Iraq’s importance to the region’s projects market is growing, but it requires strong government to push ahead with reconstruction efforts

Security improvements and a more investor-friendly business climate have bolstered Iraq’s image as a potentially lucrative construction market.

Since November 2009, foreigners have been able to own land for housing projects, helping to unlock investment for a series of real-estate schemes across the country. Increased budget allocations by the government for capital projects have also helped put Iraq on the map as a credible construction market.

The country’s infrastructure needs are massive; basic public services are in a poor condition, roads and transport links are inadequate, and there is an urgent need for 3.5 million new houses, according to the government’s latest projections.

Although a few foreign developers are investing in real estate developments and infrastructure schemes, many large international contractors are playing a wait-and-see game when it comes to pursuing Iraqi opportunities. Gulf contractors are also eyeing markets closer to home.

| Regional construction market: Project market value ($bn) | |

|---|---|

| Iraq | 102 |

| Qatar | 36 |

| Oman | 33 |

| Saudi Arabia | 253 |

| UAE | 476 |

| Kuwait | 168 |

| Bahrain | 27 |

| Yemen | 112 |

| Note: Includes projects in study, design and tendering phases only | |

| Source: MEED Projects | |

Security concerns

“We haven’t ruled Iraq out as a market, but we’ll look at other markets before we start to consider Iraq as there are enough opportunities in countries such as Saudi Arabia and Kuwait,” says Chris Gordon, general manager at UAE/Australian contractor Al-Habtoor-Leighton. “If there were fantastic opportunities [in Iraq] we’d probably jump in, but we haven’t got the resources to look at them at the moment.”

Another large Dubai-based contractor highlights security concerns. “We are looking at the market and may venture later, depending on the safety of the staff,” says Riad Kamal, chairman, Arabtec Construction.

On paper at least, the next year should provide some rich pickings for contractors, particularly in light of the recovery in Iraqi state spending. “There’s a lot of work across all sectors, and funding is available,” says Amad Aziz, head of local contractor Al-Wakeel International.

The 2010 budget has proposed expenditure of $72.1bn, a third of which is earmarked for capital projects. At the provincial level, Iraq’s investment commissions are backing a series of housing schemes to meet demand for new homes.

One of the largest real-estate projects is a $10bn mixed-use development in Baghdad, comprising entertainment facilities, a golf course and technology centre, to be built by the UAE’s Al-Maabar Real Estate company.

Much of the initial focus will be on rolling out affordable housing projects, with the government planning to build least 3.5 million housing units over the next 10 years to meet pent-up demand.

The country’s National Investment Commission (NIC) wants investors to build more than 1 million houses in the next three years. Maysan, Wasit, Muthanna, Qadisiyah, Basra, Najaf, Thi Qar, and Diyala provinces have all announced housing schemes this year.

Some proposed projects mimic Gulf-style mega developments. In the capital, the $5bn Rasheed real-estate development, backed by the UAE’s Millennium Solutions and Bonyan International Investment Group, is intended to provide 65,000 housing units spread over a 12.5-square-kilometre site on the former Rasheed airbase.

However, many of these megaprojects have yet to achieve any progress on the ground. “To build 1 million houses in three years is going to be a real challenge,” says an Iraq-based developer. “The problem will be in providing the infrastructure for the developments such as roads, power and water, before the investment even goes in.”

Rebuilding Baghdad

A proposed masterplan for Baghdad is intended to consolidate the reconstruction efforts in the capital, and set out targets for development up to 2030, covering the housing, power, water, transport, sewage and industrial sectors. However, the masterplan is still in the planning stage, despite the appointment of Lebanon’s Khatib & Alami and Mebex as consultants in 2009. Its delay has been blamed on lengthy decision-making processes, and a dispute between the Baghdad municipality and the prime funding source, the Washington headquartered World Bank.

A decision has now been taken for the Iraq government to finance the project, without the World Bank’s participation.

The masterplan will include the $3bn Baghdad metro project, which involves building two lines on a 39km route across the capital. Invitations to contractors to bid on the project are expected to be issued by the end of the year, with construction scheduled to start in 2011.

The masterplan fits with a government strategy to encourage private investment across a range of sectors. Provincial investment commissions have issued licences to foreign firms for package deals that include a mix of residential and commercial real estate, manufacturing, school and medical facilities, along with upgrades to basic infrastructure, Dunia Frontier Consultants noted in a November 2009 report on private foreign investment in Iraq.

The governorates of Anbar, Thi Qar and Karbala have announced deals for the construction of new industrial cities with international firms at a combined value of $46bn.

The central government and provincial authorities have encouraged mixed sector investment deals to tackle multiple challenges simultaneously. Companies have been asked to build schools or roads as a condition for approval of their investment plans.

However, consultants highlight the difficulty of dealing with local authorities. “You have to deal with a number of different departments and inevitably end up getting bounced between them,” says a consultant advising on an Iraqi housing project.

Another consultant attributes slow decision-making to a variety of reasons and notes that the disputed outcome of the March general election will make progress even more difficult. “With the election stalemate, nobody knows if they are secure in their job until the new government is formed, so further delays are likely,” he says.

Political will

There is a clear need for a strong and stable leadership to push forward the country’s reconstruction efforts. “Infrastructure and affordable housing are attractive sectors for investors, but the authorities have not yet revealed a clear vision of how to implement these schemes,” says Nazar Mohammed, Iraq director at the UK’s Cyril Sweett, which is consulting on several construction projects in the country.

One foreign real-estate developer involved in an affordable housing project in Najaf also highlights planning difficulties. “We’re waiting for land boundaries on our housing project to be clarified,” says the developer. “We started off with several thousand units, but the client then said they wanted 7,000 units, which means you need more land.”

