State-owned oil company and France’s Total have secured the banking commitments needed to finance their $9.6bn refinery at Jubail in Saudi Arabia, bankers close to the deal tell MEED

However, the companies’ advisers are keeping the door open to international banks that missed the 18 September deadline to provide financing offers, to ensure the deal receives the best possible terms.

“Not all the responses from banks are in yet, but it is clear that the Saudi tranche is significantly oversubscribed, and the inter-national bank portion is already oversubscribed,” says one banker working on the project.

Aramco and Total want to raise $8.3bn in debt to finance most of the $9.6bn project.

The refinery, which will be developed by Saudi Aramco & Total Refining & Petrochemical Company (Satorp), will receive the remaining $1.3bn capital in the form of equity from Aramco and Total.

The $8.3bn debt is split into a $1.4bn international bank tranche, a $1.4bn Saudi bank tranche, and a $2.2bn guaranteed loan from an as yet unnamed export credit agency.

There is also $3.3bn in loans from the Saudi Industrial Development Fund and the Public Investment Fund.

The banker says that although the project is already oversubscribed, Satorp will accept further submissions from banks as Aramco is keen to pay as little as possible for borrowing the money.

“Aramco is keen to set a new pricing benchmark,” says the banker.

You might also like...

UAE rides high on non-oil boom

26 April 2024

Qiddiya evaluates multipurpose stadium bids

26 April 2024

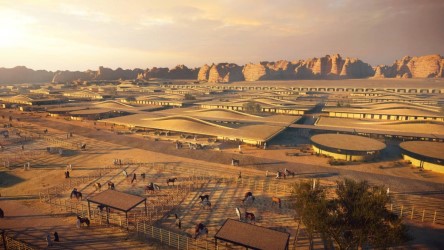

Al Ula seeks equestrian village interest

26 April 2024

Morocco seeks firms for 400MW wind schemes

26 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.