Register for MEED's guest programme

The GCC projects market has broken the record for the value of contracts awarded in a single calendar year.

As of 21 November, 1,268 contracts totalling $178.6bn had been awarded in the region, according to regional projects tracker MEED Projects.

The total so far this year beats the previous full-year record of $173.5bn set in 2014.

With more than a month to go, the 2023 total is expected to break the $185bn mark and could reach $190bn.

On a country level, both Saudi Arabia and the UAE have also broken their all-time highs for contract awards.

Year-to-date, contract awards in the kingdom have reached $82.5bn, far in excess of the previous record of $58.3bn made last year.

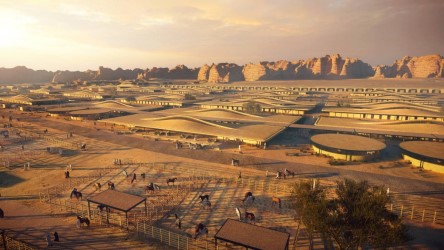

Riyadh has benefitted from a sharp increase in spending on its gigaprojects programme, which includes the $500bn Neom development, the $64bn Diriyah Gate scheme, and the $15bn-plus Red Sea and Amaala tourism projects.

Other major capital expenditure contributors this year include the $23bn-worth of contracts let by Saudi Aramco, $15.3bn of power sector deals and $14.3bn of transport projects.

The UAE has also witnessed a surge in activity, with a total spend of $68.4bn year-to-date, smashing 2014’s $48bn figure and more than doubling last year’s disappointing $27.1bn.

Sector-wise, the federation’s most active sectors have been construction and gas, with $28.1bn and $19.5bn of contract awards, respectively.

Across the region as a whole, the largest single contract was the main engineering, procurement and construction (EPC) package on Qatar’s estimated $10bn-plus second phase liquefied natural gas (LNG) expansion.

This was followed by the main onshore and offshore packages for Adnoc’s Hail and Ghasha sour gas programme, worth $16.9bn.

The biggest single non-hydrocarbons deal was the $2.1bn contract to build the Wynn gaming resort in Ras al-Khaimah.

The estimated $2bn main landscape package on Riyadh's King Salman Park project was the next biggest.

MEED’s analysis highlights that 2023’s record performance has been driven by the confluence of significant project awards in both the hydrocarbons and construction sectors.

While these sectors regularly lead annual expenditure, it is relatively rare for both to award major contracts in the same year, the last time being 2015.

Other major drivers include two years of higher oil prices, Saudi Arabia’s Vision 2030, a revival of the Dubai real estate market, and the go-ahead for significant long-awaited gas and petrochemicals schemes.

Looking forward, there are some $105bn-worth of contracts in the market under bid evaluation, plus a further $130bn-worth of deals at the prequalification and tender issuance stages. These imply that the current momentum will continue into 2024 and beyond.

This year’s record performance stands in stark contrast to previous years. Following the fall in oil prices in late 2014, average annual spending declined to just $106bn between 2016 and 2022, a period that included a two-decade low of just $71.7bn in Covid-hit 2020.

While the market undoubtedly welcomes the increase in expenditure, this year's rapid bounce-back has led to questions regarding the capacity and capability to deliver such a swift increase in workload.

Over the past half-decade, the market slump resulted in several international contractors exiting the market and the downsizing of personnel at many regional firms.

At the same time, such is the acceleration in activity levels that there are question marks about the availability of materials, equipment and manpower to complete the more-than-$2tn-worth of projects in the GCC pipeline.

For example, MEED estimates that Saudi Arabia alone will require more than 800 million tonnes of cement by 2030 to deliver its project plans, along with more than 1 million additional labourers and 100,000 extra engineers.

Irrespective of these challenges, the market is entering a boom period that will likely offer more than enough opportunities for all project companies to participate and win.

You might also like...

TotalEnergies to acquire remaining 50% SapuraOMV stake

26 April 2024

Hyundai E&C breaks ground on Jafurah gas project

26 April 2024

Abu Dhabi signs air taxi deals

26 April 2024

Spanish developer to invest in Saudi housing

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.