Moroccan lender continues Africa expansion

Moroccos Attijariwafa Bank has signed an agreement to acquire 100 per cent of UK-based Barclays Banks Egyptian subsidiary.

MEED reported in March that Barclays Egyptian unit is valued at approximately $500m. The deal is subject to regulatory approval by the central banks of Egypt and Morocco, but could be finalised by the end of 2016.

Dubais Emirates NBD was also reported to have bid for the Barclays unit.

Barclays Bank Egypt posted a net banking income of E£1.5bn ($171m) and net income of E£606m in 2015. Its total assets reached E£20.2bn and its shareholders equity was E£3.4bn as of 31 December 2015.

Egyptian banks have remained profitable despite Egypts hard currency crisis and the consequent drag on growth.

The Egyptian economy and banking sector offer significant growth prospects in the medium and long term, said Mohamed el-Kettani, chairman and CEO of Attijariwafa, in a statement. This transaction will allow Attijariwafa bank to contribute to further economic integration between Egypt and our countries of presence in Maghreb, Western and Central Africa. It will also offer Attijariwafa bank a unique opportunity for further development in the Middle East and Eastern Africa.

Attijariwafa was advised by Switzerlands UBS Investment Bank, Moroccan Attijari Finances Corporation, Naciri & Associés, the Moroccan office of the UKs Allen & Overy, Egypts Sharkawy & Sarhan Law Firm and Frances Mazars.

The bank, part-owned by the Moroccan royal family holding company Societe Nationale dInvestissement (SNI), has about a quarter of the market share in Morocco. It already has subsidiaries in Tunisia and four West African countries, but has suffered from high levels of problem loans in these markets.

You might also like...

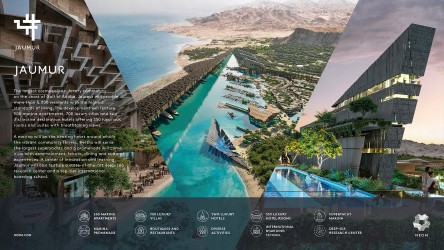

Neom appoints architect for Jaumur

09 May 2024

Gulf plans GCC-wide tourist visa by end-2024

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.