Muscat offers a huge opportunity for contractors with its $5.2bn Liwa Plastics project while the rest of the GCC petrochemicals projects market remains subdued

Special Report Contents

Price drop puts strain on GCC petrochemicals

The Gulfs petrochemical sector faces new challenges

Companies plan investments in Irans petrochemicals sector

Chinese domestic production to slow down GCC exports

Databank: Petrochemicals production and construction forecast

GPCA: Petrochemicals sector has entered a time of change

With its plans to establish a new greenfield cracker complex in Sohar, Oman is bucking the trend in the Gulfs petrochemicals sector.

The UAE and Saudi Arabia are prevented from major expansions by a lack of spare gas supplies, while Qatar has cancelled plans for two major projects within the past 12 months. But Oman is ready to push ahead with the largest petrochemicals project in its history.

The Liwa Plastics Industries Complex is also the largest of several schemes being undertaken by state refiner Oman Oil Refineries and Petroleum Industries Company (Orpic) that are set to transform the sultanates downstream and chemicals industries.

Existing plants

Orpic was formed in 2010 to integrate the operations of three of the largest downstream firms in the sultanate. These companies are responsible for the Mina al-Fahal and Sohar refineries, the 1-million-tonne-a-year (t/y) Sohar aromatics plant and the 350,000-t/y Sohar polypropylene (PP) plant.

The latter has long been Omans sole polyolefins plant, but this is set to change when Orpic completes Liwa Plastics and establishes the sultanates first polyethylene production.

On 20 October, the firm said it had selected the preferred engineering, procurement and construction (EPC) bidders for three of the four main packages on the Liwa scheme. These are Italys Tecnimont; a joint venture of South Koreas GS Engineering & Construction (GS E&C) and Japan-based Mitsui & Company; and Indias Punj Lloyd.

While the client has not specified which packages the preferred bidders will build, based on the contractors prequalified for each package, MEED understands Tecnimont has been selected to build three plastics plants at Orpics main site in Sohar.

The GS E&C/Mitsui team is understood to have been selected to build a natural gas extraction unit in Fahud, and Punj Lloyd will install a natural gas liquids pipeline between Fahud and Sohar. Orpic said it would announce the preferred bidder for the largest package - the Sohar steam cracker - in late October.

With the GCC petrochemicals projects market going through a quiet phase, Oman represents a scarce opportunity for chemicals-focused contractors to win major work in the region.

Project funding

Orpic plans to borrow money to finance 70 per cent of the project and has contacted 35 banks and eight export credit agencies (ECAs) about funding. Japans Mitsui Banking Corporation is advising Orpic on raising the funds, which are expected to be settled with the EPC awards.

We are not waiting for the commercial EPC bids to come in to start financing. We started the process in January, CEO Musab al-Mahruqi said at a tour of the companys Sohar site in September. Securing of financing will be concurrent with the award of the EPC bids in the fourth quarter.

Orpic says the process will be the largest project financing in Oman and will be financed with limited government support.

The project has already obtained environmental permits from the Environment and Climate Affairs Ministry. It has also been granted a gas allocation and is finalising gas supply agreements with the Gas Ministry.

Feedstock combination

The cracker will use a combination of feedstocks including natural gas liquids (NGLs) extracted from natural gas, liquid petroleum gas (LPG) from the Sohar refinery and aromatics plant, dry gas from the Sohar refinery, and condensates from Oman LNG.

The complex will have the capacity to produce 880,000 t/y of high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE); 300,000 t/y of PP; 90,000 t/y of methyl tert-butyl ether (MTBE); 41,000 t/y of butane; and 111,000 t/y of pyrolysis gasoline.

The project, when completed by 2018, will transform Orpic from a company reliant on oil refining for profit margins to a dynamic and flexible producer of petrochemicals and plastics, said Al-Mahruqi.

We are now in discussions with eight [ECAs] to verify the finance terms of the project. We have also requested commercial banks to submit their offers.

In March 2014, the schemes front-end engineering and design (feed) contract, which includes the cracker technology licence, was awarded to Netherlands-based Chicago Bridge & Iron (CB&I), while Engineers India picked up the project management consultancy (PMC) deal.

Boosting output

Orpics petrochemicals output will also be given a boost after completion of its next largest scheme the Sohar Refinery Improvement Project (SRIP). The scheme aims to expand the northern refinerys capacity to 187,000 barrels a day (b/d) from 116,000 b/d.

The $2.1bn EPC work for the SRIP, which was awarded to a consortium of South Koreas Daelim Industrial and UK-based Petrofac in 2013, is expected to be completed by November 2016.

The new units include vacuum distillation, hydrocracker, delayed coker, bitumen blower and MTBE production.

Orpics PP facility in Sohar has been running at less than 60 per cent capacity due to a lack of propylene feedstock, but the SRIP will backfill that shortfall to ramp the plant up to 100 per cent.

Orpic insight

Orpic employs 2,400 people, three-quarters of whom are Omani, and expects to create 1,600 additional jobs with the expansion projects between 2014 and 2018.

The companys medium-term plans include a potential privatisation, but this is unlikely to happen until towards the end of the decade, according to Al-Mahruqi.

Orpic is on track to be privatized, said the CEO. We are very excited about the opportunity and we see it as a motivation for the organisation to improve in general and be ready, and maximise the commercial capabilities inside the company.

We need to build a strong commercial company that is able to attract local and international investors.

Orpic estimates that its operations represented about 6 per cent of Omans total GDP in 2014, and booked earnings before interest, tax, depreciation and amortisation (EBITDA) of $215m in the first half of 2015.

Major flotation

An initial public offering (IPO) of the size of Orpic would likely have a major impact on the Muscat Securities Market if the government chose to list the company on Omans only stock exchange.

With the government, which is a shareholder in this company, we are working to design the right planning, said Al-Mahruqi. This has to take into account the internal factors at Orpic and how advanced we are in realising our projects and whether the stock market is really ready for an IPO of our size.

For the timing, I expect [the flotation] before 2020, but I do not know which year yet.

Significant challenge

Given the surging domestic demand for fuel, Orpic faces a significant challenge in meeting the sultanates future consumption needs.

Orpic estimates that Omans fuel demand will grow at five times the average global increase, with a forecast compound annual growth rate of 10 per cent between 2015 and 2025.

Demand for gasoline increased by a huge 10.8 per cent a year between 2006 and 2013.

When the SRIP is completed at the end of 2016, Orpic will have a combined refining capacity of 293,000 b/d from its two sites. According to the companys forecasts, this means demand is set to overtake supply by 2023 if no new refining capacity is brought online.

Difficult time

Orpic is expanding at a difficult time in the oil and petrochemicals industry.

The fall in oil prices has squeezed the profit margins of gas-based petrochemicals producers, while slower economic growth in China leaves fewer opportunities for new GCC producers to export.

But the Liwa Plastics scheme is an important part of Muscats strategy to diversify the economy and decrease reliance on oil and gas. It could also provide the building blocks for downstream industries to create further jobs for Omanis.

Orpic will be hoping for an EPC competitive bidding process to keep the costs down for one of the largest projects ever undertaken in Oman.

You might also like...

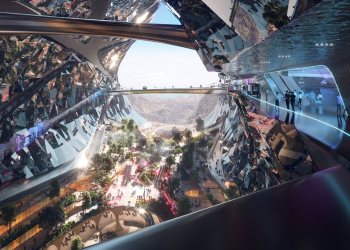

Neom seeks firms for the Vault at Trojena

06 May 2024

Acwa Power signs 5GW Uzbek deal

06 May 2024

Dana Gas restores production at Iraqi gas field

06 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.