UAE bank sets price guidance ahead of Islamic bond issue

Abu Dhabi Islamic Bank has set price guidance for its sukuk (Islamic bond) issue of 235 basis points above the midswap rate, according to sources close to the deal.

The bank is due to complete the sale of the five year bonds by 29 October. Final pricing for the deal will depend on market appetite.

The UK’s HSBC, Standard Chartered and Barclay’s Capital have been appointed to run the issue, which is part of a $5bn sukuk programme.

The issue size is not yet decided, but is due to be around $500m.

You might also like...

Qiddiya evaluates multipurpose stadium bids

26 April 2024

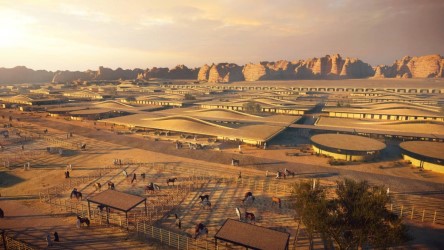

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.