Nearly six years on from the signing of the Joint Comprehensive Plan of Action (JCPOA) in Vienna on 14 July 2015, Iran’s economy once again hangs in the balance as negotiations for the US and Iran to return to the terms of the nuclear deal promise to either unlock growth or deepen its economic malaise.

There is almost as much at stake in principle – though not in practice – in Iran’s political scene, as the presidential election draws close on 18 June. An early resolution of the negotiations with the US will be a victory for Iran’s outgoing President Hassan Rouhani, as well as the reformist camp at large.

However, the results of the upcoming presidential election itself have all but been determined by the country’s powerful Guardian Council, which has paved the way for Iran’s chief judge, Ebrahim Raisi, to win the race by preventing credible rival candidates from across the political spectrum from running.

In the background, while battered by US sanctions, Covid-19 and low oil prices, Iran’s resilient economy appeared to bottom out in 2020 and achieve modest growth, despite the privations of the pandemic.

As in 2015, that leaves the country’s relatively self-reliant domestic market and industrial base ready to exploit the lifting of US sanctions, should the negotiations in Vienna conclude successfully.

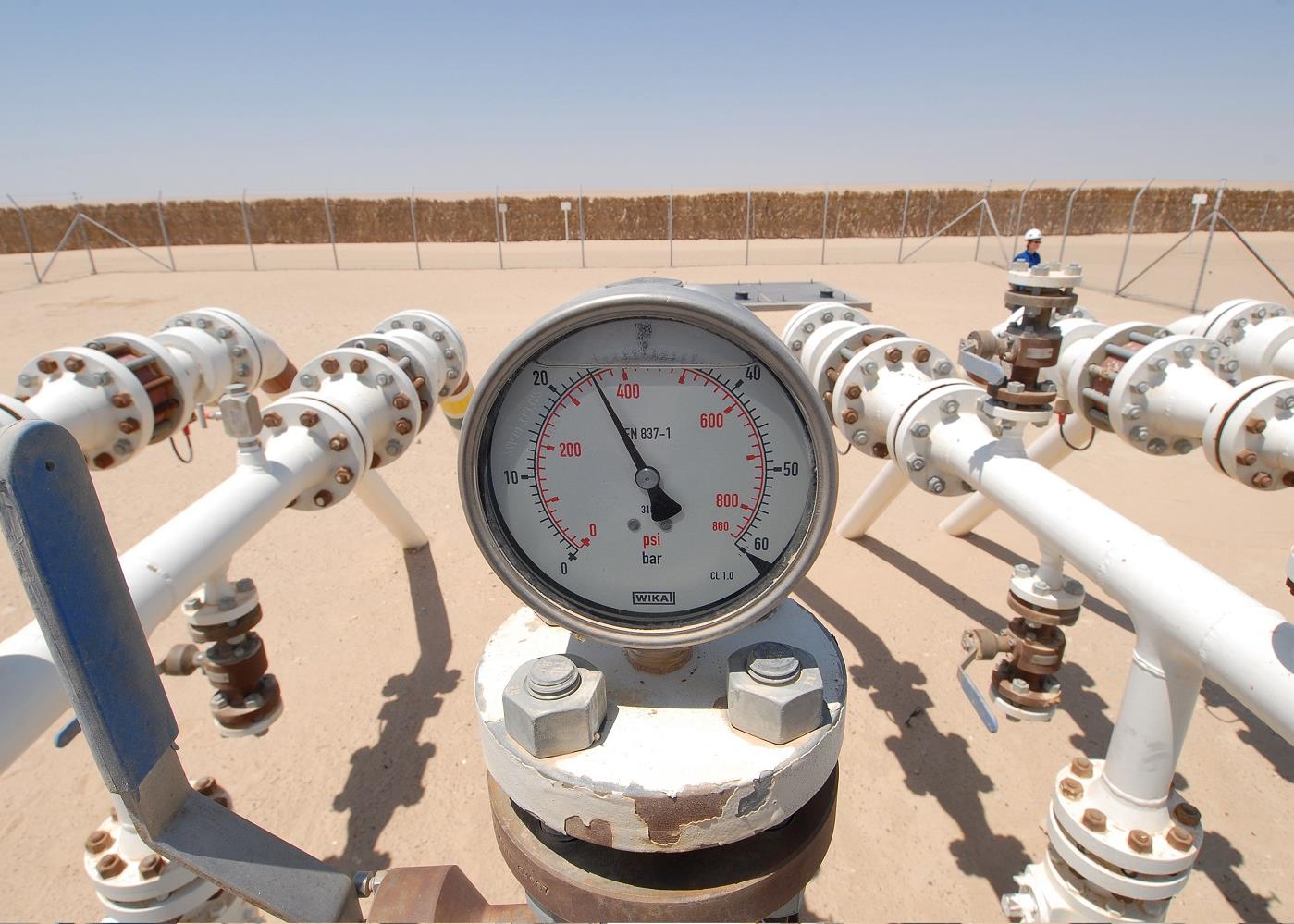

In the hydrocarbons sector, Iran’s state energy companies have been investing in production and export capacity in preparation for the potential post-sanctions trade growth, and in January signed eight deals worth $1.2bn with domestic companies to develop several of the country’s oil fields.

In the hydrocarbons sector, Iran’s state energy companies have been investing in production and export capacity in preparation for the potential post-sanctions trade growth, and in January signed eight deals worth $1.2bn with domestic companies to develop several of the country’s oil fields.

Iran has also ramped up its oil production in recent months, from an average of 1.94 million barrels a day (b/d) in the third quarter of 2020 to 2.4 million b/d in April, according to unofficial estimates.

Things have been looking slightly more desperate in Iran’s power sector, with cities hit by massive power outages in January as the power infrastructure failed to keep pace with spiralling energy demand.

Iran’s civil nuclear energy programme, led by the $9bn development of the second and third units of the Bushehr nuclear plant, is a key part of the solution to this problem, alongside renewables development.

Rising population pressure in Iran’s major urban centres is also driving the authorities to pursue transport and housing schemes, and has allowed the broader construction sector to continue to grow even in the wake of Covid-19.

In November, the transport ministry announced plans to build rail and road projects worth $5.7bn by March 2022, while port projects are currently the subject of about $3.8bn in private sector investment.

It is these supressed, but still very much alive, undercurrents that provide an indication of how much more active the Iranian economy could become in a sanction-free business environment and investment climate.

MEED's June 2021 special report on Iran includes:

MEED's June 2021 special report on Iran includes:

> Iran shows underlying economic resilience

> US-Iran talks intensify Iranian political tension

> Iran rebuilds energy sector amid sanctions

> Iran works to improve its ageing utilities

> Infrastructure needs drive construction in Iran

> Beijing raises the stakes with Iran deal

> Iran awards $1.8bn gas field contract

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.