Despite promises from Opec and non-Opec producers to cut output over the next six months, higher oil prices are by no means guaranteed

For the first time in eight years, Opec has intervened to stabilise oil prices, committing to slash production by 1.2 million barrels a day (b/d) from January. The agreement was reached on 30 November after two and a half years of weak oil prices and means the new year will begin on a more positive foot for the worlds oil-exporting economies.

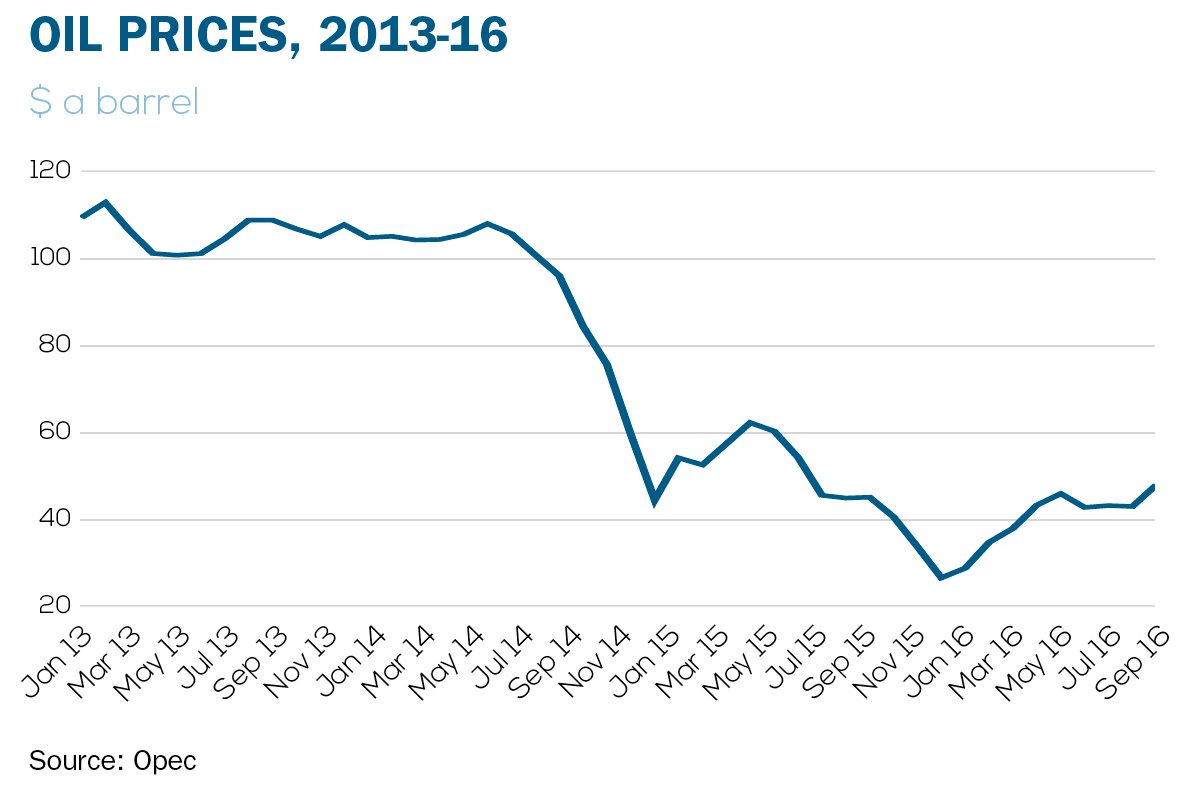

After the deal was announced, the Brent oil price jumped 10 per cent to $53.90 on 1 December, from $46.38 on 29 November. In January 2016, the benchmark had been trading at about $30 a barrel down 70 per cent from the $114-a-barrel peak seen in mid-2014.

