Contract awards to remain limited amid declining prices and constrained GCC gas supplies

The petrochemicals sector in the Middle East and North Africa (Mena) is scrambling to adapt to a rapidly changing global market amid an ongoing shale boom in the US, increasing production in China and plunging petrochemicals prices.

Since 2011, the annual value of petrochemicals contract awards in the region has steadily declined.

As of 30 November, 2015 has seen just $4.5bn in contracts awarded, 69 per cent less than the $14.3bn awarded in 2011.

A stark sign of the difficulties the sector is facing is the series of major project delays and cancellations

Over the past five years, increasingly constrained gas supplies in the GCC and competition from other regions have weighed on the Mena regions petrochemicals sector.

Persistently low oil prices since mid-2014 have driven down the price of petrochemicals, adding another dimension to the challenge faced by those looking to develop petrochemicals facilities in the Mena region.

After peaking at 1,463 in July 2014, the Platts Global Petrochemical Price Index has declined by 47 per cent, hitting 769 in November 2015.

Stalling projects

A stark sign of the difficulties the sector is facing is the series of major project delays and cancellations that have been announced since oil prices dropped.

Qatars Al-Sejeel and Al-Karaana projects, worth a total of $14bn, have both been shelved since the third quarter of 2014.

In May 2015, MEED revealed that plans to build a petrochemicals complex in Duqm, Oman, have been frozen, or at least significantly delayed, with the developer pushing back plans to build the petrochemicals complex until after the completion of a proposed refinery in the same location.

About one month later, in June, MEED reported that Saudi Basic Industries Corporation (Sabic) had shelved plans to build a $500m-800m acrylonitrile plant in Jubail.

Another scheme in limbo is phase two of the Saudi Aramco Total Refining & Petrochemical Company (Satorp) steam cracker in Jubail, Saudi Arabia, which is yet to receive a gas allocation and has seen no progress over the past four years. In Egypt, the $7bn Tahrir Petrochemicals Complex has seen repeated delays due to financing problems.

Biggest package

Over 2015, the biggest award by far was the steam cracker package for the Oman Oil Refineries & Petroleum Industries (Orpic) Liwa Steam Cracker and Polyethylene Plant.

The contract, valued at $2.8bn, was awarded to a consortium of Netherlands-based CB&I and Taiwanese group CTCI in November.

The package makes up 62 per cent of the total value of all petrochemicals projects awarded over 2015 so far.

Orpic is in negotiations with the preferred bidders for the other three engineering, procurement and construction (EPC) packages that make up the project, which could be awarded before the end of the year. The total project is estimated to be worth $5.2bn.

Other project contracts that have been awarded include the $450m contract for a petrochemicals complex in Irans Bushehr province that was awarded to Italys Maire Tecnimont in March 2015.

Maire Tecnimont also partnered with the Italian chemical company Versalis to win a $291m contract for an emulsion styrene butadiene rubber plant in Iran in October.

| 2015 contract awards | |||

|---|---|---|---|

| Project | Client | Contract value ($m) | Country |

| Liwa steam cracker and polyethylene plant project: steam cracker: EPC 1 | Orpic | 2,800 | Oman |

| Petrochemicals complex (17th olefins) | Dehloran Sepehr Petrochemical Industry Company | 800 | Iran |

| Styrene petrochemicals park | National Petrochemical Company | 450 | Iran |

| Emulsion styrene butadiene rubber plant | Sadaf Petrochemical Assaluyeh Company | 291 | Iran |

| Chemical plant at Wadi-el Natrun industrial area | Obegi Group | 90 | Egypt |

| Speciality chemical production plant | Addar | 35 | Saudi Arabia |

| Solid oral dosage plant | Pharmax Pharmaceuticals | 28 | UAE |

| Source: MEED Projects | |||

Future awards

While Orpic is likely to award the rest of the packages on the Liwa steam cracker and polyethylene plant over coming months, there is unlikely to be a surge in petrochemicals contract awards in the Mena region over 2016.

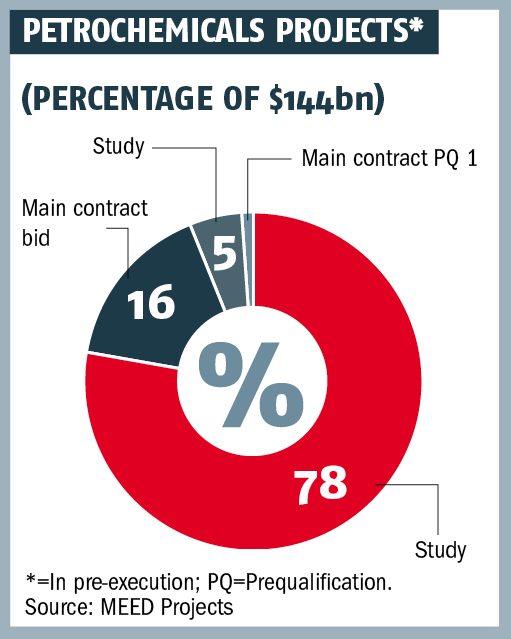

The total value of active petrochemicals projects in the Mena region is $143.5bn, according to the project-tracking service MEED Projects, but 78 per cent of this sum is made up of projects that are still at the study phase.

