MEED Projects is forecasting a worst-case scenario $93bn of awards in the GCCs projects sector in 2017, and a best-case scenario of just over $138bn

The GCC in 2016 experienced its worst year for project awards since 2005. Contract awards have steadily declined since 2014, after peaking at $186bn. With lower government revenues as a result of the collapse in oil prices, project spending has been reduced to ease the burden on state coffers.

Unlike the 2009 oil price decline, when GCC governments pushed ahead with hydrocarbons schemes to take advantage of the lower cost and competition for contractors, resulting in huge savings on engineering, procurement and construction deals, this prolonged slump in the oil price has diminished governments confidence of returning to budget surpluses.

Consequently, billions of dollars-worth of projects have been postponed. However, there is only so much governments can hold back on. Growing populations and high unemployment will necessitate selective infrastructure investment to facilitate job creation. Contract awards in the GCC are expected to total just over $100bn in 2016, a significant drop from the $178bn awarded in 2015.

By value, the bulk of the deals awarded in the GCC in 2016 were in the construction sector (44 per cent), followed by the transport sector (21 per cent). Oil, gas and chemicals schemes accounted for 19 per cent, followed by power projects at 8 per cent of the total value.

2017 decline

In a November customer survey by regional projects tracker MEED Projects, 68 per cent of respondents indicated that their respective businesses performed better or the same during 2016, compared with 2015. Although project awards have declined substantially over the past two years, project workload peaked at $216bn during 2016 as a result of the mega awards made during 2014 and 2015. This is an increase of 25 per cent on 2015. Ignoring project awards during 2017, which will have a minor impact on project workload in any case, there will be a projected decline of 20 per cent in cash flow during 2017, which will pose a significant threat to the projects supply chain.

Analysing the market by country, Bahrain was the exception to the rule in 2016, with $7bn-worth of contract awards during the year, principally the Aluminium Bahrain smelter project, the airport expansion and the Bahrain natural gas plant.

GCC construction cost index

GCC construction cost index

Annual project workload increased from $2.8bn to $3.7bn and will continue to grow into 2017 to reach $4.5bn as the workload picks up on awards made in 2014, 2015 and 2016. This excludes commitments on project awards after November 2016.

The residential sector in Bahrain has the most active projects, with the largest total contract values and still plenty to spend. The aluminium production and downstream sectors have a large total project value and lots remaining to be spent, but not as many schemes, which would make it a less desirable sector to focus on.

Kuwait activity

Project awards in Kuwait declined by 60 per cent to less than $14bn in 2016. The value of project awards in 2014 and 2015 was exceptional, but long overdue. Kuwait, unlike its GCC neighbours, had great aspirations, but did not always follow through with contract awards. With ageing infrastructure, the impression at the start of 2016 was that the countrys projects market had finally taken off. Enormous deals were awarded during the previous two years in the hydrocarbons sector and a flurry of new infrastructure work announced. Unfortunately, a repeat of 2014 and 2015 did not take place.

Kuwait had great aspirations, but did not always follow through with awards

Workload commitments are set to continue their growth trajectory on the back of the massive awards during 2014 and 2015. Commitments saw a 50 per cent growth in 2016 and are expected to grow a further 24 per cent in 2017 to reach $27bn. The fall in project awards during 2016 will result in a significant drop in workload commitments in 2018.

The infrastructure sector in Kuwait is hugely appealing as it has a large number of active schemes totalling more than $20bn; a significant amount of that total still needs to be spent or committed.

2016 GCC Project Awards by Country

2016 GCC Project Awards by Country

The total value of project awards in Oman for 2016 is expected to top out at about $8bn, almost 50 per cent down from 2015. The bulk of the 2016 awards was accounted for by the two independent power projects at Ibri and Sohar. The sultanate has been adversely affected by the low oil price and the government faces significant challenges in managing its budget deficit.

Omans project workload peaked during 2016 at $15bn and is set to decline 22 per cent to below $12bn in 2017. Critical infrastructure will receive most of the focus as Muscat manages its restricted access to funding.

The infrastructure sector is by far the most prominent, with the bulk of the current and upcoming projects, valued at more than $23bn and consisting of in excess of 120 schemes. The infrastructure sector has most of the remaining uncommitted workload and it is the sector that will receive the most attention in the short term when accessing much-needed funding.

