Bahrain’s Gulf International Bank has suffered deep losses

Bahrain-based Gulf International Bank (GIB) has indicated the pricing levels for its upcoming bond issue.

The dollar-denominated issue, which is expected to be at least $500m in size, will be priced at 165 to 175 basis points above the midswap rate.

GIB appointed itself, along with the US’ JP Morgan, the UK’s Barclays and Standard Chartered, France’s Societe Generale and the National Bank of Abu Dhabi to arrange the deal.

After suffering deep losses as a result of the financial crisis and its investments in US structured products, the bank received a $4.8bn bailout from its shareholders, the six governments of the GCC. A rights issue left the bank 97 per cent owned by the government of Saudi Arabia. GIB now plans to launch retail banking operations in the kingdom as it tries to diversify its business away from a concentration on investment banking activities.

You might also like...

Ajban financial close expected by third quarter

23 April 2024

TotalEnergies awards Marsa LNG contracts

23 April 2024

Neom tenders Oxagon health centre contract

23 April 2024

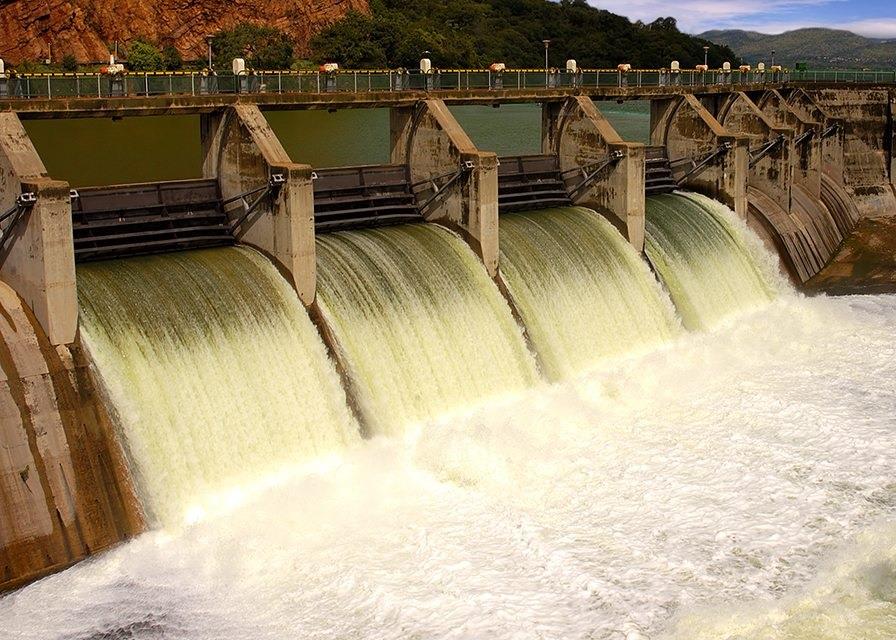

Neom hydro project moves to prequalification

23 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.