Doha has approved a state budget for 2018 that shows a 2.4 per cent increase in the country’s year-on-year spending to QR203.2bn ($55.8bn).

However, there are indications that Qatar’s capital spending in 2017 is falling short of its budget.

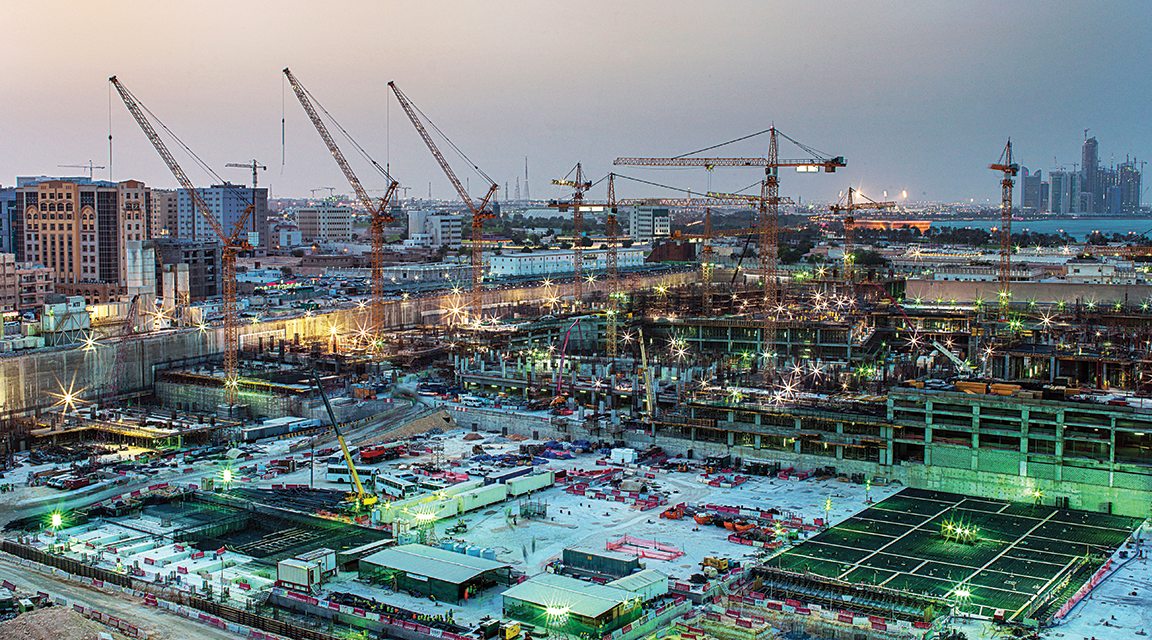

The 2018 budget includes an allocation of QR97.5bn or 48 per cent of the total figure to capital expenditure projects, including QR11.2bn on schemes related to the 2022 FIFA World Cup.

There are currently 355 projects worth $51.68bn with their main contract award due in 2018, according to MEED Projects.

Key projects include the $3bn Facility E IWPP, the $2.7bn phase two of the Barzan Gas Development, and the $2.5bn extension the main terminal at Hamad International Airport and development of the airport’s $1.7bn D and E concourses, alongside a range of major real estate projects.

According to an analysis for the first nine months by credit ratings agency Moody’s, Qatar’s capital spending accounted for only around 62 per cent of the full year budget.

While it remains hard to draw any specific conclusions about the impact of the Qatar crisis on the projects market, there are growing indications of a slowdown, and clear rationales for such an approach.

The value of contract awards in Qatar has also slipped almost every quarter since the second quarter of 2016, and the value of contract awards for the first nine months of 2017 ($9.44bn) was 16 per cent lower than value of awards for the same period in 2016 ($11.26bn), according to MEED Projects data.

The transport blockade being imposed on Qatar by Saudi Arabia, Bahrain and UAE, for example, raises stark questions about the business rationale for projects such as the ongoing airport expansion.

Read more: How will the crisis affect Qatar’s projects market?

Negative indicators

In terms of the wider impact of Qatar’s dispute with its GCC neighbours, Qatar’s non-hydrocarbon economy has been much more negatively impacted than the hydrocarbon economy.

Qatar recorded 74 per cent of its budgeted 2017 hydrocarbon revenue during the first nine months the year, according to Moody’s, but non-hydrocarbon revenue was only 57 per cent of the budgeted target, “most likely due” to the dispute with the GCC, the agency said.

The country’s fiscal deficit also reached QR27.2bn for the first nine months, close to the budgeted amount of QR28.4bn for the full year.

Moody’s concluded: “While we continue to see upside to oil and gas revenues given oil prices averaging around $60 a-barrel in the fourth quarter to date, a combination of current spending overruns and underperforming non-hydrocarbon revenue would jeopardise reaching the budget deficit target.”

Qatar currently has a Aa3 long-term issuer and sovereign debt rating from Moody’s, which downgraded the country by one notch from Aa2 on 26 May 2017 in response to the diplomatic crisis.

Fiscal flipside for 2018

In terms of revenue, Qatar’s 2018 budget uses an oil price assumption of $45 a-barrel and projects a marginal reduction in the country’s fiscal deficit despite the increase in spending compared to 2017.

Together with 4.9 per cent growth in nonhydrocarbon revenue, total government revenues are projected to reach QR175.1bn, up 2.9 per cent from the 2017 budget.

Given the unchanged oil price assumption from the 2017 budget, the budget foresees hydrocarbon revenues increasing marginally by 2.3 per cent to QR133.1bn, on account of slightly increased gas production.

According to credit ratings agency Moody’s, Qatar’s approach to budget planning is "credit positive” as it reduces the risk of fiscal slippage that would increase the government’s debt burden at potentially higher costs.

Moody’s sees upside potential for revenue in 2018 based on its own average oil price assumption of $54 a-barrel next year.

The ratings agency therefore forecasts a small fiscal surplus of QR2.3bn (0.4 per cent of GDP) in 2018, compared to the authorities’ estimate of a QR28.1bn (4.4 per cent of GDP) deficit.

While this would also mean smaller financing needs than suggested by the government budget, Moody’s still expects the government to access international debt capital markets in 2018 to refinance $2bn of sukuk maturing in January, and to build up its foreign exchange reserves.

You might also like...

Hassan Allam and Siemens confirm Hafeet Rail award

24 April 2024

UAE builds its downstream and chemical sectors

24 April 2024

Acwa Power eyes selective asset sales

24 April 2024

Bahrain mall to install solar carport

24 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.