Abu Dhabi-based Mubadala Development Companysigned on 23 August a landmark agreement with the UAE University to develop a new campus in Al-Ain on a build-own-operate-transfer (BOOT) basis. The 28-year concession agreement, the first of its type for a UAE education project, calls for the construction of a new campus to accommodate 19,000 students at an estimated cost of $300 million-400 million.

The campus will cover over 280,000 square metres and comprise educational and sports facilities as well as residential accommodation. Mubadala is planning to implement the project in four phases, with overall completion set for 2011-12. The first construction tenders are expected to be released in late 2005 with work beginning in the first quarter of 2006. Mubadala will set up a new company to oversee the project and will be joined by several institutional investors as the main shareholders. 'As the developers, we felt that taking this option would be the best way to develop this project because of the complexity of the campus,' says a source close to the scheme. 'It was important to provide the university with a full service facility.' Australian architect Woods Bagothas carried out the masterplan for the development, while HSBCis acting as financial adviser. The next appointment is expected to come in mid-October with the selection of a project manager: at least four companies have recently received the request for proposals (RFP) documents for the contract. It will be followed by early December with the selection of a design consultant. The Al-Ain campus is expected to be the first of several build-operate projects to be implemented by Mubadala, which is understood to be looking at a range of opportunities in various sectors across the federation. Mubadala, an investment company wholly owned by the government, has the mandate to establish new companies or to acquire stakes in existing companies in the UAE or abroad. It also focuses on generating sustainable economic benefits for the emirate of Abu Dhabi through partnerships with local, regional and international investors. Its largest investment so far is a 51 per cent stake in Dolphin Energy, which is implementing the $3,500 million Dolphin gas project (MEED 20:08:04).

You might also like...

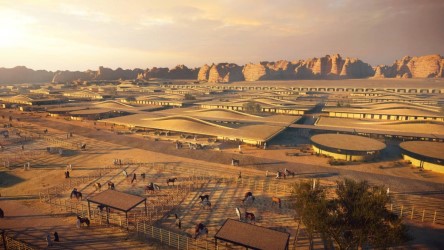

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

Countries sign Iraq to Europe road agreement

26 April 2024

Jubail 4 and 6 bidders get more time

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.