National Titanium Dioxide Company aims to refinancing existing debt through sharia-compliant syndicated loan

National Industrialisation Company, one of the top chemicals and industrial conglomerates in Saudi Arabia, has said one of its subsidies has raised SR6.96bn ($1.86bn) in financing from banks.

Tasnee, as the company is known, said its unit, The National Titanium Dioxide Company (Cristal), has signed a syndicated Islamic finance and working capital deal with its existing banks.

The financing agreement has a bullet repayment at the end of the third year, with an option for Cristal to extend for an additional two years if conditions are met, Tasnee said in a statement on the Saudi Stock Exchange (Tadawul), where its shares are traded. It did not provide the pricing details or the names of the lenders who have provided the funds.

The purpose of the facilities is to refinance the companys existing liabilities, the Tasnee statement said, adding that the new funding deals will provide Cristal, which is 79 per cent owned by Tasnee, with a viable capital structure and will provide a solid foundation for future growth.

You might also like...

UK firm wins Sitra wastewater EPC contract

06 May 2024

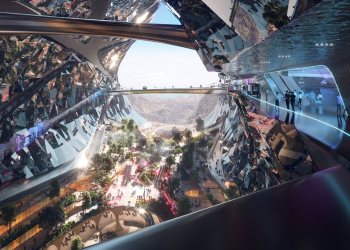

Neom seeks firms for the Vault at Trojena

06 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.