Gulf bankers maintain volume of deals, but the value of work undertaken tumbles as markets tighten.

The level of merger and acquisition (M&A) activity in the region should be unaffected for at least another year despite the global financial turmoil, according to senior Gulf investment bankers.

While the average size of deals has been falling over the past year, the number of deals has remained relatively stable.

“A lot of the deals that we began working on in the first quarter are starting to be executed,” says Jeffrey Culpepper, vice-chairman of investment banking at Credit Suisse. “In the Gulf, people are being more cautious about new projects, but they are continuing to honour existing projects that were committed to months ago.”

“The underlying deal-making in the region is certainly continuing,” says Yorick van Slingelandt, head of corporate finance for the Middle East and North Africa region at JP Morgan.

The latest figures from UK-based financial data provider Dealogic show that the number of M&A deals in the Middle East and North Africa is almost unchanged from a year ago. Some 102 M&A deals were done in the July-to-September quarter of this year, compared with 103 deals in the same quarter of 2007.

But the size of deals is getting smaller. The total value of the deals in the third quarter of 2008 was $6.9bn, compared with $16bn in the third quarter of 2007.

The value of deals has fallen steadily since the fourth quarter of 2007, when investment banks advised on deals worth $27.6bn. Banks advised on deals worth $12.4bn in the first quarter of 2008 and $9.7bn of deals in the second, according to Dealogic.

The level of activity could start to fall in the second half of 2009, unless the financial turmoil ends soon. “If the international crisis continues to drag on, this time next year, will the pipeline be as robust? The pipeline is not filling up as rapidly as I would like,” says Culpepper.

Credit Suisse is the leading M&A adviser in the region, in terms of the value of deals it has worked on, according to Dealogic. The Zurich-based bank advised on 11 deals in the first nine months of the year, worth a combined $13.7bn.

Merrill Lynch is second with eight deals, worth $12.8bn. When combined with Bank of America, which is in the process of acquiring Merrill Lynch, it would be propelled into the top spot for the year to date, with a total of 10 deals worth $21.5bn.

Goldman Sachs is the region’s third-largest adviser with seven deals, worth $12.3bn. JP Morgan is fourth, advising on four deals, worth $10.4bn.

Culpepper says the most important sectors for M&A activity include transport, power and water. “The sweet spot for us is $400m to $1bn because it is quicker to do and more manageable,” he says.

Smith says he expects M&A activity will pick up once regional stock markets stabilise and begin to climb once more.

“In this region, we have an enormous entrepreneurial group of companies that are growing fast and will potentially change ownership,” he says.

You might also like...

Ajman starts corniche beach project work

10 May 2024

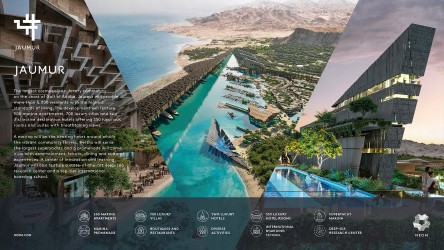

Neom appoints architect for Jaumur

09 May 2024

Gulf plans GCC-wide tourist visa by end-2024

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.