As the economic context weakens in the kingdom, lenders will suffer too

Banking sector growth and profits are expected to weaken in Saudi Arabia in 2016, reflecting the kingdoms slower GDP growth, which is projected by the Washington-based IMF to be 2.3 per cent.

Falling oil revenues and government bond issuances are also having a major impact on liquidity, and this is pushing pricing up for corporate borrowers. At the same time, those borrowers are also taking a hit to their profits.

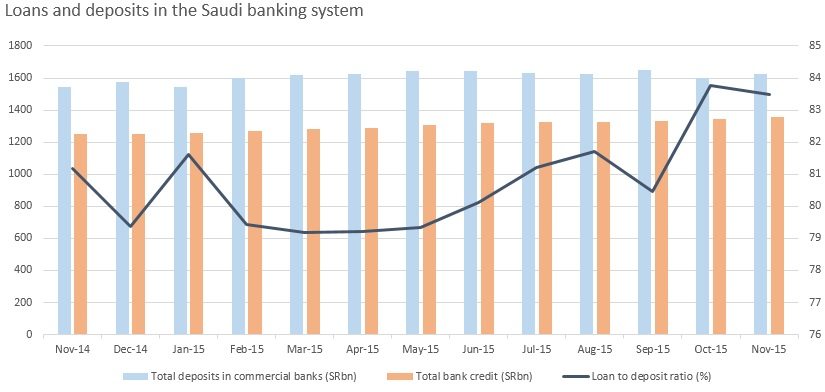

Deposit growth has already slowed and loan growth is expected to follow suit, as liquidity dries up. Banks will adopt a more cautious attitude and focus on big-name borrowers.

The financial sector used the huge buffers they built up while oil prices were high to cushion their landing in 2015 and maintain lending. The longer oil prices remain low, the more banking profits will suffer, along with the rest of the economy.

With less lending and project finance deals expected, transaction fees could also suffer.

Liquidity constraints

There are significant liquidity constraints after the long glut, says an international banker based in Riyadh. The banking sector may not grow this year, just 1 per cent or even negative.

Government deposits declined 28.7 per cent year-on-year to the end of November 2015, while banking sector deposits grew just 5.3 per cent, according to the Saudi Arabian Monetary Agency (Sama), the central bank.

Saudi government deposits

Both National Commercial Bank (NCB) and Banque Saudi Fransi, the first to report to the Saudi Stock Exchange (Tadawul), saw deposits fall slightly year-on-year, but still reported strong profits. More financial results will reveal how sharp the deposit slowdown has been.

At the same time, loan growth slowed to 8.2 per cent year-on-year to November. This is down from the double figures seen over the past few years, but still faster than deposit growth.

This led the loan-to-deposit ratio (LDR) to spike in October at 84 per cent, low by global standards, but close to Samas regulatory limit of 85 per cent.

Saudi loan-to-deposit ratio

There is pressure on liquidity, but its not alarming, says Fahad al-Turki, chief economist and head of research at Riyadh-based Jadwa Investment. There is great competition for deposits, especially time and savings deposits, and rates have increased to attract since mid-2015.

The weak deposit growth is a reflection of a wider economic slowdown, as companies deposit less and scale back investment plans.

Loan growth

This means lower demand for finance to fund expansions. Jadwa Investment predicts the credit growth rate will fall from 9 per cent in 2015 to 6.7 per cent in 2016, which is still strong in global terms.

Banks will also be much more cautious about who they lend to and on which terms.

Saudi interbank rate

Pricing has risen significantly from the extremely low rates between 2012 and 2014, allowed by low Sama rates, abundant liquidity and high competition to lend.

Companies are not struggling to get finance, but return requirements have gone up; loan margins and pricing are up, says a Saudi-based banker. Before it was historically low, it had fallen a lot, but what is normal?

A poorer economic performance overall will increase the number of problem loans, rising from a very low 1.5 per cent in June 2015 to 2.5 per cent, according to the US Moodys Investors Service.

Project finance

Project finance bankers are focusing on major refinancings in the market, with companies looking for better terms than they achieved before 2012. Just one project finance deal is on the horizon.

There are several transactions in the market for refinancing projects, says the Riyadh-based international banker. They are looking to mop up liquidity as quickly as possible before it gets more difficult. This is the last gasp before it goes quiet.

