APM Terminals Bahrain expects to appoint a transaction adviser by the end of April and be a listed company by October.

“We expect that by October we should be a listed company,” Mark Hardiman, CEO, APM Terminals Bahrain told MEED on 17 April. “We are on track and in the process right now of making the appointments to relaunch the IPO [initial public offering]. We are in the final stages [of appointing a transaction adviser], and we will probably make an announcement next week [late April] and that is a key appointment in the whole process.”

It is understood that the transaction will be a local financial institution.

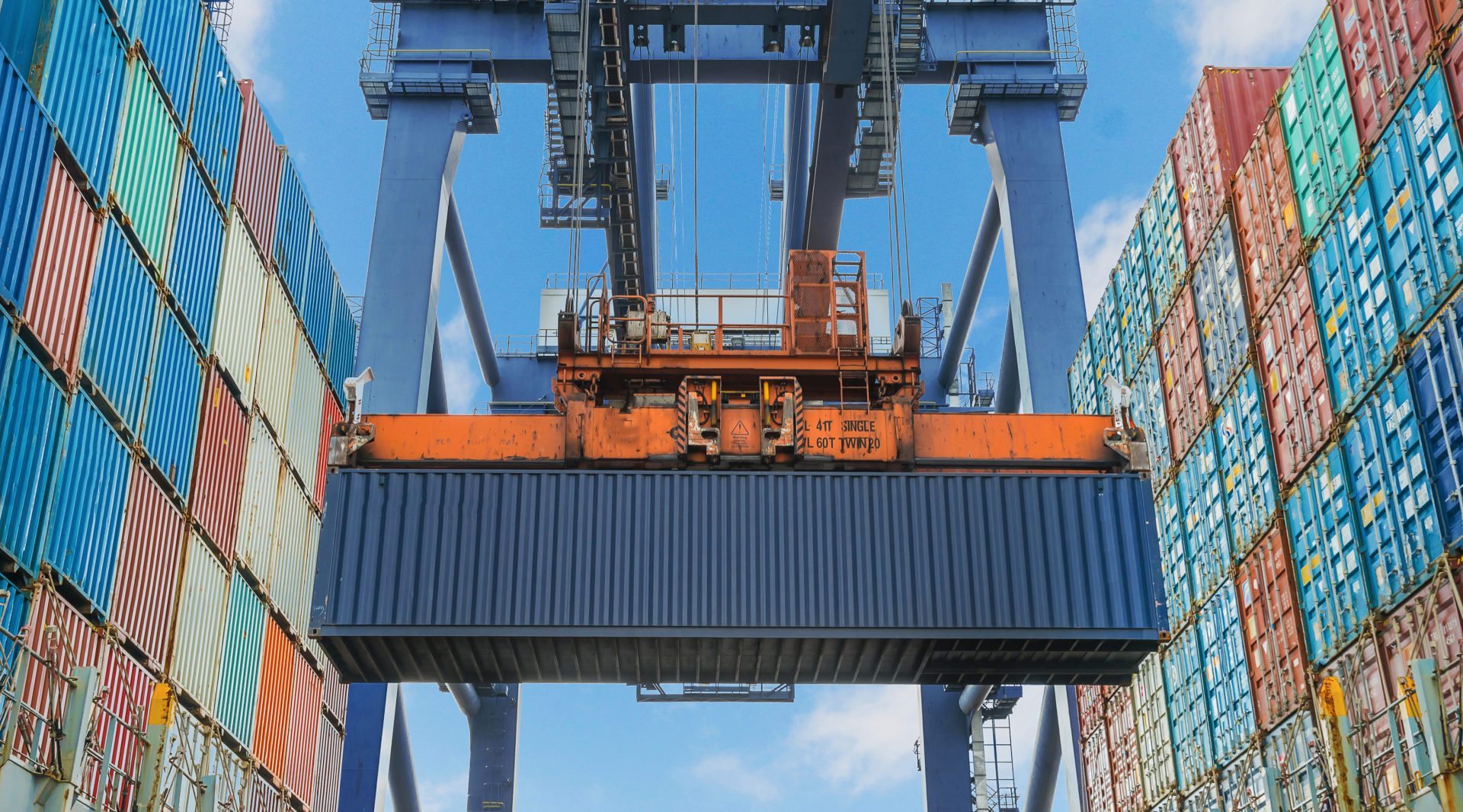

The IPO of 20 per cent of the company, which operates Khalifa bin Salman Port (KBSP), will be on the local Bahrain exchange. “The intention, the spirit of the IPO, is for us to give the public the opportunity to invest in a very successful PPP story,” says Hardiman.

KBSP is a joint venture of Netherlands-based APM Terminals and local firm YBA Kanoo Holdings. APM Terminals has an 80 per cent shareholding in the port, with the local partner accounting for the rest.

The 20 per cent equity stake to be offered to the public will be divested proportionally by the existing investors, which means APM Terminals’ shares will be reduced to 64 per cent and Yba Kanoo’s to 16 per cent following the planned listing.

The company does not plan to float any more shares in the future. “There is no intention to further dilute; it is just meant to be 20 per cent and that is our obligation that we agreed with the government when we signed our concession,” says Hardiman.

An IPO was embedded in the 25-year concession agreement signed between the Bahraini government and the port operator in 2009.

An IPO was first attempted in 2015, but was deferred due to market uncertainty and technical issues that have now been resolved with the authorities.

“The government and the Ports & Maritime Authority, our regulator, have helped us address those issues with the capital markets supervision directorate,” says Hardiman.

You might also like...

Amiral cogen eyes financial close

26 April 2024

Lunate acquires 40% stake in Adnoc Oil Pipelines

26 April 2024

Saudi Arabia's Rawabi Holding raises SR1.2bn in sukuk

26 April 2024

Iraq oil project reaches 70% completion

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.