Abu Dhabi's state-owned Mubadala Investment Company has acquired a 44 per cent stake worth at least $271m in an oil subsidiary of Russian energy major Gazprom.

Gazprom said its board of directors had agreed to sell 44 per cent of its subsidiary Gazprom Neft-Vostok to Mubadala Petroleum, the oil and gas arm of the Abu Dhabi investment body.

Mubadala has also teamed up with the Russian Direct Investment Fund (RDIF) for the Gazprom stake acquisition, with RDIF taking another 5 per cent stake in the company, taking the joint venture’s total stake in Gazprom Neft-Vostok to 49 per cent.

Russia's Kommersant newspaper had reported talks on the deal in February, saying Gazprom Neft-Vostok produced oil at six fields in Western Siberia's Omsk and Tomsk regions.

The Russian oil subsidiary's combined production declined by 3 per cent to 1.64 million tonnes in 2017.

The deal is Mubadala Petroleum’s first investment in the Russian energy market.

Proven and probable oil reserves in the fields amount to approximately 300 million barrels. Oil production from the fields last year was about 33,000 barrels a day.

The output from the fields is sold into Russia’s domestic market as well as exported internationally, and transported primarily through the Eastern Siberia-Pacific Ocean oil pipeline.

You might also like...

UAE rides high on non-oil boom

26 April 2024

Qiddiya evaluates multipurpose stadium bids

26 April 2024

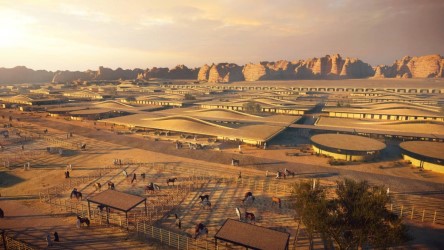

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.