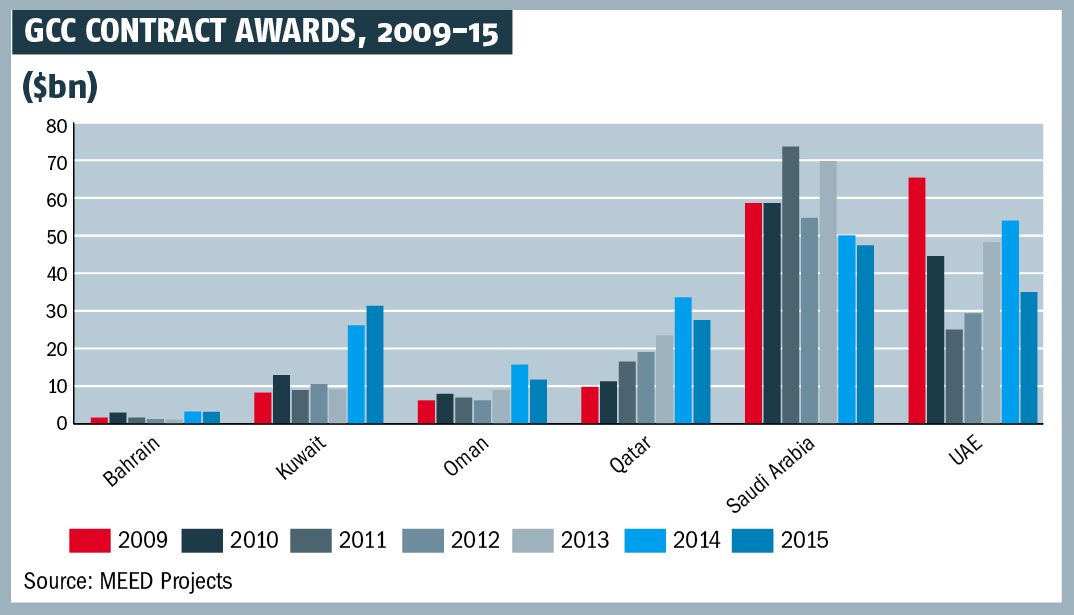

Our best estimates anticipate a 15-20 per cent drop in contract spending to some $120bn-140bn in the GCC next year, down from a high of $172bn in 2014 and $160bn in 2015.

The countries of the region have already indicated the scale of the challenge ahead. Saudi Arabia announced a hiatus on contract awards for the final quarter, while clients everywhere have cautioned that belts will have to be tightened until crude prices start rising again.

Strategic sectors

But it is not all doom and gloom. Certain strategic sectors will continue to see healthy spending levels. Power and water, which are primarily driven by population growth, will have to see maintained levels of spending if states are to avoid shortages in supply.

Similarly, social infrastructure outlays are expected to be ring-fenced from cuts. Startled by the Arab spring, the GCC states know they simply cannot afford to rein in spending on affordable housing, schools and healthcare.

There is a realisation that now is not the time to put the brakes on economic diversification and job creation

Rail and metro investment too will be protected. Governments have repeatedly said that rail spending is strategic and viewed as a driver to stimulate economic growth. The acceleration of tender activity in the sector in the second half of 2015 tends to underline that view.

Clients have also made it clear that cutting capital investment is not necessarily the right response to falling revenues.

There is a realisation that now is not the time to put the brakes on economic diversification and job creation; the overall health of the economies is as much dependent on continued project spending as project spending is on high oil prices. Drastically cutting expenditures could have a worse than anticipated effect on each countrys development.

Optimists can also point to the fact that countries and clients have a number of project funding solutions at their disposal. Kuwait, for example, is developing almost all of its major non-oil projects on a public-private partnership (PPP) basis, which will keep project spending off its balance sheet.

Oman is looking at project bond issuances, while Dubai has launched power sector build-operate-transfer (BOT) schemes for the first time. The market can expect to see a more accelerated shift to privately financed schemes.

Plugging shortfalls

All this is in addition to traditional ways of plugging any budgetary shortfalls. Saudi Arabia in 2015 issued more than $5bn-worth of bonds, for instance, while the six GCC states have more than $1.5 trillion-worth of foreign currency reserves they could dip into should they choose to.

Likewise, with slower global economic growth comes cheaper construction costs. A fall of 10 per cent in the price of key materials and labour would have a dramatic impact on project budgets. In parallel, cost efficiency solutions such as value engineering already being carried out on the $20bn-plus Riyadh Metro could help keep spending levels in check.

MEED anticipates a 15-20 per cent drop in contract spending to $120bn-140bn in the GCC next year

Source: MEED

From a country perspective, the outlook varies widely. For 2016, the countries that performed the best in 2015 Kuwait, Oman and Qatar are expected to continue to do well. The Kuwait market broke the $30bn mark for the first time in 2015, boosted by the $13bn-worth of contracts awarded on the New Refinery Project at Al-Zour.

With its ambitious healthcare, education, housing and road-building programmes, as well as a massive budgetary surplus accumulated over the previous decade, the state is in possibly the best position of any in the GCC to weather the current storm. While it will be difficult for it to match 2015s record spending levels, its lengthy pipeline of projects, combined with its comparative financial strength, should ensure it continues to do well in 2016.

The same goes for Qatar, although for markedly different reasons. Dohas projects market has been driven chiefly by the need to build the required infrastructure in time for the 2022 Fifa World Cup. In 2015, this resulted in total contract awards of more than $27bn, down slightly on 2014 levels but still far higher than the $16bn-a-year average between 2009 and 2013.

With projects including the long-distance rail, most of the football stadiums, the airport expansion, the expressway and local roads and drainage programmes, there will be plenty of opportunities in the state in 2016 and the years to come.

Liwa Plastics

Oman is another country to have performed well above historical norms in 2015, with more than $12bn-worth of deals. Its largest individual project award over the past 12 months was on the main packages on the $5.2bn Liwa Plastics complex, funded through project financing.

The slowdown in the UAE was caused primarily by a 50 per cent collapse in project spending in Abu Dhabi to just $11bn

Other significant deals in the sultanate included the Salalah 2 independent power project, and the Barka and Sohar independent water projects.

Entering 2016, Oman is expected to award the multibillion-dollar first phase of its railway programme and several major contracts on its Duqm Refinery and petrochemicals complex. It received GCC and foreign investor finance for both projects, so lower revenues are not expected to have as major an impact as in some of its more oil-dependent neighbours.

Negative impact

Indeed, it is in the regions two biggest oil and gas producers and its two largest projects markets where lower crude prices are having the most negative impact.

Both Saudi Arabia and the UAE awarded markedly fewer contracts in 2015 than the previous year. In the UAE, spending was almost $20bn down on 2014, while in Saudi Arabia

project expenditure hit $47bn, a decrease of $3bn on the previous 12-month period, and $20bn down on the $67bn awarded in 2013.

The slowdown in the UAE was caused primarily by a 50 per cent collapse in project spending in Abu Dhabi to just $11bn. The emirates spending plans have been in limbo while it decides its future strategy, and this has had a major knock-on effect on non-oil projects development.

With few signs that the federations capital is finalising its plans, there is little hope among contractors that 2016 will fare any better.

Dubai in 2016 performed slightly better, helped in large by a more robust private sector. However, it too was $5bn down on 2014s figures.

As real estate prices stagnate and market confidence wavers, a significant pick-up in project spending is not expected to be on the cards.

Ed James is director of analysis at MEED Projects. For more information and data on the GCC and Middle East and North Africa projects market, please visit www.meedprojects.com

GCC actual contract awards versus forecast

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.