The story of the discovery, exploitation and significance of the region's oil deposits includes dramatic twists and turns that were inconceivable a century ago

In 2017, the ability of Middle East oil producers to influence the global energy market is being tested to its limits. With little spare capacity and a resurgent North American oil sector, the Middle East and North Africa (Mena) producers under the Opec umbrella are for the first time in more than 40 years finding their supplies are no longer the dominant factor determining prices.

Oil is the backbone of the Middle Easts economy and, with about two-thirds of global reserves, the region will continue to be at the centre of the oil and gas sector as long as hydrocarbons remain essential to the worlds energy needs.

Shaping history

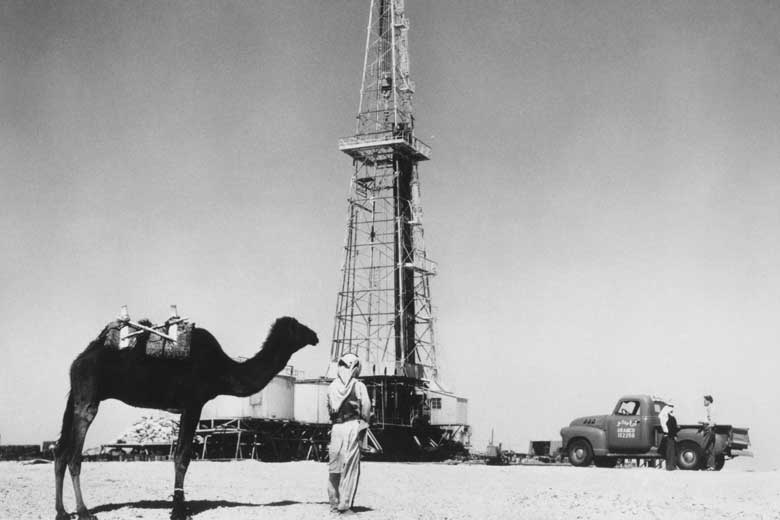

It has been more than a century since oil was discovered in the Middle East. A company that would later evolve into British Petroleum struck oil in Iran, then known as Persia, in 1908, but it was not until the second half of the 20th century that the fuel would have a transformative impact on the wider region.

The discovery, production and sale of oil has since shaped the regions history, intertwining with business, politics and society, and playing its part in growth and prosperity, but also revolution, war and economic crises.

Over the past 60 years, the emergence of crude as the most important energy source and commodity has shifted the economic centre of the Arab world from the Mediterranean towards the oil-rich Gulf.

In 1957, the production and export of oil in the Middle East was almost solely carried out by Western companies in exchange for a cut of the revenues, with little contribution from host nations.

International oil companies (IOCs) posted the official prices of oil sold, and paid governments a share of the revenues. However, this worked in the oil companies favour as they were able to increase prices without changing the posted prices and without the knowledge of the oil-producing nations.

Opec formed

This all began to change in 1960 when, discontented with posted price reductions, Venezuela, Iran, Iraq, Kuwait and Saudi Arabia formed Opec. The early incarnation of Opec demanded that price changes could not be made without consulting the governments, and set out to study a system for stabilising prices through the regulation of production.

The 1960s saw the addition of Qatar, Libya, Indonesia, the UAE and Algeria to Opec, but in the first decade the group achieved little more than a few increases to posted prices.

In the 1970s, Opec members sought to increase their power over production levels and take control of the companies operating within their borders. For some countries, such as Algeria, nationalisation happened suddenly, while in Saudi Arabia there was a seven-year transition from the Arabian American Oil Company (Aramco) to the nationalised Saudi Aramco.

In states such as Saudi Arabia the government took a monopoly on all upstream oil production. Others, such as the UAE, decided to operate fields in partnership with IOCs to ease the transition and retain expertise in managing the assets.

With new powers to control oil supplies, Middle East producers would flex their muscles on the international stage for the first time in 1973. Six Arab countries decided to stop supplying crude to the US and the European trading hub of the Netherlands in October 1973, in response to American support for Israel in the fourth Arab-Israeli War.

The spike in the price of oil at the end of 1973 brought an end to the era of low posted oil prices as the Arab countries saw what impact they could have on the global market. The increased revenues quickened the pace of oil nationalisation in the 1970s, with governments reluctant to increase payments to IOCs.

Second shock

The first oil shock of 1973-74 was followed by a second in 1978-81, which reinforced how political developments in the Middle East could have a disproportionate impact on world energy markets. Strikes by Iranian oil workers in late 1978 in defiance of the Shah led to a halt in Iranian oil production. The subsequent Islamic revolution and Iran-Iraq war led to a collapse in production from the two countries and a further spike in prices.

The Saudi leadership has been the most vocal on the need for economic diversification

The 1980s were characterised by lower prices and excess Opec capacity, while global markets moved towards more transparent methods of pricing. From 1986, prices would no longer be set by Opec. Between 1985 and 2005, crude prices remained relatively stable until demand caught up with Opecs ability to supply the market and regulate prices. The lower spare capacity increased prices at the start of the new century, triggering an economic boom that has propelled development in the GCC.

Crude prices declined in 2014 after four years of $100-plus prices, leading to some soul searching in the oil-reliant Gulf states. The Saudi leadership has been the most vocal on the need for economic diversification.

The dominance of oil in the energy and transport sectors is under threat in the long term by the rise of renewable energy and electric cars. But in the meantime, oil and gas will continue to exert an overwhelming influence on Middle East economies.

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.