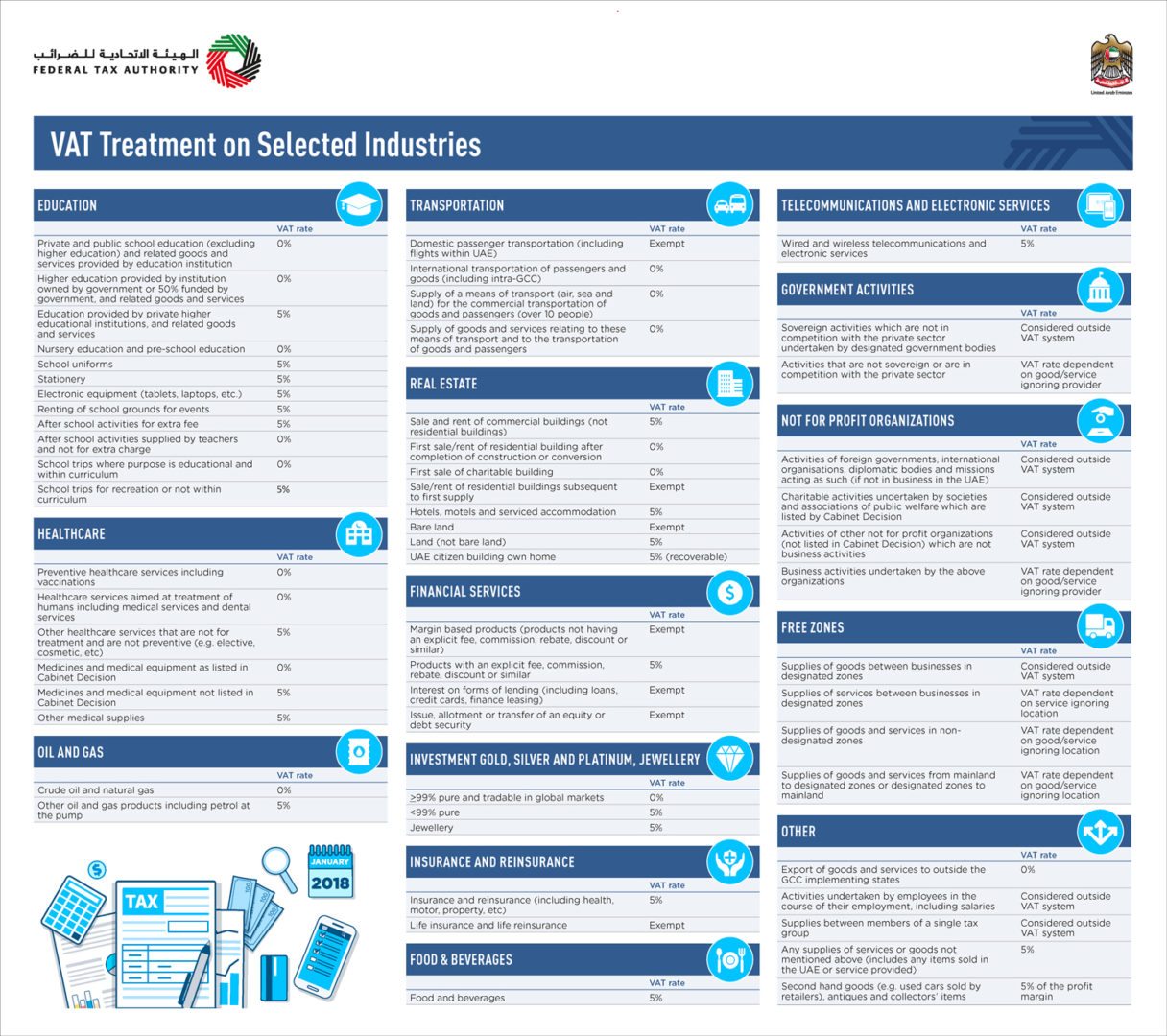

UAE’s Federal Tax Authority (FTA) has issued the list of supplies that will be subject to or exempt from the 5 per cent value added tax (VAT) once it is implemented on 1 January.

The VAT will apply to specific supplies and services in education, health care, oil and gas, financial services, real estate, hospitality, investment, precious metals and jewellery, telecoms, insurance and reinsurance and food and beverage (see list below).

Services in some sectors like transportation will not be subject to VAT.

School fees, preventive healthcare services including vaccinations, issue, allotment or transfer of an equity or debt security, and 99 per cent pure gold materials that are tradeable are among the products and services exempt from VAT.

Export of goods and services to outside the GCC states implementing VAT and the activities of not for profit organisations are also considered outside the scope of the VAT system.

