The kingdom has increased domestic energy and utilities prices to help control spending in 2016

The Saudi governments annual budget statement is rarely an accurate guide to future trends in public spending and income.

Finance Ministry figures show Saudi budgets from 2004-14 underestimated government income by an average of more than 70 per cent.

In 2005 and 2011, revenue was more than twice the figure projected in the budget. Oil price volatility since the start of the past decade is the principal reason for the inaccuracy in forecasting revenue trends.

The way the governments revenue is calculated can be mystifying. The 2016 budget statement released on 28 December said oil income fell by 23 per cent to SR445bn ($119bn) in 2015. But the oil price averaged about 48 per cent less than in 2014. Production was 10.12 million barrels a day (b/d), 5 per cent above the 2014 average. These figures suggest that government oil income should have been at least 40 per cent lower than the 2014.

Spending figures

There are similar problems with the planned spending figures. They are aggregated and allocated by sector rather than by spending department. This makes it difficult to identify which government agency is responsible for any divergence in actual spending.

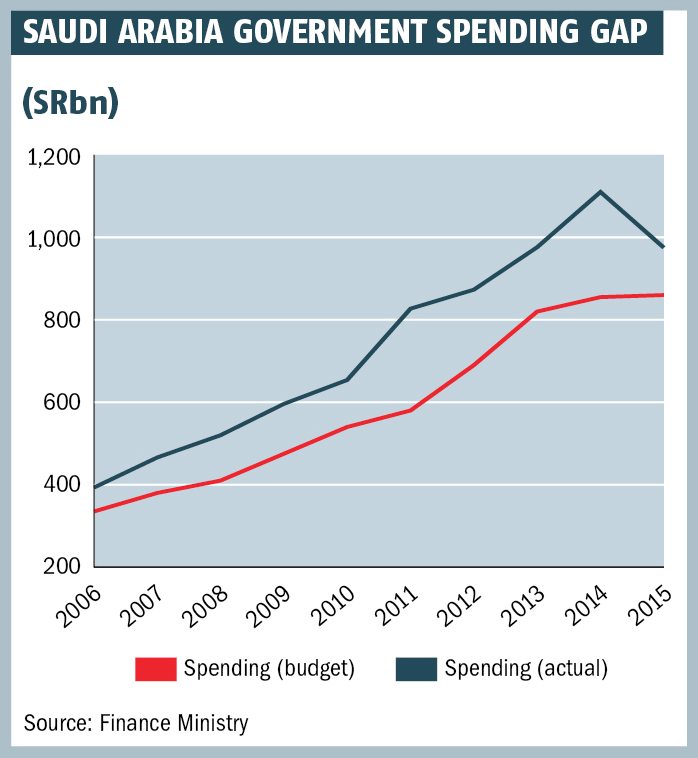

There has been a tendency for actual spending to exceed budgeted levels by a substantial margin.

The 2015 budget called for a 32 per cent cut in expenditure from the actual level recorded in 2014. In reality government spending, although down, was 14 per cent higher than budgeted, at SR975bn ($260bn).

About SR88bn of unbudgeted payments were approved for all government employees and for beneficiaries of social security and pension income, to mark King Salman bin Abdulaziz al-Sauds succession in January. Unplanned defence and security expenditure, assumed to be due to Saudi Arabias Yemen intervention, amounted to SR20bn, and there was a further unbudgeted SR7bn spent on projects.

The average above-budget spending for the 12 years ending December 2015 was close to 20 per cent. Projected budget balances have consequently had little relationship with the reality subsequently reported by the Finance Ministry.

Financial planning

The aggregate of budget balance forecasts for the years 2004-15 was a deficit of SR214bn. Actual figures released at the end of each financial year, in contrast, show the kingdom recorded an aggregate surplus of SR1.75 trillion ($465bn) over the period.

The conclusion is that Saudi Arabias financial planning has been ineffective. The issue was highlighted in the Washington-based IMFs annual Article IV report on the kingdoms economy, published in September.

It called for Saudi Arabia to set its annual budget within a medium-term fiscal framework that clearly establishes the authorities policy intentions, fully integrates expenditure priorities from the national development plan and delinks expenditures from short-term volatility in oil revenues, while ensuring spending adjusts to long-term price trends.

The IMFs recommendations have drawn a swift response.

The 2016 budget statement said the Finance Ministry will create a public finance unit that will set a spending ceiling within a five-year framework, rather than an annual one, and have the power to ensure the ceiling is respected.

The government also promised to apply budget disclosure and planning standards in accordance with international best practice, optimise current spending, improve the effectiveness of investment in capital projects, and cap the growth of recurrent spending, particularly on wages and salaries, which account for more than half of government spending.

A revision of the kingdoms competitiveness and procurement law and an improvement in the management of government assets are also promised.

Non-oil focus

The overarching vision is to promote higher levels of non-oil output.

Oil prices ended 2015 about 70 per cent lower than their June 2014 peak of $114 a barrel. The consensus is the price will be low for longer than previously thought. This is the principal factor driving Saudi policymakers to develop a more credible approach to fiscal management.

The new economic reality is reflected in the projection that government income will be 14 per cent lower in 2016. The figure can be reconciled with oil output being maintained at more than 10 million barrels a day (b/d) and oil prices at about $50 a barrel. This price is higher than in the first week of 2016, but reflects the conventional view about trends for 2016 as a whole.

The planned 13 per cent spending cut is, nevertheless, open to question in view of the kingdoms record of overspending. The projected deficit of SR326.2bn, equivalent to about 13 per cent of forecast GDP in 2016, consequently looks optimistic.

Controlling expenditure

It is likely that spending and the deficit will be higher than the government forecasts.

This would not be disastrous for the economy or the governments reputation. Official financial reserves total more than $600bn. The governments capacity to borrow both regionally and internationally is almost unlimited. Creditors are likely to be tolerant of a modest failure to hit the deficit target.

But evidence will be required that spending is under control, with the gap closing between spending plans and realities. That will only be forthcoming this time next year.

Government action to increase non-oil income is the most substantial element of the budget. Gasoline prices were hiked by 50-67 per cent and ethane doubled on 29 December. Sharp increases were announced for other domestic fuel prices. Electricity, water and sanitation prices were selectively hiked from 1 January.

The government said its non-oil income rose 29 per cent in 2015 to SR164bn to account for 27 per cent of total income. An increase on at least this scale looks likely this year. Time will tell whether the radical changes in fiscal policy signalled by other elements of the 2016 budget will produce similar results.

You might also like...

Hassan Allam and Siemens confirm Hafeet Rail award

24 April 2024

UAE builds its downstream and chemical sectors

24 April 2024

Acwa Power eyes selective asset sales

24 April 2024

Bahrain mall to install solar carport

24 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.