The Saudi retailer is embarking on an ambitious expansion to increase its market share

Company snapshot

Date established: 1980

Main business area: Retail

Main business regions: Saudi Arabia

Chairman: Abdullah Saleh al-Othaim

Chief executive officer: Abdulaziz al-Othaim

Abdullah al-Othaim Markets Company Structure

Saudi retailer Abdullah al-Othaim Markets Company has its roots in Saleh al-Othaim Trading Establishment, which was founded in 1956 by the late Sheikh Saleh al-Othaim.

Saleh al-Othaim Trading Establishment opened its first branch at Hilat al-Gusman in the Al-Batha area of Riyadh’s business district. Abdullah bin Saleh al-Othaim and his brothers continued the business and expanded it, opening a series of commercial wholesale and retail centres in the kingdom.

| Al-Othaim market share target | |||

|---|---|---|---|

| (percentage) | |||

| 2009 | 2010 | 2011 | 2012 |

| 4.1 | 5 | 6 | 7.5 |

| Source: Al-Othaim | |||

Abdullah al-Othaim Markets Company was set up in 1980, as a subsidiary of Al-Othaim Holding Company. In 1990, the firm changed most of its outlets to wholesale and supermarket format in a bid to get closer to its customers.

Al-Othaim Markets was incorporated as a limited liability company in 2000. In 2006, its capital was increased to SR225m ($60m).

| Al-Othaim sales growth, 2008-2012, (SRm) | ||||

|---|---|---|---|---|

| 2008 | 2009 | 2010 | 2011 | 2012 |

| 2,855 | 3,231 | 3,715 | 3,901 | 4,096 |

| Source: Al-Othaim | ||||

In September 2007, Al-Othaim Markets was converted into a joint stock company. In July the following year, it debuted on the Saudi Arabian Stock Exchange (Tadawul) through an initial public offering (IPO), which saw 6.77 million shares sold off at SR40 a share.

Highlighting the strength of the Al-Othaim brand, the IPO was 21 times oversubscribed as more than 2 million Saudi nationals invested SR1.74bn in the firm’s shares.

| Al-Othaim financial performance (SRm) | ||||

|---|---|---|---|---|

| (SRm) | ||||

| 2007 | 2008 | 2009 | 2010e | |

| Sales | 2,274 | 3,457 | 3,139 | 3,493 |

| Net income | 60 | 77 | 78 | 97 |

| Sources: Al-Othaim; NCB Capital forecast | ||||

The privately held Al-Othaim Holding Company retains a 27.6 per cent stake in Al-Othaim Markets, with chief executive officer (CEO) Abdulalaziz al-Othaim holding a 21 per cent stake and chairman Abdullah Saleh al-Othaim a 6 per cent interest.

Abdullah al-Othaim Markets Company Operations

Al-Othaim Markets operates four types of retail outlets: hypermarkets; supermarkets; convenience stores; and wholesale stores. It is primarily engaged in wholesale and retail trading of foodstuff and consumer products, such as soaps, detergents and household appliances.

Al-Othaim Markets is Saudi Arabia’s second largest retailer, behind the local Savola-owned Azizia Panda chain, which has a 10 per cent market share.

The company has grown rapidly in the past couple of years and today owns four hypermarkets, 58 supermarkets, eight wholesale stores and 16 convenience stores in 21 cities across the kingdom.

Al-Othaim Markets’ biggest presence is in Riyadh, where it runs 52 stores, with nearby Qassem province hosting 12.

In addition to retail outlets, Al-Othaim Markets manages and operates recreation centres, bakeries and training centres.

The firm also buys land as an investment and manages its logistics requirements through its own fleet of vehicles.

Al-Othaim Markets has 6,300 employees. Supermarket sales account for more than 60 per cent company revenues, with hypermarkets contributing about 14 per cent of income.

In 2009, Al-Othaim Markets recorded net profit of SR78m, against sales of SR3.14bn.

Abdullah al-Othaim Markets Company Ambitions

Having built up a strong presence in Riyadh, the company is now focused on expanding its retail footprint across the kingdom, leveraging its strong nationwide distribution network.

Al-Othaim Markets aims to open up to 10 new stores a year. By 2012, it plans to operate 11 wholesale stores, 10 hypermarkets, 84 supermarkets and 20 convenience stores.

The geographic focus will largely remain on the central region, despite talk of opening stores in Jeddah – the stronghold of rival Azizia Panda.

