Oil prices rose by a further dollar in mid-July, ahead of an OPEC meeting on 21 July which is expected to rubber stamp a further 500,000-barrel-a-day (b/d) quota increase in output from 1 August. However, most of the indicators were bearish, with stocks rising and actual and potential supply disruptions abating. Spot Brent was trading at $36.90 a barrel on 14 July, compared with $35.90 a week earlier.

The International Energy Agency (IEA) released its monthly report on 13 July, sending an unusually reassuring note to consumers accustomed to reports raising demand growth forecasts and bewailing OPEC's lack of concern at high prices. IEA figures suggest that OPEC members, excluding Iraq, produced about 26.9 million b/d in June - making the debate at OPEC's Vienna gathering on whether to raise the quota to 26 million b/d somewhat academic. The agency also noted that while forecasts for 2004 demand growth have been constantly revised upwards, the pace of the increase is likely to slow in 2005. However, a word of warning was sounded about recent oil industry events in Russia. The arrest of Yukos' main shareholder Mikhail Khodorkovsky and a threat by the courts to freeze the company's assets over unpaid taxes 'open up questions about longer-term growth and investment in the Russian upstream', the report said. But hopes of a resolution to the stand-off between the authorities and Yukos have risen with a proposal on the table for the billions of dollars owed by the local oil giant to be paid in installments. In Nigeria, actual supply disruption caused by a strike by workers at France's Total, protesting at the threat of job cuts, came to an end. The action had caused Total to declare force majeure, taking out 235,000 b/d of the country's production. Pushing prices in the opposite direction was a serious fire at a Norwegian refinery owned by the local Statoil, preventing gasoline sales from one of Europe's main export terminals and tightening an already tight market for the product. The incident was the second in as many months, following a general strike in June, in which the usually peaceful Scandinavian state has contributed to price rises. US inventory data released on 14 July was relatively neutral. Crude inventories fell by 0.7 per cent to 302.9 million barrels, while gasoline stocks rose 0.6 per cent to 205.9 million barrels.

You might also like...

UAE rides high on non-oil boom

26 April 2024

Qiddiya evaluates multipurpose stadium bids

26 April 2024

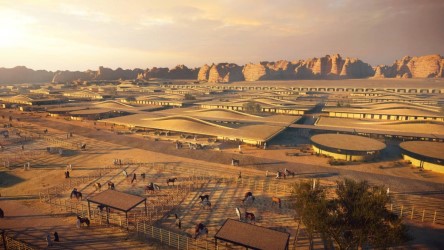

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.