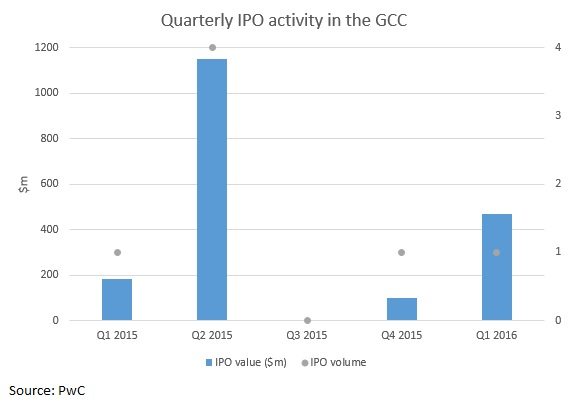

Just one flotation took place in the first quarter of 2016

Just one initial public offering (IPO) took place in the GCC in the first quarter of 2016, on the Saudi Stock Exchange (Tadawul).

Middle East Healthcare Company (Meahco), which owns and operates the Saudi German hospitals, raised $471m from the flotation.

While this is an increase on the $101m raised through a Tadawul listing in the fourth quarter of 2015, it is still well down on 2014 levels, according to UK-based PwC.

IPOs in the GCC in the first quarter of 2016

Source: PwC

The Tadawul has been the only active market over the past five quarters, as other GCC exchanges suffer from persistently low oil prices, regional instability, negative sentiment and low liquidity.

Concerns over a global economic slowdown and high levels of market volatility in the first quarter also discouraged companies from listing both regionally and globally, according to PwC.

The key elements characterising the 2015 capital markets performance related to uncertainty over oil prices and the geopolitical developments in the GCC region, which continued during the first part of 2016, says Steve Drake, head of PwCs capital markets and accounting advisory services team in the Middle East.

Postponed IPOs

However, the GCC pipeline for the remainder of 2016 looks promising, he says. IPOs put on hold in 2015 due to regional instability are expected to come back in 2016 as lower oil prices become the norm and are factored into the market.

The Tadawul also has the strongest IPO pipeline in the GCC, and is expected to remain the most active market. Recently announced reforms to increase the level of foreign investment are also supporting the bourses performance. Saudi Arabias National Transformation Plan includes the privatisation of several state-owned companies.

Over the longer term, we would expect to see positive effects on the Saudi equity markets, in particular as a result of the recently announced government reforms, although it is difficult to predict exactly when that might be, says Drake. Similarly, the Capital Market Authoritys (CMAs) desire to increase the number of [local] listed entities on the Saudi exchange is expected to have a positive impact on IPO volumes in the medium term.

Bond and sukuk (Islamic bond) activity recovered slightly in the first quarter of 2016, although activity remains subdued. Challenging market conditions and higher pricing expectations from investors caused several firms to delay issuance, according to PwC.

Ratings downgrades across the GCC also pushed up pricing.

Corporate bond and sukuk issuance was dominated by banks. Notable issuances include Kuwaits Burgan Bank. It issued KD30m ($100m) of 10-year subordinated notes at a fixed interest rate of 6 per cent, and KD70m of 10-year subordinated notes at a floating rate of 3.95 per cent above the Kuwait central bank rate.

Dubai Islamic Bank also saw its $500m five-year sukuk 2.4 times oversubscribed.

PwC expects issuance to pick up over the year, despite the market remaining uncertain.

You might also like...

TotalEnergies to acquire remaining 50% SapuraOMV stake

26 April 2024

Hyundai E&C breaks ground on Jafurah gas project

26 April 2024

Abu Dhabi signs air taxi deals

26 April 2024

Spanish developer to invest in Saudi housing

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.