Overall Gulf index grows by 0.3 per cent

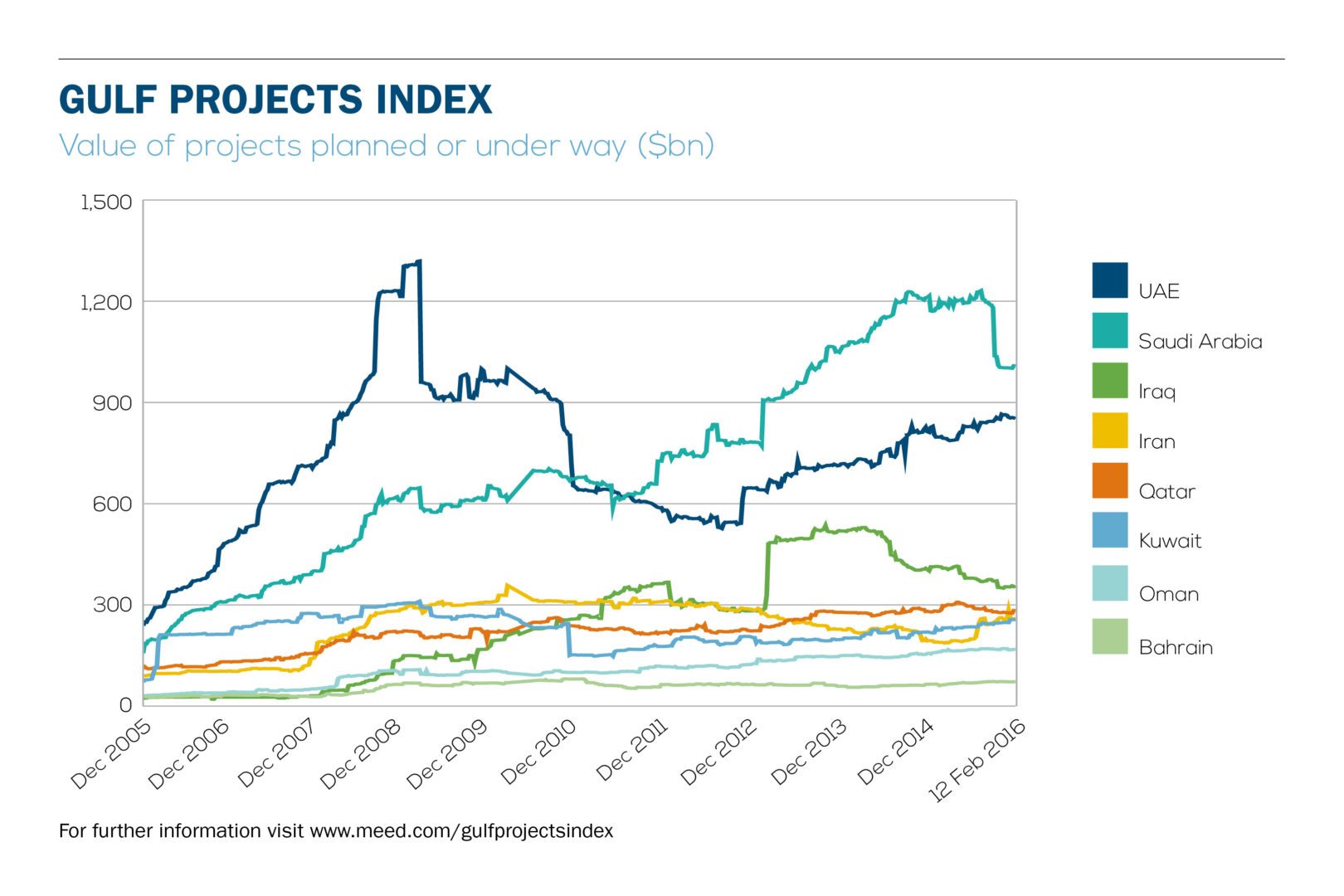

The Gulf Projects Index inched up 0.3 per cent in the week ending 12 February, as Iran, Saudi Arabia and Bahrain posted significant growth.

