Egypt will not reduce income tax on companies operating within the newly established SCzone

Egypts Ministry of Investment says it will not reduce the income tax rate applied on investments in the Suez Canal economic zone.

The tax currently sits at 22.5 per cent with investment minister Ashraf Salman saying in a press briefing on 18 January the government conducted comprehensive studies, comparing the tax value applied in neighbouring economic zones. Only the Moroccan market imposes a lower tax, at 19 per cent.

There have been talks of the government reducing the tax for the SCZone in a bid to better attract investment. But it has now been confirmed that this rate will not be reduced to rates seen in the past under previous governments.

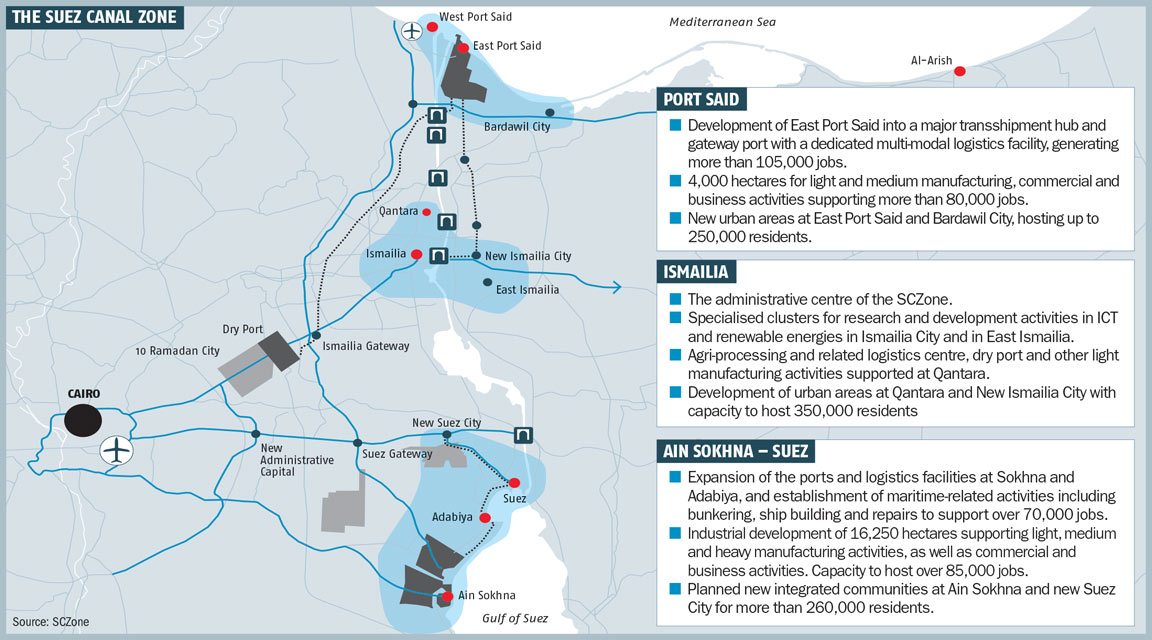

Egypt has historically only one economic zone, the North-West Suez Gulf Economic Zone, which used to offer tax breaks of up to 10 per cent. This economic zone was transformed into the Suez Canal Economic Zone (SCZone) , which has an independent law and is permitted to issue licences for investors and undertake decisions to initiate operation.

The government has approved a draft decree establishing the General Authority of the Economic Zone of the Suez Canal (GAESC), changing the area into an economic authority, allowing the SCZone to act as a single window able to deal with investors directly.

You might also like...

UAE firm breaks ground on Kezad food facility

17 May 2024

Chinese firm signs National Housing Company deal

17 May 2024

Two bid for 90-100MW Bahrain solar contract

17 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.