Project to be developed by Abengoa and Total

Banks have been granted an extension to the deadline for lending commitments to finance Abu Dhabi’s Shams 1 solar power project. The 24 September deadline has been pushed back to 7 October (MEED 16:9:10).

Shams 1 will cost around $740m to develop and the financing will include around $600m debt with a 20-year tenor. The scheme will generate 100MW of solar power.

A market sounding took place in June, with a request for proposals (RFP) issued to banks asking them to give an indicative response on the financing.

The project is said to have garnered a good level of interest from banks. According to a source close to the project, 16 banks are considering lending.

The high level of interest may be the result of several factors. As Abu Dhabi’s first thermal solar power project, banks are eager to finance the scheme, which is set to be followed by similar projects in the future.

Also, Masdar’s strong relationship status is said to have played a key role. But, it is the government’s willingness to shoulder risk associated with the project that is seen as particularly attractive for banks.

According to one banker, the “offtake risk is very low” as there is a 25-year power purchase agreement (PPA) in place. Further, almost all of the debt will be guaranteed by the government. As a result “pricing is very competitive”.

France’s BNP Paribas is acting as financial adviser on the project.

Masdar was not available for comment.

You might also like...

Qiddiya evaluates multipurpose stadium bids

26 April 2024

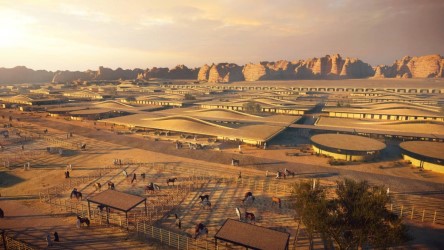

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.