Qatar issue shows appetite for Middle East bonds still high

Qatar National Bank (QNB), one of the largest banks in the region, completed a $1bn bond issue on 7 November after attracting offers of $3.4bn, indicating that appetite for Middle East debt remains high.

The bank priced the deal, which matures in 2018, at 3.375 per cent. Germany’s Deutsche Bank, the UK’s HSBC and Standard Chartered, Japan’s Mitsubishi UFJ, and QNB Capital arranged the deal. It brings the total that QNB has borrowed this year so far to almost $4bn. In February, the bank did another $1bn bond issue and in August it borrowed $1.8bn from other lenders.

Although QNB did not specify what it would use the proceeds for, it is becoming increasingly acquisitive. It is planning to buy France’s Societe Generale’s 77.2 per cent stake in Egypt’s National Societe Generale Bank.

You might also like...

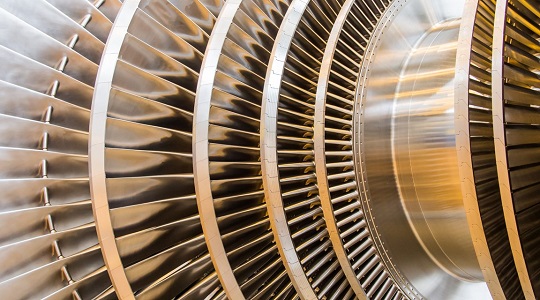

Amiral cogen eyes financial close

26 April 2024

Lunate acquires 40% stake in Adnoc Oil Pipelines

26 April 2024

Saudi Arabia's Rawabi Holding raises SR1.2bn in sukuk

26 April 2024

Iraq oil project reaches 70% completion

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.