The retailer aims to increase market share from its current 4.1 per cent to 7.5 per cent by 2012. It expects sales to exceed SR4bn a year by the same date.

Overseas expansion which Azizia Panda has undertaken, opening a hypermarket in Dubai, is also being considered. Former Al-Othaim CEO, Yousef Algafari said in 2009 that Egypt would be the firm’s first overseas target.

Saudi Arabia the shift to big retail

Food shoppers in Saudi Arabia face limited choices when it comes to filling their baskets. Small corner stores dominate the retail landscape, compared with the other Gulf states where ‘big box’ retailing has made significant inroads.

The biggest challenge is in pacing its expansion and [Al-Othaim] must not try to do too much, too soon

Farouk Miah, NCB Capital

Currently more than half of the market share is held by independent grocery retailers. However, this is likely to change over the next couple of years, as supermarkets and hypermarkets prepare to grab a larger slice of Saudi consumer spending.

The market is ripe for picking. The 50,000-plus grocery stores in the kingdom fail to offer shoppers the range of choice that the supermarkets of the kingdom’s two largest retailers, Al-Othaim Markets and Azizia Panda do. Small stores also cannot leverage the same economies of scale to deliver cheaper products.

This is Al-Othaim Markets big opportunity, as it pursues a major rollout of new retail floor space across the country. “With Al-Othaim, the big driver in relation to their plans to open at least eight new supermarkets a year for the next four years is that Saudi Arabia is still very under-penetrated in terms of organised supermarkets,” says Farouk Miah, an equity analyst at NCB Capital, the investment banking arm of local National Commercial Bank. “Most people still buy foodstuffs from corner stores. However, the market is now leaning towards organised supermarkets like Al-Othaim.”

Disposable incomes in Saudi Arabia have been supported by about 10 years of high oil prices. Demographic changes are also important in re-engineering private consumption in the region, with customer preferences now accentuated more towards high-end products.

This provides an added layer of insulation for Al-Othaim Markets as it invests in building new stores. “Relative to most places, Saudi Arabia’s consumer sector is pretty strongly linked to oil prices,” says Miah. “The thing about Al-Othaim is that it is a defensive company, primarily selling food items.”

The company’s track record in recent years has been impressive. During the 2005-08 period, Al-Othaim’s revenues more than doubled, witnessing a robust combined annual growth rate of 26.1 per cent, despite a higher cost of sales and a rise in commodity prices.

More recently, Al-Othaim Markets has witnessed strong sales growth. In the second quarter of 2010, revenues rose 13.5 per cent to SR851.6m, on the back of higher sales to both existing stores and new stores opened up in 2009. A larger footprint will further consolidate the retailer’s market position, enabling it to buy in bulk and negotiate strong discounts from suppliers. But there are risks in growing too large, too fast.

“The biggest challenge is in terms of pacing its expansion and they must not try to do too much, too soon,” says Miah. “The market is very fertile and there are lots of opportunities for them. The risk they face is in opening too many stores, too quickly, and thereby spreading themselves too thinly, which leads to existing stores not doing very well.”

The company is unlikely to overtake Azizia Panda in terms of overall market share, but its expansion will keep it well ahead of the competition.

Its market share is twice as big as the next biggest competitor, Bindawood, and it remains well ahead of the foreign brands, such as France’s Carrefour.

Another advantage is Al-Othaim Markets also manages its logistics and owns its own fleet of vehicles, an investment made back in the 1990s.

The move to go public has widened the company’s investor base, granting it additional capital resources with which to grow. In fact, it is the only pure supermarket company that has listed in the Gulf and the stock has performed well on the Tadawul.

New CEO Abdulaziz al-Othaim faces a challenge in rolling out 8-10 new stores a year to tap the booming Saudi consumer market, while protecting margins and keeping a cap on costs. It must also decide whether to expand overseas. But if its recent record is anything to go by, the company should be up to the task.

Abdullah al-Othaim Markets Profile

You might also like...

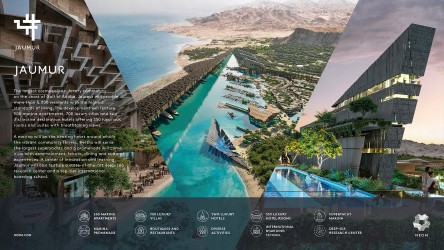

Neom appoints architect for Jaumur

09 May 2024

Gulf plans GCC-wide tourist visa by end-2024

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.