Qatar market

Qatars 2016 award value is expected to be less than $14bn, well down from the peak of more than $35bn in 2014 and $31bn in 2015. The biggest awards were for the expressway, the Emirs palace and metro stations, which accounted for 34 per cent of the total awards.

Although Qatar is less reliant on the oil price, long-term gas supply agreements are well down from the peaks seen in the 2000s. Similar to other GCC countries, this has placed a strain on the governments available funding and desire to push ahead with infrastructure that might ultimately not be needed after the 2022 football World Cup.

In terms of cash flow, project workload will reduce by 24 per cent to just over $27bn in 2017, from a peak of $36bn in 2016. Assuming a 36-month construction cycle, the last projects required for the World Cup need to be awarded by the end of 2018.

Should this trend present itself, the expectation would be an increase in spending during 2020-22 relating to World Cup infrastructure.

2016 awards by sector

2016 awards by sector

With one of the largest infrastructure sectors, second only to Saudi Arabia, Qatar will channel most of its funding to complete what has already been awarded. The infrastructure sector has almost 300 projects worth more than $75bn under way, with almost 60 per cent still to be committed.

New project activity in Saudi Arabia was a major disappointment in 2016, with just over $24bn of contracts awarded, compared with more than $51bn in 2015.

As in the other GCC countries, 2017 will see the kingdoms project workload spend decline by 30 per cent to just shy of $57bn, from well over $80bn in 2016.

UAE performance

The UAE, and Dubai in particular, led the GCC in terms of construction awards in 2016, with more than $36bn of contracts signed. Although still marginally down from the 2015 total of $42bn, this was a better-than-expected performance.

The project workload trend in 2017 will see a decline of roughly 23 per cent to $44bn, down from the peak of $57bn in 2016.

The UAEs residential sector has the biggest value of project awards of just over $41bn and almost 800 projects and 56 per cent of the commitments still to come.

