Contracts are part of a scheme to produce 12 million barrels a day by 2016

Iraq has signed deals with seven international oil and gas consortiums to add 4.7 million barrels of oil to the country’s daily production capacity as Baghdad pushes to make the oil-rich state one of the top producers in the world.

The contracts were awarded by the Oil Ministry during a two-day bid round held on 11 and 12 December, only the second to be held in the country in 30 years.

The ministry received bids for seven out of a total of 10 fields on offer.

The UK/Dutch Shell Group and Malaysia’s Petronas won the first contract, to develop the Majnoon field 60 kilometres northwest of Basra on 11 December (MEED 11:12:09).

The consortium pledged to boost output to 1.8 million barrels a day (b/d) from current levels of 45,000 b/d in return for a fee of $1.39 for every barrel of oil and gas liquids they produce above 70,000 b/d. Shell will operate the field with a 60 per cent stake. Petronas will hold 40 per cent and will help Shell to develop the field.

Also on 11 December, France’s Total and China’s CNPC were successful in winning the rights to develop the Halfaya field, with Petronas as a minority shareholder.

The consortium aims to increase production at the field, in the Missan governorate north of Basra, from 3,000 b/d currently to 535,000 b/d for a fee of $1.40 for every additional barrel produced above a175,000 b/d target. CNPC will operate the field with a 50 per cent stake. Total and Petronas will split the remaining equity equally.

Angola’s Songanol won two deals to develop oil fields in the Nineveh governate to the south of Mosul City on 11 and 12 December. A deal for the first license covering the Qaiyarah field came after renegotiations between the Oil Ministry and Songanol, which was the sole bidder for the development rights.

Songanol will add 120,000 b/d of production to the field, output at which the ministry currently describes as “limited”. The Angolan firm submitted a bid of $12.50 for each barrel of oil produced at the field above a 30,000 b/d target on 11 December, but reached a deal for $5 a barrel on 12 December.

The second deal was also agreed on 12 December, with Songanol taking on the Najmah field for a fee of $6 for every barrel of oil produced above 20,000 b/d target, with an overall production target set for 110,000 b/d. Baghdad does not currently produce oil at the field

Three other deals were agreed on 12 December for the development rights on the West Qurna, Garraf, and Badra fields.

Russia’s Lukoil and Norway’s Statoil agreed to raise output at the northern half of the West Qurna field to1.8 million barrels b/d for a fee of $1.15 for every barrel produced above an agreed level of 120,000 b/d. Lukoil leads the consortium with an 85 per cent stake, and will operate the field.

The deal is the second to be awarded on the West Qurna field which sits to the northwest of Basra city. The US’ ExxonMobil and UK/Dutch Shell Group are still in talks with Baghdad over the first phase, to increase production at the southern part of the field to 2.325 million b/d from current levels of 280,000 b/d. The consortium have asked for $1.90 for every additional barrel of oil produced. An initial deal was inked in November.

Russia’s Gazprom will operate the Badra field southeast of Baghdad City after the consortium it leads won the deal to produce 170,000 b/d at the currently inactive reservoir. Gazprom with Turkey’s TPAO, South Korea’s Kogas, and Petronas were the only consortium to bid for the deal, and offered $6 for every barrel of oil produced above a 15,000 b/d target, although this was cut to $5.50 after talks with the Oil Ministry.

Petronas led the final winning consortium with a 60 per cent stake and will act as operator on the development of the Garraf field in the Thi Qar governate. Japan’s Japex holds the remaining 40 per cent equity in the deal, to produce 230,000 b/d at the field. The consortium will earn $1.49 for every barrel of oil produced above 35,000 b/d.

The deals promise to bring considerable additional revenues to Iraq’s cash-strapped government. The winning firms have agreed to pay out sign-on fees totalling $850m for the deals, and at current oil prices of around $70 a barrel the additional 4.7 million b/d would earn the government more than $320m a day.

In the first bid round held in June Baghdad awarded just one license to a consortium of the UK’s BP and CNPC after other international oil companies (IOCs) baulked at the terms on offer (MEED 30:6:09).

The contracts are part of a programme to increase Iraq’s oil production capacity to 12 million b/d by 2016 from current levels of around 2.5 million b/d.

Oil output in Saudi Arabia, the world’s biggest oil producer, totalled 10.8 million b/d in 2008 according to the UK’s BP. The Kingdom’s oil minister Ali al-Naimi says that overall production capacity is 12.5 million b/d.

The second and third biggest oil producers in the world, the Russian Federation and the US, pumped 9.9 million b/d and 7.9 million b/d in 2008.

You might also like...

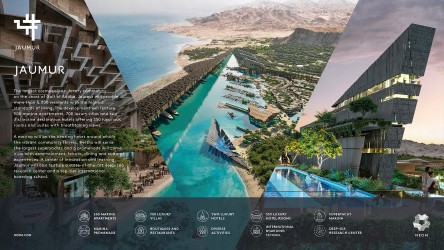

Neom appoints architect for Jaumur

09 May 2024

Gulf plans GCC-wide tourist visa by end-2024

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.