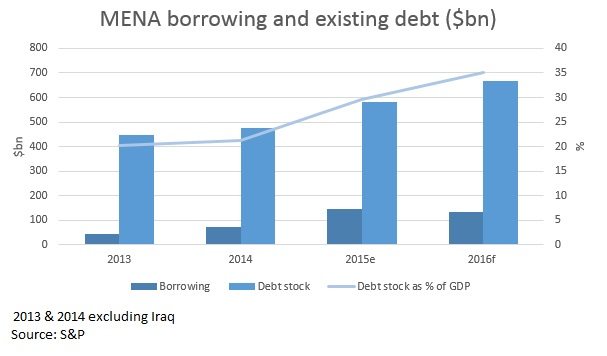

Borrowing hit $143bn in 2015, according to Standard & Poors

Middle Eastern sovereigns will borrow $134bn in 2016, according to US ratings agency Standard & Poors (S&P).

The figure includes Abu Dhabi, Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Ras al-Khaimah, Saudi Arabia and Sharjah.

This is a 9 per cent decrease on the 2015 total of $143bn.

Sovereign debt in the Middle East and North Africa

Source: Standard & Poors

This will be driven by fiscal consolidation in Egypt, leading to less borrowing. It is only expected to refinance $53bn of maturing debt in 2016 compared with $61bn in 2015. Its commercial borrowing will increase by $23bn to $327bn, according to S&P estimates, mainly on the domestic market.

The Middle Easts total sovereign debt stock will reach $814bn, a 17 per cent, or $116bn, increase on 2015. Of this, $667bn will be commercial debt, and the remainder bilateral and multilateral.

GCC borrowing will rise to $45bn in 2016, up 12.5 per cent from $40bn in 2015 and $5bn in 2014, according to S&P forecasts. The low oil prices are weakening government fiscal positions, and they are balancing assets drawdowns and debt.

Sovereign borrowing in the Middle East and North Africa

Saudi Arabia and Iraq will also be the largest issuers after Egypt. After issuing $26bn of debt in 2015, the kingdom is expected to borrow $31bn in 2016, making up nearly 70 per cent of GCC borrowing.

Iraq borrowed $30bn in 2015 and is expected to borrow another $29bn in 2016.

You might also like...

Partanna and Saudi firm tests carbon negative concrete

25 April 2024

Hassan Allam and Siemens confirm Hafeet Rail award

24 April 2024

UAE builds its downstream and chemical sectors

24 April 2024

Acwa Power eyes selective asset sales

24 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.