- Merger between Texas-based firms to be completed in Q2 2018

- Combined company expected to generate revenue of $10bn yearly, and work on a total order backlog worth $14.5bn

- Name for merged enterprise yet to be decided

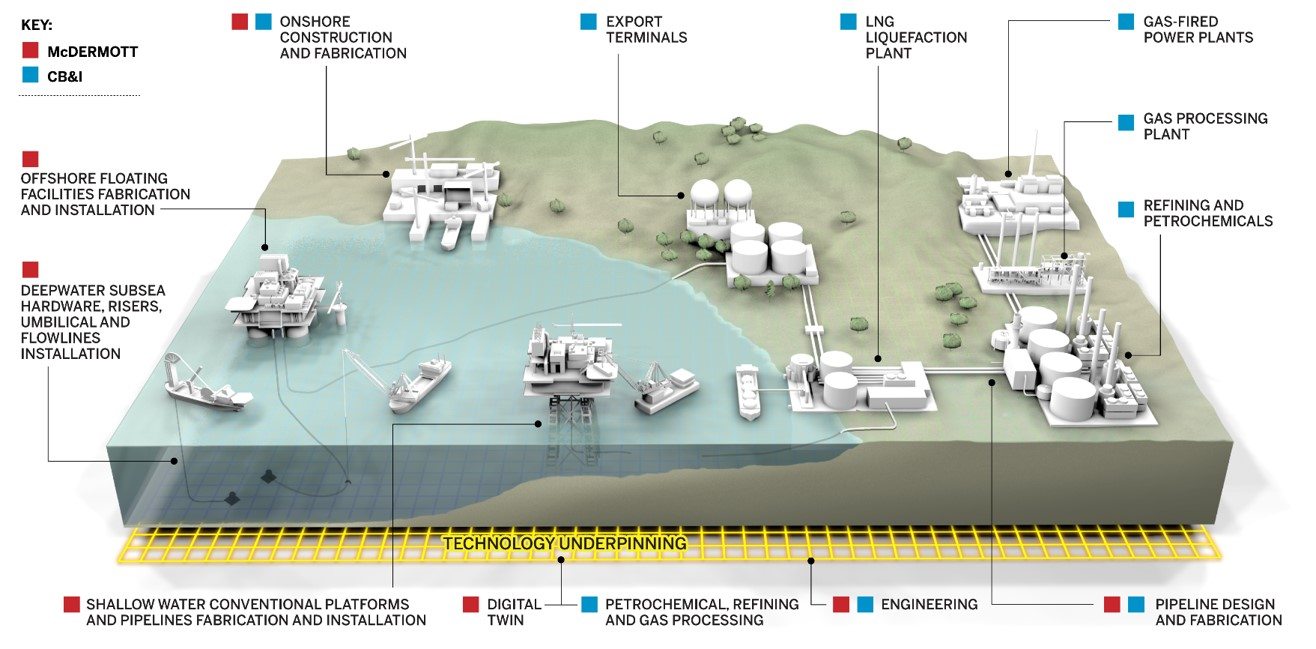

- Acquisition gives McDermott control of CB&I’s competitive technology portfolio, and diversifies business from offshore into onshore, as well as key sectors such as petrochemicals, gas processing and power generation

- Business operations and revenue streams of combined entity to be almost evenly split between American and foreign markets

The merger process between US firms McDermott International and Chicago Bridge & Iron (CB&I), will likely be completed in the second quarter of 2018, creating an oil and gas engineering major garnering $10bn in annual revenues, MEED has learnt.

McDermott does not expect any obstacles to be posed by US regulatory authorities or the shareholders of both companies, in the way of a successful merger, a source working for the Houston-based company has told MEED.

The source admits that McDermott and CB&I may have taken the global oil and gas industry and market analysts by surprise, when the formal announcement about the merger was made on 18 December. The management of both companies are yet to decide upon a name for the combined organisation, which is to be headquartered in Houston, with the source saying “we are going to take our time.” A “different approach” is being adopted for the nomenclature, which will not be all about imposing the acquiring company’s name on the acquired, but “will reflect the richness of CB&I’s 128 years and McDermott’s 94 years of legacy,” the source remarked.