Ten days later, Opec also managed to reach an agreement with non-Opec producers to cut production by 558,000 b/d, with the biggest player Russia agreeing to reduce its output by 300,000 b/d from the beginning of 2017. Other producers Azerbaijan, Bahrain, Bolivia, Brunei, Equatorial Guinea, Kazakhstan, Malaysia, Mexico, Oman, Sudan and South Sudan have agreed to nearly 4 per cent cuts in production for six months. The deal with non-Opec producers sent Brent oil above $55 a barrel, a 17-month high.

Oil prices 2013-16

Oil prices 2013-16

The fast-developing events caused economists to scramble to revise their 2017 oil price forecasts. Prior to the Opec agreement, commodities analysts were predicting oil prices to stabilise at about $55 a barrel in 2017, amid expectations of non-Opec, especially US shale, producers ramping up production.

Bullish predictions

However, with non-Opec producers now amenable to output cuts for the first time since 2001, revised oil price forecasts for 2017 are looking increasingly bullish and cover a wide range, reflecting the lack of clarity in the market.

At the more conservative end, the US Energy Information Administration has maintained its forecast for Brent at $50.91, regardless of the production cuts. Riyadh-based Jadwa Investment has revised its forecast upwards from $55 a barrel to $60, the same price that Dutch bank ABN AMRO is forecasting.

UK bank Barclays forecasts Brent to average $57 a barrel in the first quarter of 2017 and increase to $62 in the second quarter. This compares with an expected average of just $45 a barrel for the whole of 2016.

Oil giants

Saudi Arabia and Russia are currently producing at historic levels. Moscow is pumping 11.2 million b/d, its highest level in nearly 30 years. Saudi Arabia, which produced 10.5 million b/d in October, has vowed to cut substantially below the level committed to on 30 November, according to the kingdoms energy minister Khalid al-Falih.

Riyadh has already signalled that it will be exporting far less from January 2017 onwards. There has even been talk of extending the cuts beyond the six-month agreed timeframe.

Oil forecasts by key analysts

Oil forecasts by key analysts

Bank of America Merrill Lynch is projecting global oil demand to be about 560,000 b/d above supply on average over the course of 2017. Based on this assumption, the bank forecasts Brent will average $61 a barrel in 2017 and rise to $70 at the peak of the US driving season.

Higher oil prices will be contingent on producers fulfilling their promises to cut production, and Opec has a poor record in this regard. Members of the group routinely renege on agreed quotas or fail to disclose accurate production figures. More importantly, some of the largest Opec members Iraq, Iran and Libya are looking to increase production.

Growth plans

Some 90 per cent of Baghdads income comes from oil revenues, which are more critical than ever. Military spending is escalating due to the fight against Islamic State in Iraq & Syria.

Iran is looking to regain market share lost during the sanctions years and wants to boost production to at least 5.7 million b/d by 2018, from about 3.9 million b/d today. The country urgently needs money to plough into its investment-starved economy.

Iraq and Iran are the two countries we expect the most growth from, says Jessica Brewer, principal analyst Middle East upstream at UK energy consultancy Wood Mackenzie.

Libya, meanwhile, is aiming to double production to 1.1 million b/d in 2017, from its current level of 528,000 b/d. Output has already increased from 260,000 b/d in August following the liberation of its oil export terminals.

The danger in Opecs strategy is that higher prices could trigger a revival in US shale oil production. Defending market share from the sharp increase in American shale oil output was the motivation for Saudi Arabia ramping up production to record levels and allowing prices to collapse from mid-2014.

The agreement to cut production will be in place for six months, which is the average timeline for shale producers to boost production. Anything in the mid-50s will trigger an increase in production, says Abu Dhabi Investment Authority global research head Christof Ruhl. Theres a physical ability to respond to higher oil prices faster than traditional conventional oil production.

You might also like...

Iraq signs deal to develop the Akkas gas field

25 April 2024

Emaar appoints beachfront project contractor

25 April 2024

Acwa Power signs $356m Barka extension

25 April 2024

AD Ports secures Angola port concession agreement

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.