Total value of deals let in the region grows by 20 per cent in first quarter from last three months of 2016

There were signs of a tentative recovery in the GCC projects market in the first quarter of this year as the total value of contract awards increased by about 20 per cent, according to regional projects tracker MEED Projects.

The total value of deals inked in the first quarter was just over $26bn, up from $22.2bn in the final quarter of 2016. The first-quarter total for 2017 is down by about 17 per cent compared with the first quarter of 2016, when there were $33.5bn of deals let.

The second quarter of this year will be crucial. If the total value of awards increases again, then it will start to look like the market found a bottom at the end of 2016.

If the market is recovering, any growth will be tempered by schemes that are completed. According to MEEDs Project Activity Monitor (PAM), during the first quarter of this year there were $28.2bn of schemes completed, about $600m or 2 per cent more than the value of awards over the first quarter.

The difference is more encouraging than the spread between awards and completions registered during 2016, when there was a net loss of $61bn as project completions outpaced new awards. There were $105bn of contracts signed in the GCC during 2016, while at the same time $166bn of work was completed.

The imbalance meant the market contracted for the first time since contract award and completions data started to be collected by MEED in 2004. The worst-performing year previously was 2012, when there was a net gain across the GCC of $14bn. The best-performing year was 2006, when there was a net gain of $90bn.

UAE leads

The UAE was the best-performing market by a considerable margin, with $10.8bn of deals let during the first quarter of this year. There were $4.7bn of awards in Saudi Arabia, followed closely by Kuwait with $4.6bn of deals let. In Qatar, there were $2.7bn of contracts signed, in Oman $3bn, and in Bahrain $753m.

The largest award made during the first quarter, valued at $1.3bn, was awarded to the UKs Petrofac by state-owned upstream operator Kuwait Oil Company for Gathering Centre 32. The scheme involves greenfield activities with tie-in works to existing brownfield infrastructure. The new infrastructure will have the capacity to produce about 120,000 barrels a day of oil together with associated water, gas and condensate.

The oil sector also produced the second-largest award, with South Koreas GS Engineering & Construction winning the estimated $950m deal to repair processing units at Takreers Ruwais refinery in Abu Dhabi, after a fire in January.

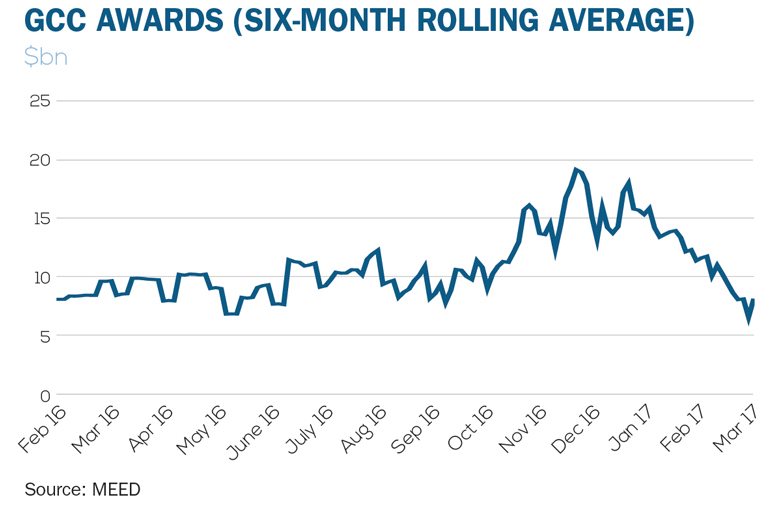

GCC awards (six-month rolling average)

GCC awards (six-month rolling average)

In the power sector, the largest deal inked was a $872m contract secured by Chinas Jinko Solar for Abu Dhabi Water & Electricity Authoritys photovoltaic solar plant in Abu Dhabi. The other major power awards were for transmission works in Qatar.

For transport, the largest contract signed was a $774m road construction deal let to Lebanons Consolidated Contractors Company (CCC) for Al-Bustan Street North in Qatar. The only other major transport award was for the development of infrastructure at South al-Mutlaa City in Kuwait. The estimated $708m contract was won by China Gezhouba Group Corporation.

Largest awards of 2017*

Largest awards of 2017*

The largest construction awards were made in Dubai. The local Alec secured an estimated $610m order to build a new shopping mall at Dubai Hills for the local Emaar Properties, and the local/UK Al-Futtaim Carillion secured the $600m contract for the construction of the Thematic District at the Expo 2020 site. The only other construction deal valued at more than $500m was the $570m contract secured by CCC for UAE developer Majid al-Futtaims Mall of Oman.

You might also like...

Hassan Allam and Siemens confirm Hafeet Rail award

24 April 2024

UAE builds its downstream and chemical sectors

24 April 2024

Acwa Power eyes selective asset sales

24 April 2024

Bahrain mall to install solar carport

24 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.