Many of the projects at the early stages of development are likely to see slow progress due to the headwinds faced by petrochemicals projects in the region.

There are a wide range of interconnected factors that are undermining the viability of petrochemicals projects in the region.

Global factors include the US shale boom as well as slowing growth in China, increasing domestic petrochemicals production in China, persistently low petrochemicals prices, and the impact of the removal of sanctions on Iran.

In the Mena region itself, the major factors negatively affecting the petrochemicals sector are a continuing shortage of ethane gas in the GCC and reduced spending on projects. The scaled-down spending on projects is connected to weaker crude prices and lower oil revenues for Gulf States.

Chinas appetite

Asia has been a key market for the Middle East for decades and China remains the number one destination for petrochemicals produced in the Mena region.

However, there are concerns that Chinas appetite for the Gulfs petrochemicals could diminish.

In October, statistics released by China revealed that the countrys economy had expanded by 6.9 per cent in the third quarter compared with the same period the previous year.

It was the slowest quarterly expansion the country had seen since 2009.

Petrochemicals projects

On top of growth concerns, over recent years China has increased domestic petrochemicals production, eroding the need for imports from the Gulf.

Just how much new domestic petrochemicals facilities will affect demand for imports in the future is likely to be determined by how many coal-to-olefins facilities are given the green light over coming years.

The US boom in shale gas has transformed Americas petrochemicals sector over the past seven years and is a key factor in the decline in the price of petrochemicals products.

The US Energy Information Administration is expecting US petrochemicals-capacity-expansion projects to increase domestic demand for ethane by nearly 600,000 barrels a day (b/d) and propane by nearly 200,000 b/d.

Most of the project announcements were made between early 2011 and mid-2013, when increasing quantities of natural gas from shale formations pushed down ethane prices and increased the margins for facilities turning ethane into ethylene.

Increased production of natural gas has also increased the supply of propane, leading to a flurry of new propane dehydrogenation projects.

Iran impact

The impact of the removal of sanctions on Iran is another source of uncertainty for the regions petrochemicals sector.

Iranian authorities have made it clear that the country is looking to embark on a number of new projects with the aim of significantly increasing petrochemicals capacity.

Just how quickly capacity will increase remains unclear. After years of underinvestment, Iranian infrastructure is substandard and geopolitical tensions remain a concern for investors.

Even with worsening headwinds and increased competition there is confidence among governments that the Mena region can remain a global player in the petrochemicals industry.

Many large-scale facilities are still being built to schedule, a clear sign that governments and private sector partners believe that the right kind of project can still make big profits in the Gulf. These include the $20bn Sadara Chemical, a joint venture between the US-based Dow Chemical and the state energy company Saudi Aramco.

Sadara started production at its first plant in December and will have a capacity of 3 million tonnes of petrochemicals a year when fully operational.

It is hoped that projects like Sadara will remain viable because the GCC still has a number of advantages over its competitors even though its surplus of cheap gas has dried up and its geographical distance from growth markets puts it at a cost disadvantage.

Refinery integration

The Sadara complex is also an example of a petrochemicals facility that is integrated with a refinery in order to increase efficiency and improve margins. Saudi Arabias recently resurrected $3bn Ras Tanura refinery Clean Fuels Project is also using refinery integration to improve its competitiveness.

Projects by country

Outside Saudi Arabia, Omans Liwa Plastics project is planning to integrate the Orpic refinery at Sohar with an 800,000 tonne-a-year ethylene cracker and three polyethylene plants.

It is expected to see contract awards in the fourth quarter of 2015.

In Kuwait, a study looking at integrating a petrochemicals plant with Kuwait National Petroleum Companys Al-Zour New Refinery Project is ongoing.

While the Gulfs petrochemicals sector is quickly adapting to the challenges the market poses, it remains to be seen whether the drive to increase efficiency and integration will make it an attractive region in which to develop petrochemicals projects over the coming years.

Beyond control

Success will depend on a wide range of factors over a long period of time. These include the price of petrochemicals on global markets, the rate of the development of Irans petrochemicals sector, the resilience of US shale gas operations and how strictly Chinese environmental legislation is enforced.

Unfortunately for the regions government officials and private sector project developers, many of the factors that will determine the success of the regions petrochemicals sector are beyond their control.

The Platts Global Petrochemical Price Index has declined by 47 per cent since peaking in July 2014

Source: MEED Projects

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time to revise MGS package bids

18 April 2024

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.