The deal was arranged by Sumitomo Mitsui Banking Corporation, which has acted on a number of Nakilat transactions, with 12 banks providing the debt. Nakilat is also expecting to raise a further $1bn from the bank market in the next 18 months.

The debt was split between a 17-year $925m senior bank facility, a 17-year $125m subordinated debt facility, and a 12-year $450m bank facility provided by export credit agency Korea Export Insurance Corporation (KEIC).

On 3 August Nakilat said it made a profit in the second quarter of 2008 of QR50.9m ($14m), an increase of 63 per cent compared to the same period in 2007.

You might also like...

Four bid for Dubai EV charging stations contract

10 May 2024

Ajman starts corniche beach project work

10 May 2024

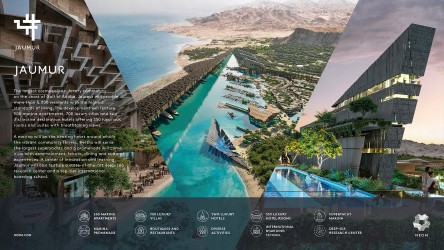

Neom appoints architect for Jaumur

09 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.