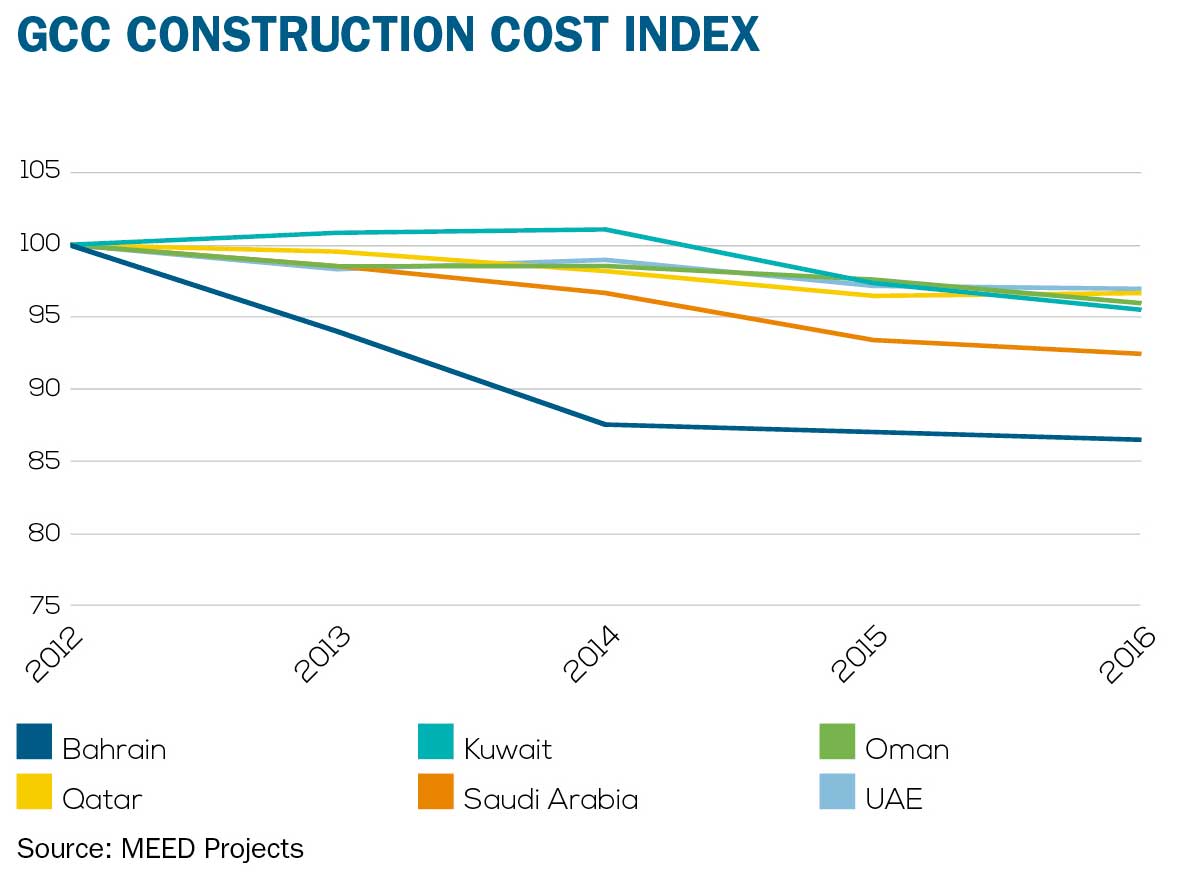

MEED Projects tracks costs for major construction commodities by surveying construction companies throughout most of the Middle East and North Africa (Mena) region on a monthly basis. Using this monthly commodity data in a pricing model for a ground plus basement plus 25-floor residential building, MEED can monitor the impact of commodity prices across the GCC. As an index, with the exception of Kuwait, all six of the GCC countries have seen a decline in the cost of construction since 2012. In some markets, costs have reduced by more than 10 per cent over the five-year period. Kuwait saw an ever-so-slight increase during 2013 and 2014.

However, from 2015 onwards costs started to reduce. Based on the specifications used for the MEED residential building and applying the latest cost data, Oman has the lowest cost of construction, followed by the UAE. The most expensive GCC country to build in is Bahrain, followed by Kuwait.

Forecasting method

By applying performance statistics over the past 15 years, MEED has developed a forecasting methodology to render a band (best-worst case scenario) in which project awards are expected to fall with a degree of certainty.

In December 2015, this methodology was applied and a forecast for 2016 set. The model predicted with 86 per cent certainty that the minimum value of project awards would exceed $103.8bn. As of the middle of December 2016, the total value of awards for the GCC was $102bn.

2016 awards by sector

2016 awards by sector

Applying this forecast methodology to the GCC projects market yields a worst-case forecast of $93bn in contract awards during 2017. The best-case scenario yields a total award value of just over $138bn. During 2018, there will be a slight increase and then a slight decline to 2021.

The forecast for project awards in Bahrain, applying the methodology and focusing on the worst-case scenario which yields an 80 per cent certainty, comes to just above $2bn and the best case as high as $5.3bn for 2017. The five-year worst-case forecast declines slightly, but stabilises at about $1.8bn.

Kuwaits worst-case forecast comes in at $2.8bn, with the expected forecast at just over $10bn. With ageing infrastructure and a new parliament in place, the expectation is a gradual increase over the next five years, with the worst case increasing to just over $14bn by 2021.

If Oman manages to secure access to funding, the worst-case forecast for 2017 comes in at more than $10bn, with large investments expected in Duqm and other critical infrastructure. Worst-case forecasts for 2018 to 2021 vary between $9bn and $12bn.

Qatars 2017 worst-case forecast comes in at just over $12bn, with a further decline expected during 2018, before a likely increase related to the looming 2022 World Cup deadline.

Saudi Arabia had a dismal 2016, but the expectation is that critical infrastructure awards will start to move forward, with a worst-case scenario of $34bn in awards expected during 2017.

An overall decline in project awards in Dubai, with an increase in critical infrastructure awards in Abu Dhabi is expected. The worst-case forecast for the UAE is set at $25bn and a best case at $45bn. The five-year forecast is set in a similar range of $25bn to $48bn.

You might also like...

Amiral cogen eyes financial close

26 April 2024

Lunate acquires 40% stake in Adnoc Oil Pipelines

26 April 2024

Saudi Arabia's Rawabi Holding raises SR1.2bn in sukuk

26 April 2024

Iraq oil project reaches 70% completion

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.