Dubai-based contractor Alec has completed the acquisition of Abu Dhabi contractor Target Engineering Construction Company. The $100m deal creates a contracting group with cross-sector capabilities that hopes to double its turnover in the next five years.

Alec is one of the region’s leading building contractors and is working on landmark projects such as One Zabeel in Dubai and the Natural History Museum in Abu Dhabi.

Target is an engineering, procurement and construction (EPC) contractor working on oil and gas projects including the Borouge 4 petrochemicals complex in Abu Dhabi and the North West Development of the Dalma field, also in Abu Dhabi.

Ambitions to double size

Target, previously owned by Arabtec, has an annual turnover of about AED1.5bn ($408m) and is a significant addition to the Alec business.

“Target will constitute about 30 per cent of our [combined] turnover,” says Kez Taylor, CEO, Alec.

“Going into the future, we see both businesses growing because there is work out there that needs to be executed for both Alec and Target. We see the size of both businesses doubling over the next five years.”

Although Alec and Target are both contractors, their operations are complementary.

“It is a very good fit for us,” says Taylor. “We do complex building jobs; they do oil and gas, energy and marine.”

We have been able to save 11,000 jobs and keep a company working

John Deeb, CFO, Alec

Workforce of 21,000

In terms of manpower, the group is now one of the largest in the region. Target has a workforce of 11,000, and together with Alec’s 10,000, the group has a total workforce of 21,000.

“We feel we have a good cultural mix because they are contractors and are similar to us. When we interact, we talk the same language,” says Taylor.

While both companies will assist one another and work together, in terms of management, Target will continue to have its own management.

“Target will run Target and we will allow them to operate,” says Taylor.

Financial standing

Alec was able to complete the acquisition thanks to its strong financial position.

“We don’t have debt as a business. Over the years, we have actually avoided it. We have a strong balance sheet and that’s why we were in a position to make a move like this,” says Taylor.

Target was available for sale after its previous owner Arabtec filed for bankruptcy in 2020.

“It started when Arabtec went under,” says John Deeb, CFO, Alec. “If you look at Alec in the past, we’ve never really done big acquisitions. We have grown our businesses organically, so we weren’t looking [to acquire].

“Oil and gas was something we had been looking at. We wanted to do something, and then when Arabtec went insolvent, we talked to people about what was good at Arabtec because obviously it wasn’t all bad. Target was the one thing that stood out.”

Bankruptcy law

The Arabtec insolvency has been a key test of the UAE’s bankruptcy law, which came into force in late 2016.

“This deal is one of the first to show how the process works,” says Deeb. “We have been able to save 11,000 jobs and keep a company working.”

Acquisition benefits

The acquisition helps Alec diversify its business and gain access to one of the region’s most active sectors.

“We have focused on the high-end building market. We haven’t done roads, bridges – we decided to stay away from that, but oil and gas is something that does make a lot more sense as the barriers to entry are higher and it’s more challenging work,” says Deeb.

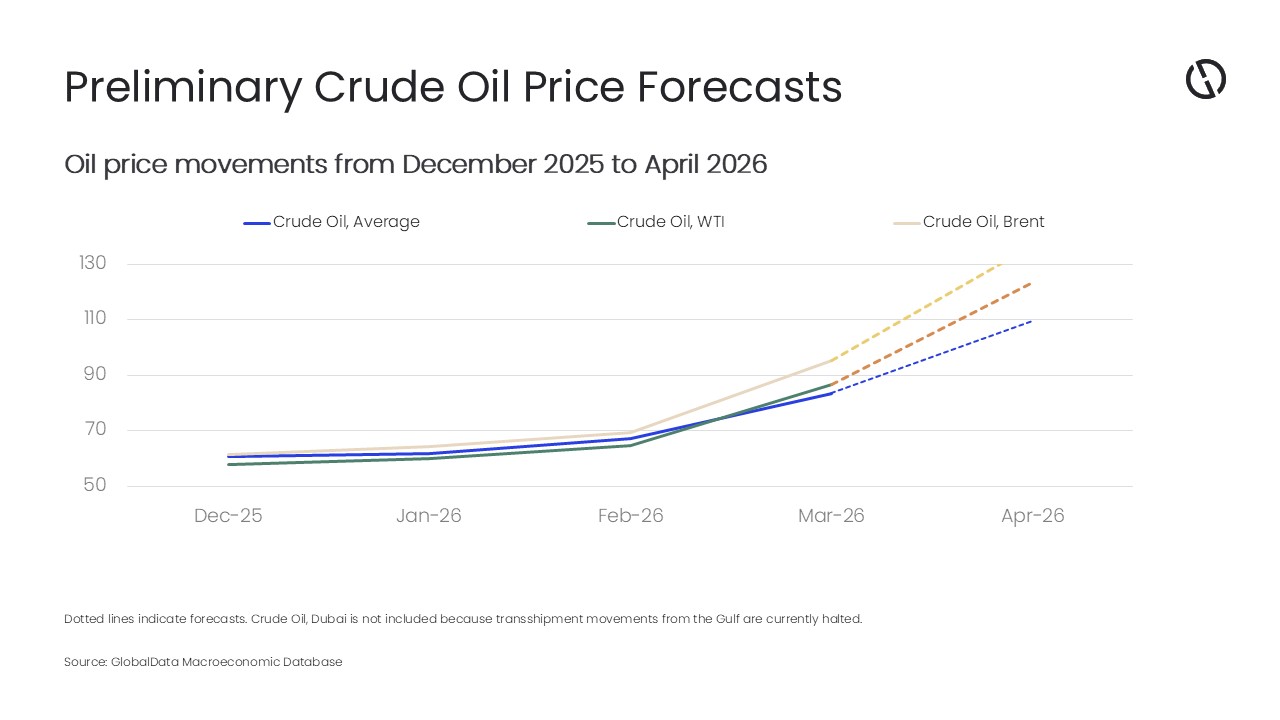

The outlook for investment in projects in the oil and gas sector is backed by strong economic fundamentals and the increasingly important energy transition.

“The UAE has the capacity to produce 4 million barrels a day (b/d) and they want to get it up to 5 million b/d by 2027. In Saudi Arabia, they are producing about 10 million b/d, and they want to increase that to 13 million b/d. That’s a 25 per cent increase for the UAE and a 30 per cent increase for Saudi Arabia. Coupled with that, you have net-zero targets,” says Taylor.

Geographically, the two main markets for the group are Saudi Arabia and the UAE.

“There is a huge amount of work to be done. The market share in the UAE for Alec is about 2 per cent and in Saudi Arabia, we see it being about 1 per cent,” says Taylor.

Construction will also play a key role in helping the UAE and Saudi Arabia achieve their long-term economic aspirations.

“The UAE wants to be the leading country and economy in the world by 2071 and 10 per cent of that GDP is made up of the construction sector,” says Taylor.

“Saudi Arabia and the UAE are closely aligned in terms of their ambitions, and we believe we can play a significant role in achieving this.”

You might also like...

Saudi Arabia’s private sector picks up the baton

02 March 2026

Qatar halts LNG production after attack on facilities

02 March 2026

Engie sells power and water assets in Qatar

02 March 2026

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.

Take advantage of our introductory offers below for new subscribers and purchase your access today! If you are an existing client, please reach out to your account manager.

Saudi gigaprojects gear up for $569bn of contract awards

Saudi gigaprojects gear up for $569bn of contract awards