In numbers

$7.7bn Value of projects added to the Saudi market

$2.8bn Value of new projects added to the UAE market

30 Completed projects across the region

Irans projects market continued its year-on-year growth of 33.7 per cent, pushed on by the wave of interest in the country since nuclear-related sanctions were lifted in January.

Contract awards in Iran included the $2.7bn Tehran-Qom-Isfahan high-speed rail network and a $60m ore complex. No schemes were put on hold or cancelled this week.

| Projects planned or under way 12 February 2016 | |||||

|---|---|---|---|---|---|

| Country | 12-Feb-16 | 05-Feb-16 | % change on week | 13-Feb-15 | % change on year |

| Bahrain | 72,964 | 72,319 | 0.9 | 65,036 | 11.2 |

| Kuwait | 255,342 | 256,603 | -0.5 | 216,909 | 18.3 |

| Oman | 167,001 | 168,195 | -0.7 | 158,036 | 6.4 |

| Qatar | 283,696 | 282,933 | 0.3 | 279,367 | 1.3 |

| Saudi Arabia | 1,014,177 | 1,007,849 | 0.6 | 1,170,075 | -13.9 |

| UAE | 853,307 | 852,777 | 0.1 | 829,132 | 2.9 |

| GCC | 2,646,487 | 2,640,676 | 0.2 | 2,718,555 | -2.9 |

| Iran | 262,901 | 259,124 | 1.5 | 193,804 | 33.7 |

| Iraq | 358,008 | 356,800 | 0.3 | 412,561 | -13.5 |

| Gulf Total | 3,267,396 | 3,256,600 | 0.3 | 3,324,920 | -2.1 |

| For further information visit www.meed.com/projects/gulf-projects-index | |||||

Saudi Arabia grew by 0.6 per cent, with the addition of $7.7bn-worth of projects. Earlier this month, Dubai-based developer Majid al-Futtaim said it planned to invest $3.7bn to develop two shopping malls in Riyadh. The company plans to build Mall of Saudi in northern Riyadh, which will become the kingdoms largest shopping mall, with a total land area of more than 866,000 square metres. It will be home to an indoor snow park. One scheme was cancelled and $159m of projects were put on hold in the kingdom this week.

The size of Bahrains market grew by 0.9 per cent. The expansion was mainly due to the addition of a $600m liquefied natural gas terminal coupled with no schemes being cancelled or put on hold.

The UAE witnessed a gain of 0.1 per cent, as $2.7bn of projects were added to the index. The UAEs growth was limited as $789m of schemes were put on hold, including the local Arabtecs $193m P-17 tower in Dubai.

| Project updates this week | ||

|---|---|---|

| Country | Project name | Status |

| Iran | Resalat Field Development | On hold |

| Iran | Tehran-Qom-Isfahan High-Speed Rail Network | New project |

| Oman | Yibal Khuff Sour Development Project: Onplot | On hold |

| Saudi Arabia | Mall of Saudi | New project |

| UAE | Mall of the Emirates Extension | Complete |

| For further information visit http://www.meedprojects.com/home | ||

The projects markets in Kuwait and Oman both witnessed contractions of 0.5 and 0.7 per cent respectively, despite year-on-year growth for both. Kuwaits projects market has been growing at a rate of 18.3 per cent year-on-year, but the combination of a limited number of new projects entering the market and budget changes to some major schemes has slowed down growth.

Iraq, on the other hand, increased by 0.3 per cent following the recent announcement that authorities want to redevelop the Mosul dam at a cost of up to $2.5bn. The government is also building a $110m, 10-foot-high security wall around Baghdad in an attempt to defend against attacks by the jihadist group Islamic State in Iraq and Syria (Isis).

You might also like...

Contractors win Oman Etihad Rail packages

23 April 2024

Saudi market returns to growth

23 April 2024

Middle East contract awards: March 2024

23 April 2024

Swiss developer appoints Helvetia residences contractor

23 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.