Saudi Arabian Mining Company (Maaden) recently closed a $3bn refinancing of Maaden Phosphates Company complexes.

Rabigh Electricity Company, the projects special-purpose vehicle owned jointly by the local Acwa Power, Korea Electric Power Company (Kepco) and Saudi Electricity Company (SEC), is close to completing the refinancing of $1.9bn of debt on the Rabigh independent power project (IPP).

Frances Engie (formerly GDF Suez) and SEC are also refinancing debt for the PP11 IPP, thought to be about $2bn.

Saudi Arabias only upcoming IPP yet to be awarded is the Fadhili cogeneration plant, with a capacity of 1,200-1,600MW of electricity, 3.19 million pounds an hour of steam and 768.8 tonnes an hour of water. Banking proposals were submitted with the bids, but a contract award has been delayed.

The economic transformation plan, to be announced at the end of January, should contain details of Riyadhs plans for public-private partnerships (PPPs) and opportunities for the financial sector. Saudi utilities are also considering reviving the independent water and power project (IWPP) model.

But bankers expect a significant gap between the Fadhili IPP and the next PPP or project financing to be brought to the market.

Levers to pull

While the tightening liquidity is still not a crisis in the kingdom, there are actions Sama or the Finance Ministry could take to ease it and boost growth if necessary.

Banks bought SR27.6bn ($7.4bn) of government bonds between May and November 2015, soaking up a significant proportion of liquidity, and Riyadh is continuing to sell domestic rather than international bonds.

The government continuing to issue debt is good in itself as a financial instrument to develop debt capital markets, but it takes available liquidity from the private sector, says Al-Turki. I dont think we will see [the private sector] crowded out in 2016.

Jadwa Investment expects the government to issue SR120bn-SR130bn of bonds in 2016, but is not concerned about banks continuing capacity to buy the debt.

But the kingdom could also return to the international debt market if the situation deteriorated.

Diversified lending

Lenders are likely to diversify their sources of funding by their own issuing of bonds or sukuk (Islamic bonds), although this option is more expensive. NCB and Arab National Bank both issued sukuk in 2015, raising SR1bn and SR2bn respectively.

Commercial banks have SR96bn of statutory deposits in Sama, high loan loss provisioning of 170 per cent, and a low LDR ceiling. As a last resort, regulations could be eased to promote growth.

They could relax the LDR limit to stimulate growth and loosen policy, and it would help with liquidity temporarily, but in the long term we need deposits, says the international banker. That would be a political decision, not because banks want it.

But for now banks are thought to have enough liquidity to get through 2016, even if the boom times are over.

| Saudi banking sector | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nov-14 | Dec-14 | Jan-15 | Feb-15 | Mar-15 | Apr-15 | May-15 | Jun-15 | Jul-15 | Aug-15 | Sep-15 | Oct-15 | Nov-15 | |

| Government deposits (SRbn) | 1,630 | 1,561 | 1,535 | 1,416 | 1,372 | 1,324 | 1,270 | 1,254 | 1,244 | 1,233 | 1,190 | 1,201 | 1,163 |

| Total deposits in commercial banks (SRbn) | 1,542 | 1,576 | 1,544 | 1,599 | 1,619 | 1,626 | 1,646 | 1,646 | 1,629 | 1,625 | 1,653 | 1,602 | 1,623 |

| Total bank credit (SRbn) | 1,252 | 1,251 | 1,260 | 1,270 | 1,282 | 1,288 | 1,306 | 1,319 | 1,323 | 1,328 | 1,330 | 1,342 | 1,355 |

| Loan-to-deposit ratio (%) | 81.19326 | 79.37817 | 81.60622 | 79.42464 | 79.18468 | 79.21279 | 79.34386 | 80.13366 | 81.21547 | 81.72308 | 80.45977 | 83.77029 | 83.48737 |

| 3-month Saudi interbank rate (%) | 0.8915 | 0.8622 | 0.8564 | 0.8169 | 0.7753 | 0.7727 | 0.7741 | 0.775 | 0.7769 | 0.8254 | 0.8824 | 0.9336 | 1.0347 |

| Source: Sama | |||||||||||||

You might also like...

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

Jubail 4 and 6 bidders get more time

26 April 2024

Amiral cogen eyes financial close

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.