Latest Dubai owned firm to agree debt rescheduling

Dubai International Capital (DIC), an investment arm of Dubai Holding, has agreed with creditors to a $2.4bn debt restructuring.

Under the terms of the deal, creditors will receive 2 per cent interest on $2bn of debt that has been extended for another five years. The remaining $400m of debt will be extended for three years.

Dubai Holding is owned by Sheikh Mohammed bin Rashid al-Maktoum, ruler of Dubai. It is the latest of several Dubai government-linked firms to restructure its debts. Dubai Holding is also restructuring around $10bn of debt.

A group of banks including the UK’s HSBC, Royal Bank of Scotland and Lloyds Banking Group, along with the local Emirates NBD, Mashreq and Noor Islamic Bank were part of the committee acting on behalf of the DIC lending group.

The company is now expected to try and sell off some of its assets in order to pay off the debts.

You might also like...

Qiddiya evaluates multipurpose stadium bids

26 April 2024

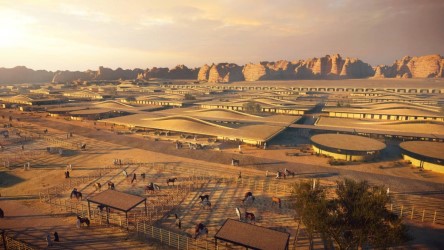

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.