Aramco links result in huge loan offers from local banks

Saudi Aramco Lubricating Oil Refining Company’s (Luberef) $1bn loan deal is four times oversubscribed, according to local banking sources.

The massive oversubscription is yet another sign that banks in Saudi Arabia remain highly liquid and desperate to book good quality assets. Luberef, a joint venture of Saudi Aramco and the local Jadwa Industrial Investment Company, is particularly attractive for the banks because of its links to the state-oil firm.

“Banks are effectively looking at this as an Aramco deal, so it is attracting a lot of interest and will get good pricing,” says one banker in Riyadh.

It is planning to raise the money, which will have a tenor of 10 years, to finance the expansion of its lube oil refinery in Yanbu.

Riyad Bank, which is coordinating the deal, started seeking responses from banks earlier this year and bank commitments were due by mid-April. Financial close is expected to happen in the second half of the year.

The project will include building a new hydrocracker at the firm’s Yanbu refinery. Luberef currently produces about 280,000 tonnes a year (t/y) of lubricants at the Yanbu site, and an additional 270,000 t/y at a site in Jeddah.

You might also like...

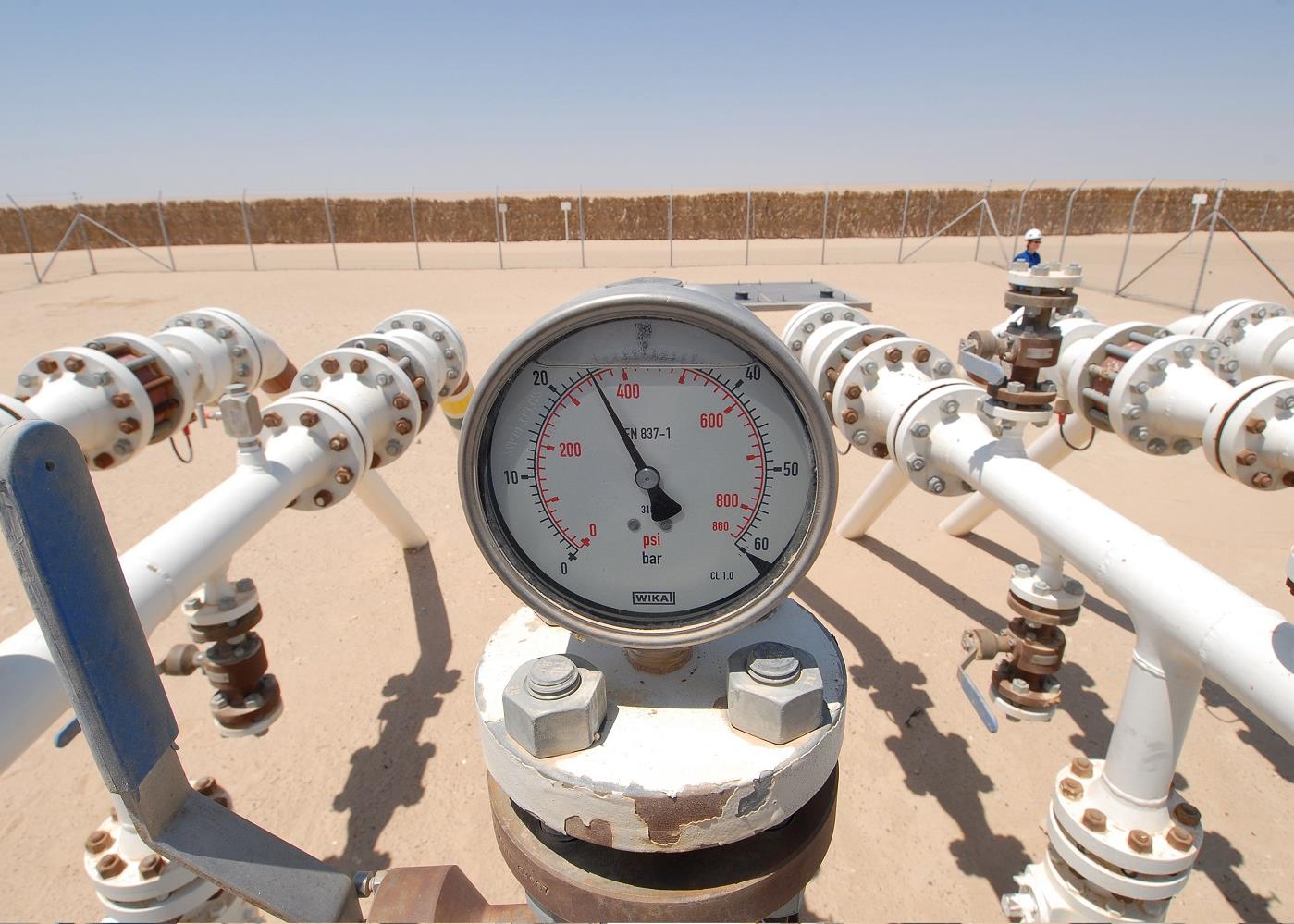

Algeria signs oil deal with Swedish company

19 April 2024

Masdar and Etihad plan pumped hydro project

19 April 2024

Ewec signs Ajban solar PV contract

19 April 2024

Contractor orders compressors for onshore project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.