Offer values company at just £6.4m

Irish oil company Petroceltic has advised its shareholders to accept a takeover offer from Sunny Hill, a subsidiary of Swiss-based Worldview, at just £0.03p a share.

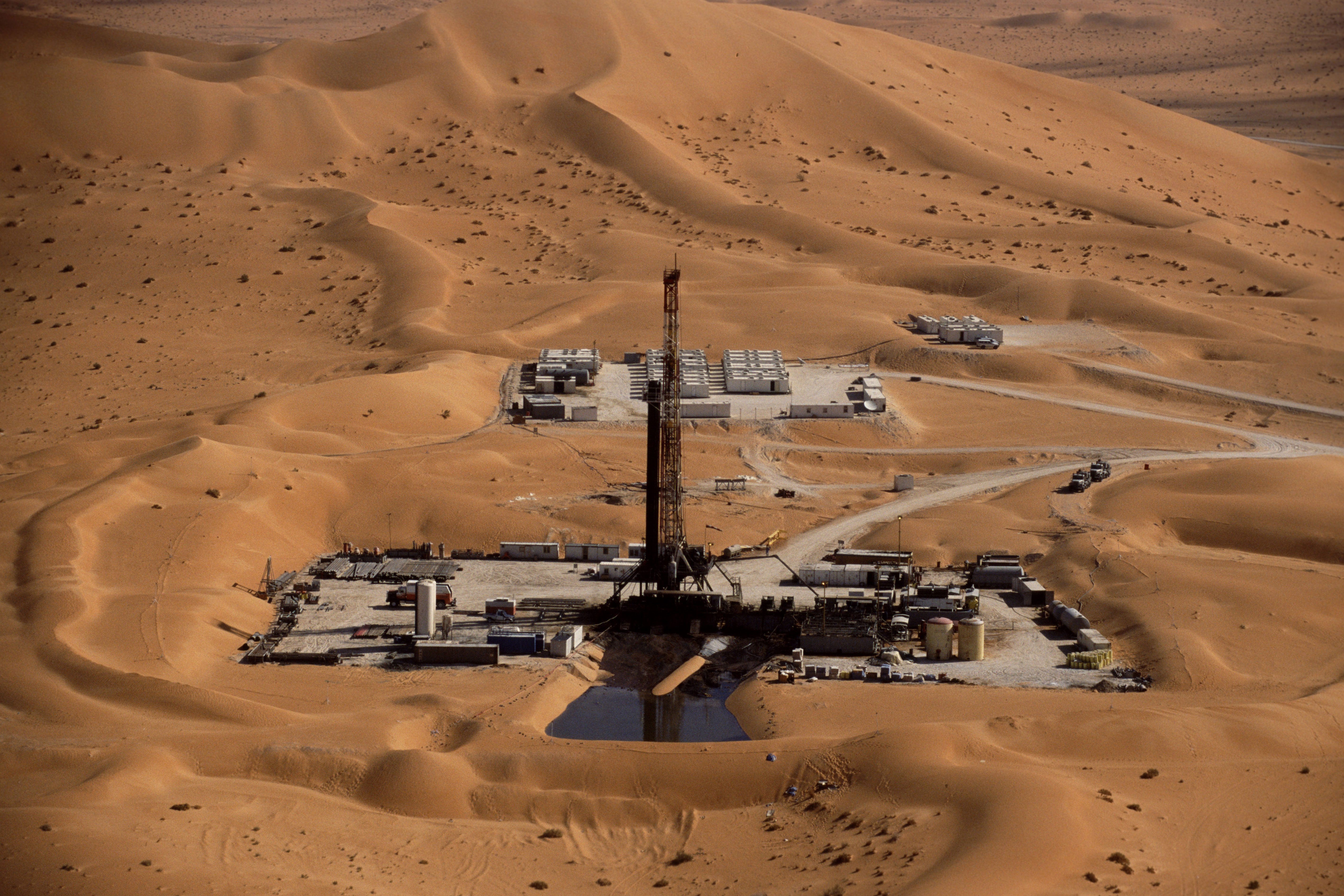

The offer values Petroceltic at just £6.4m ($9.1m), despite its 38.25 per cent stake in the 355 million cubic-foot-a-day (cf/d) Ain Tsila gas field in Algeria.

Skye Investments, which owns 19.4 per cent of Petroceltic, rejected the £6.4m offer when it was announced in March, saying it substantially undervalued Petroceltic.

The takeover cannot proceed until 90 per cent of shareholders approve it. Worldview owns 29.6 of Petroceltic shares, which were suspended at £0.075.

Worldview bought up 69.4 per cent of Petroceltics $233m of debt, effectively taking control of the examinership process. It then transferred 32 per cent of the debt to a company registered in the Cayman Islands.

Worldview filed a petition to appoint an examiner at the Irish High Court in early March, without prior notice to Petroceltic. The case was adjourned until 8 April.

Petroceltic and Worldview have been engaged in a dispute since 2014. Worldview accused Petroceltic of poor management and investment decisions, while Petroceltic alleged that Worldview was attempting to drive down the shareprice to avoid paying fair value for a takeover.

Petroceltic signed a $500m syndicated loan deal in 2013 to develop Ain Tsila. The mandated lead arrangers were UK-based HSBC, the International Finance Corporation (part of the Washington-based World Bank Group), South Africas Nedbank and UK-based Standard Chartered.

The debt was called in in late 2015 after Petroceltic missed development milestones at Ain Tsila. It was then unable to pay, but secured waivers until March.

Standard Chartered and Nedbank still retain some of the debt, according to press reports.

Drilling of the first well, by Chinas Sinopec, at Ain Tsila began in February and is progressing well. An engineering, procurement and construction (EPC) tender for the $2bn field development is expected soon.

Algerian state-owned Sonatrach and Italys Enel also own stakes in the development.

You might also like...

TotalEnergies to acquire remaining 50% SapuraOMV stake

26 April 2024

Hyundai E&C breaks ground on Jafurah gas project

26 April 2024

Abu Dhabi signs air taxi deals

26 April 2024

Spanish developer to invest in Saudi housing

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.