In the north, the Kurdistan Regional Government (KRG) has worked hard to improve the investment climate for developers. New Zealand’s Atconz Real Estate is building 1,500 houses in Erbil, including four-bedroom properties at a total cost of $100m.

“We are pricing the houses at $80,000 each. The reason we can price them so low is that the KRG investment law encourages it. The government grants land free of charge, so effectively our cost of land is really only limited to developing the infrastructure,” says Atconz regional manager Sam Michael.

Tourism is emerging as a new focus for construction activity, centred largely on the Kurdish north and the Shiite religious centres of Karbala and Najaf. UK-based property developer Range Hospitality secured government approval in April to start construction of its estimated $110m Range Karbala hotel project, and site preparation and enabling works are scheduled to begin in the final quarter of this year. The 650-room hotel will be located near the shrines of Imam Hussain and Hazrat Abbas. UAE-based Dewan Architects & Engineers is the lead consultant and project architect, and Abu Dhabi-based Noor Capital is investing in the project.

Tourism initiatives are also being planned in areas relatively unknown to visitors. In Wasit province, the Tourism Ministry and Wasit Province Investment Commission have announced plans for a $1bn tourism development near the provincial capital of Kut that will include hotels, apartment blocks, private chalets, swimming pools, an amphitheatre, and an amusement park.

Elsewhere, a new 65,000-capacity stadium is under construction in Basra, intended to host the Middle East football cup in 2013. Initial construction work on the $450m Basra Sports city began in late 2009, with the local Al-Jabouri group working as the main contractor.

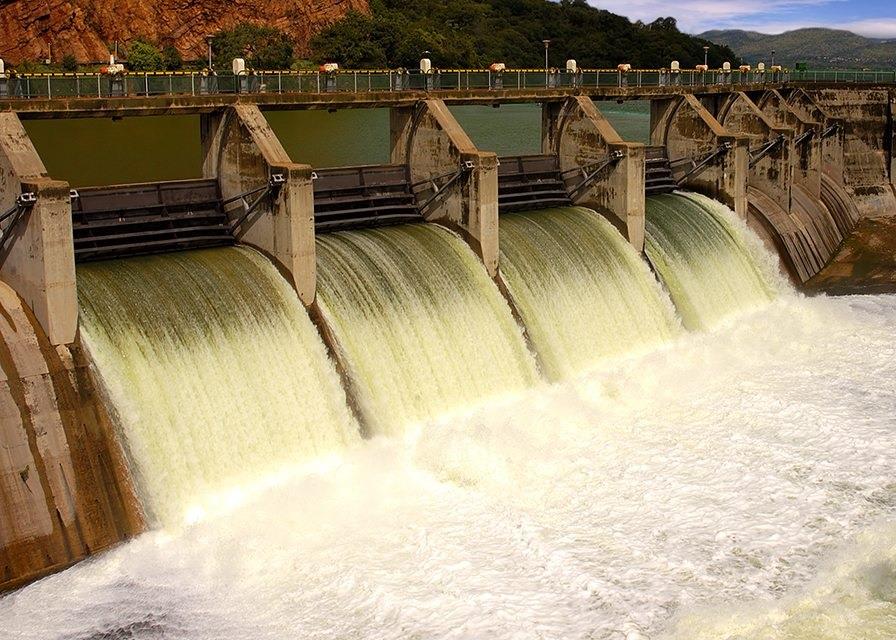

Infrastructure is another key long-term focus, with the NIC planning some $20bn of new projects. National rail projects will feature heavily in future contracting activity, with plans to rehabilitate six major rail lines, covering more than 1,200km of track.

One of the more advanced infrastructure projects is the Great Faw port development in Basra. Italy’s Impregilo is leading a consortium that will design the $6bn port, which will include 7,000 metres of dock for container ships and an additional 3,500m of dock for general cargo. Construction bids are due to be invited in the second quarter of 2010.

Focus on Basra

Such schemes in Basra are drawing a strong level of appetite from international contractors and consultants, helped by the city’s better security situation. Foreign construction groups have put large numbers of staff on the ground in the area. The UK’s Mott McDonald alone has 600 workers based in Basra.

“Basra has an advantage over the rest of the country in that it’s relatively stable – there are few instances of local problems, so it’s an area where people are happier to invest than in Baghdad,” says Tim Siddons, director at Baker Wilkins & Smith, consultant on the Basra Sports city scheme.

There are huge opportunities on offer in housing and infrastructure developments in Iraq, but contractors and developers are quick to highlight the obstacles that prevent the country from realising its potential.

Though a domestic construction sector has begun to grow alongside the large foreign firms, the NIC acknowledges few have developed the capacity for the kind of large-scale developments that will be needed in Iraq.

A lack of qualified engineers is one reason why provincial authorities have struggled to spend budgets allocated for reconstruction. “The problem is that for the past 20 years there has been very little in the way of large projects in Iraq and the middle and upper management levels just aren’t there, but we can help by bringing in outside expertise,” says Siddons.

As international contractors make inroads into the market as security improves, such issues will need to be addressed.

Iraq has a brief window of opportunity to mobilise key projects in the wake of the economic crisis, which has made business opportunities in Gulf states such as the UAE and Qatar less attractive. But regional contractors are starting to focus attention on the growing market in Saudi Arabia.

The new government in Baghdad will have to move fast to kick-start a concerted construction effort that will enable the country to compete more effectively for international contracting talent.

You might also like...

Ajban financial close expected by third quarter

23 April 2024

TotalEnergies awards Marsa LNG contracts

23 April 2024

Neom tenders Oxagon health centre contract

23 April 2024

Neom hydro project moves to prequalification

23 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.