The deal is presumed to be a win-win for solely-offshore contractor McDermott and onshore-focussed CB&I, giving the future firm control of an order backlog of $14.5bn. The acquisition of CB&I, which McDermott had been “eyeing for a while”, is aimed for achieving three key business objectives of “technology, diversity, and scale”, MEED’s source said.

More importantly, it gives McDermott the scope to diversify away from the cost-intensive, risk-laden offshore oil and gas segment, into the onshore projects market, as well as key engineering sectors like petrochemicals, LNG processing and power generation. The combination of the firms would form a company whose business is likely to be about 70 per cent onshore-heavy.

At present, McDermott is focussed largely on operations outside the US, with 98 per cent of its revenue being generated from other oil producing markets like the Middle East. This compares to 23 per cent of foreign revenues for CBI. The merger will result in an entity that generates 45 per cent of its revenue from outside America, with the other 55 per cent at home.

MEED understands that McDermott’s decision to branch out to the onshore oil and gas sphere may have been influenced by the pattern of projects being awarded in the Middle East, especially by Aramco in Saudi Arabia – its biggest regional customer. McDermott has been winning a lot of offshore contract awards in the kingdom recently thanks to the in-force long-term agreement (LTA II) with Saudi Aramco, with MEED reporting the US contractor recently being awarded its fifth deal of Aramco’s Safaniya offshore project.

However, it has been missing out on key onshore projects, engineering, procurement and construction (EPC) contracts for which the Saudi energy giant has been consistently awarding this year. The source declined to comment on this notion. It is worth noting that McDermott has been working on projects in Abu Dhabi and Qatar, but has in recent times positioned itself to concentrate on the Saudi market, possibly due to it attaining greater business prosperity due to the blossoming geopolitical and socio-economic relationship between the US and Saudi Arabia.

McDermott has also invested considerably in developing its new maritime and fabrication facility in Saudi Arabia’s Ras Al Khair industrial development, and has stated it will shift its regional base from its three-decades-old facility in Dubai’s Jebel Ali to the kingdom by 2025. That might however change in due course if the combined company starts to win projects across all segments of the energy spectrum in the region.

While the combination gives financial stability to CB&I which has been struggling this year with non-completion of projects and cost overruns, McDermott gets to absorb the former’s engineering technology unit along with its patented engineered products, which the source describes as the “No 1 in the EPC market.”

CB&I, according to the source, had put its most-prized technology business up for sale “about six months ago” due to financial pressures, but has now ended up being wholly-acquired. The source reveals that considering the direction in which current CEO David Dickson had been leading McDermott in the past 18 months of focussing heavily on developing the engineering technology capabilities of the company around concepts like digitalisation and the ‘digital twin’, the acquisition is “natural progress”.

Upon completion of the transaction, McDermott shareholders will own about 53 per cent of the combined company as part of the all-stock deal, and CB&I shareholders will own the other 47 per cent. The estimated enterprise value of the transaction is approximately $6bn, based on the closing share price of McDermott on 15 December. The total stock value of the merged entity is estimated to be $4bn, with McDermott International (MDR) having a market cap of $2.16bn and CB&I weighing worth $1.82bn on the New York Stock Exchange.

Dickson will be president and CEO of the combined company, and Stuart Spence, current executive vice president and CFO of McDermott, will be executive vice president and CFO of the combined company. Patrick Mullen, president and CEO of CB&I, will remain with the combined company during the transition period, it has been announced, indicating that he will most likely withdraw from his administrative capacity upon completion of the merger.

Operational leadership will include representatives from both companies. The board of directors will comprise 11 members, including 10 independent directors and Dickson. Five of the independent directors will come from McDermott and the other five come from CB&I. Gary Luquette, non-executive chair of the McDermott board, will serve as the combined company’s non-executive chairman. The companies combine to employ about 40,000 people, although retrenchments are common in merger processes.

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.