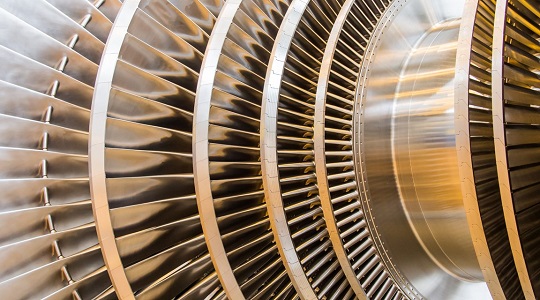

Banks bid for financial advisory work on Jorf Lasfar power plant

Moroccan utility Office National de l’Electricite (ONE) has received five bids from banks seeking to act as financial adviser on the expansion of the Jorf Lasfar independent power project (IPP).

The UK’s HSBC and France’s Calyon have submitted the lowest bids. Other bids came from the US’ Citigroup and Lazard and Rothschild, both of the UK.

The winner of the mandate will advise ONE on a project to expand the production capacity of Jorf Lasfar by 700MW, from its current capacity of 1,400MW.

The Jorf Lasfar plant, which is southwest of Casablanca, is owned by Abu Dhabi National Energy Company (Taqa), which appointed France’s BNP Paribas as its adviser on the expansion scheme in November 2009.

Taqa, which bought the plant from the US’ CMS Generation in 2007, signed the contract to expand the plant in May 2009 (MEED 13:05:09).

The plant was built in 1998 with a project finance loan of $1bn, making it one of the first IPPs in the region (MEED 30:01:98).

Once a financial adviser has been appointed they will help ONE and Taqa decide whether the work should be financed by a extension to the existing financing, or with a new facility.

You might also like...

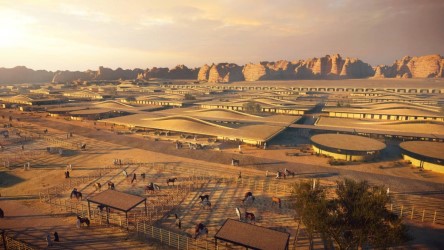

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

Jubail 4 and 6 bidders get more time

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.