UAE’s central bank puts off new regulations to limit lending concentrations

The Central Bank of the UAE has said it is delaying a new rule that would put a cap on how much exposure banks can hold to the government and state-owned companies that was meant to have been in force since the end of the September.

The rule would have forced many banks to sell of their government-related exposures, despite those assets generally being of high credit quality.

The central bank said in a statement that it had delayed implementing the rule until “all items of the regulation are reviewed with banks”. Many banks are already in breach of the limits, which cap total exposure to government entities at 100 per cent of their capital base and single-borrower limits to 25 per cent of their capital. As a result, banks had been petitioning the regulator for more time to comply with the limits.

Plans to force banks to hold high-quality liquid assets equal to 10 per cent of their liabilities from the start of 2013 have also been delayed.

You might also like...

Red Sea Global awards Marina hotel infrastructure

18 April 2024

Aramco allows more time for MGS package revised prices

18 April 2024

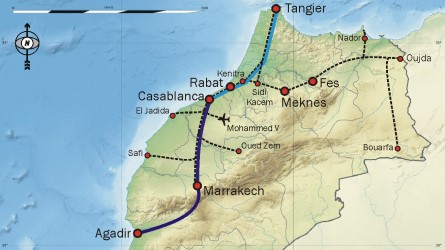

Morocco tenders high-speed rail project

18 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.