Banks still relying on inadequate information

The lack of sophisticated credit data is preventing regional banks from resuming lending for fear of taking on more uncreditworthy customers.

“Banks’ main reason for not lending before were liquidity issues,” says Zaid Kamhawi, chief business officer of Dubai’sEmirates Credit Information Company (Emcredit),the UAE’s first and only credit bureau. “But today they say they can’t identify who is safe to lend to and so they’re choosing to not lend at all in many cases.”

Meanwhile, banks who are lending are resorting to the same insufficient criteria used prior to the crisis to decide which customers to lend to.

“Regional banks are still relying on getting information from customers, mainly asking them for their three month salary payslips,” says Kamhawi. “Less than half have fully automated application process systems and instead are relying on primitive score cards and modelling.”

85 per cent of Mena banks identify weakness in credit information as a “very important obstacle to lending”, according to Emcredit research.

Emcredit currently works with six banks in Dubai and has a 30 per cent data coverage of the banking population.

“Obviously, we are looking to increase our coverage, but banks need to contribute to developing a robust credit bureau,” says Kamhawi. “We’ve had several banks tell us that ignorance is bliss so they don’t want to work with us.”

Emcredit was established by the Dubai Department of Economic Development (DED) in 2006 to improve the standard of credit information services in the emirate and increase financial transparency. It is responsible for collecting, storing, analysing and disseminating credit information.

Kamhawi was speaking at MEED’s Middle East Retail Banking 2010 conference.

Middle East Retail Banking 2010 conference

Customer skips dropping as economy stabilises

UAE retail banks to impose stronger credit checks

Lack of credit bureau to blame for high rate of consumer loan delinquencies

Personal financial problems are an issue for the region’s banks

National Bank of Abu Dhabi targets doubling retail revenues by 2015

Regional banks to focus on affluent customers for future growth

Qatari banks’ Islamic lending activities curbed by new central bank regulations

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time for MGS package revised prices

18 April 2024

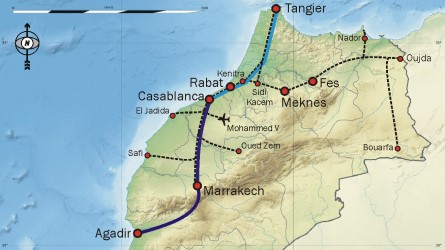

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.