VAT treatment on selected industries (Source: UAE Federal Tax Authority)

| Education | VAT rate |

| Private and public school education (excluding higher education) and related goods and services provided by education institution | 0% |

| Higher education provided by institution owned by government or 50% funded by government, and related goods and services | 0% |

| Education provided by private higher educational institutions, and related goods and services | 5% |

| Nursery education and pre-school education | 0% |

| School uniforms | 5% |

| Stationery | 5% |

| Electronic equipment (tablets, laptops, etc.) | 5% |

| Renting of school grounds for events | 5% |

| After school activities for extra fee | 5% |

| After school activities supplied by teachers and not for extra charge | 0% |

| School trips where purpose is educational and within curriculum | 0% |

| School trips for recreation or not within curriculum | 5% |

| Healthcare | VAT rate |

| Preventive healthcare services including vaccinations | 0% |

| Healthcare services aimed at treatment of humans including medical services and dental services | 0% |

| Other healthcare services that are not for treatment and are not preventive (e.g. elective, cosmetic, etc) | 5% |

| Medicines and medical equipment as listed in Cabinet Decision | 0% |

| Medicines and medical equipment not listed in Cabinet Decision | 5% |

| Other medical supplies | 5% |

| Oil and Gas | VAT rate |

| Crude oil and natural gas | 0% |

| Other oil and gas products including petrol at the pump | 5% |

| Transportation | VAT rate |

| Domestic passenger transportation (including flights within UAE) | Exempt |

| International transportation of passengers and goods (including intra-GCC) | 0% |

| Supply of a means of transport (air, sea and land) for the commercial transportation of goods and passengers (over 10 people) | 0% |

| Supply of goods and services relating to these means of transport and to the transportation of goods and passengers | 0% |

| Real estate | VAT rate |

| Sale and rent of commercial buildings (not residential buildings) | 5% |

| First sale/rent of residential building after completion of construction or conversion | 0% |

| First sale of charitable building | 0% |

| Sale/rent of residential buildings subsequent to first supply | Exempt |

| Hotels, motels and serviced accommodation | 5% |

| Bare land | Exempt |

| Land (not bare land) | 5% |

| UAE citizen building own home | 5% (recoverable) |

| Financial services | VAT rate |

| Margin based products (products not having an explicit fee, commission, rebate, discount or similar) | Exempt |

| Products with an explicit fee, commission, rebate, discount or similar | 5% |

| Interest on forms of lending (including loans, credit cards, finance leasing) | Exempt |

| Issue, allotment or transfer of an equity or debt security | Exempt |

| Investment gold, silver and platinum, jewellery | VAT rate |

| ≥99% pure and tradable in global markets | 0% |

| <99% pure | 5% |

| Jewellery | 5% |

| Insurance and Reinsurance | VAT rate |

| Insurance and reinsurance (including health, motor, property, etc) | 5% |

| Life insurance and life reinsurance | Exempt |

| Food & Beverages | VAT rate |

| Food and beverages | 5% |

| Telecommunications and electronic services | VAT rate |

| Wired and wireless telecommunications and electronic services | 5% |

| Government activities | VAT rate |

| Sovereign activities which are not in competition with the private sector undertaken by designated government bodies | Considered outside VAT system |

| Activities that are not sovereign or are in competition with the private sector | VAT rate dependent on good/service ignoring provider |

| Not for Profit Organizations | VAT rate |

| Activities of foreign governments, international organisations, diplomatic bodies and missions acting as such (if not in business in the UAE) | Considered outside VAT system |

| Charitable activities undertaken by societies and associations of public welfare which are listed by Cabinet Decision | Considered outside VAT system |

| Activities of other not for profit organizations (not listed in Cabinet Decision) which are not business activities | Considered outside VAT system |

| Business activities undertaken by the above organizations | VAT rate dependent on good/service ignoring provider |

| Free zones | VAT rate |

| Supplies of goods between businesses in designated zones | Considered outside VAT system |

| Supplies of services between businesses in designated zones | VAT rate dependent on service ignoring location |

| Supplies of goods and services in non-designated zones | VAT rate dependent on good/service ignoring location |

| Supplies of goods and services from mainland to designated zones or designated zones to mainland | VAT rate dependent on good/service ignoring location |

| Other | VAT rate |

| Export of goods and services to outside the GCC implementing states | 0% |

| Activities undertaken by employees in the course of their employment, including salaries | Considered outside VAT system |

| Supplies between members of a single tax group | Considered outside VAT system |

| Any supplies of services or goods not mentioned above (includes any items sold in the UAE or service provided) | 5% |

| Second hand goods (e.g. used cars sold by retailers), antiques and collectors’ items | 5% of the profit margin |

You might also like...

Saudi Arabia seeks K9 PPP project interest

25 April 2024

Kuwait reviews 1.1GW solar prequalifications

25 April 2024

LIVE WEBINAR: Abu Dhabi Oil & Gas 2024

25 April 2024

Qiddiya tenders site office package

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.