Ongoing fiscal reforms aim to keep country in good stead as oil prices are expected to stay lower for longer

The suspension of the tender for the second phase of the UAEs Etihad Rail, which came two weeks after the employee headcount at the firms Abu Dhabi base was reduced by 30 per cent, sent a strong message to the market that business is not as usual in the UAE capital.

Washington-based IMF expects the UAEs 2016 deficit to head to around 7.5 per cent, or even 8 per cent according to the Institute of International Finance (IIF), subject to oil price status for the rest of the year.

Indeed the UAE economy, of which Abu Dhabi accounts for two-thirds, is thought to have registered a fiscal deficit of between 3 and 5 per cent of its GDP in 2015, following several years of strong budget surpluses. It is the first time the country has run a deficit since 2009, when the global economic crisis hit.

Unlike in 2009, however, when oil prices recovered quickly, the current volatility in oil prices is a function of supply and is expected to last longer, which means deficit, rather than surplus, is likely to become the new normal for oil-exporting countries such as the UAE.

As a result, further job cuts and the cancellation of planned projects may be unavoidable.

Declining economy

Like most of its neighbours, the UAEs economy has been in expansionary mode in recent years.

At AED480.8bn ($131bn), government expenditure in 2014 the latest available full-year data was 11 per cent higher than for the previous year. Spending also accounted for 87 per cent of revenues, with a surplus of AED73bn added into international financial reserves, which the country has grown during the period of high oil prices.

Early signs of difficulties were appearing, however, in 2014. The government surplus for the year was only half that recorded in 2013, as total government revenues contracted 5 per cent due to a significant reduction in revenues from individual emirates. The seven emirates contribute up to 85 per cent of the countrys total revenue, with 15 per cent coming from the federal government. Taxes, mostly fees paid by hotels and restaurants, fees on foreign banks profits, and royalties on oil and natural gas, fell by AED39bn or 12.2 per cent, in line with the fall in oil prices, the UAE central banks annual report stated.

The central bank in July 2015 further estimated that government revenues in 2015 would likely fall by 22.4 per cent to AED430bn, creating a potential deficit of AED30.6bn.

Click the legend to manipulate the data. Source: UAE Central Bank

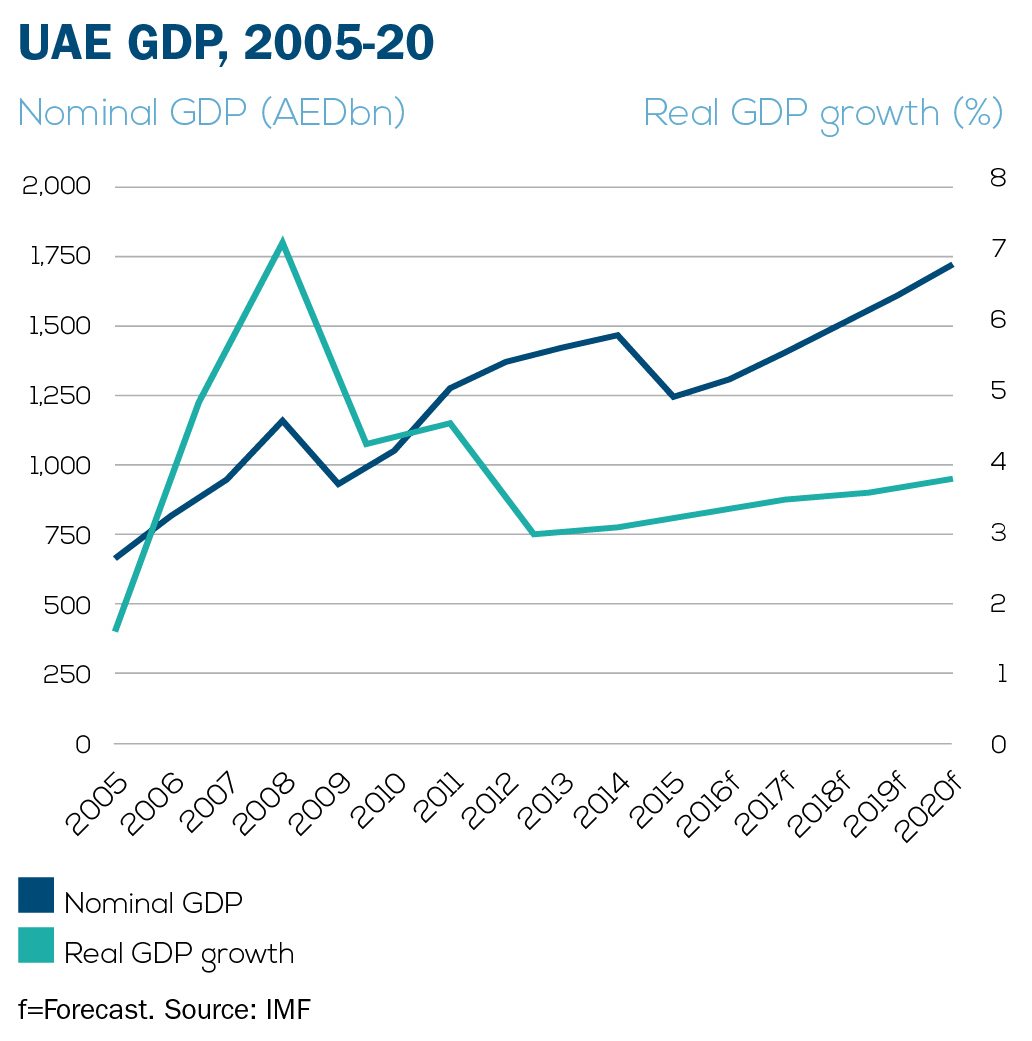

The UAEs nominal GDP was to have contracted by 15 per cent for 2015, to AED1.24 trillion ($339bn), although the IMF and IIF expect a 2.5 to 2.6 per cent growth for 2016, and the UAE Economy Ministry expects a slightly higher growth rate of 3 per cent .

While the 2015 GDP decline is still mild compared with that seen in 2009, when real GDP contracted by more than 5 per cent and the country ran its last fiscal deficit, the short-term economic outlook is hardly positive, with ratings agencies predicting that oil prices will dip further this year than the recent $27 a barrel low.

| UAE nominal GDP and real GDP growth, 2005-20 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Source: IMF | ||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Nominal GDP (AEDbn) | 663.3 | 815.7 | 947.2 | 1,158.6 | 931.2 | 1,050.5 | 1,276.0 | 1,371.4 | 1,422.0 | 1,467.0 | 1,245.3 | 1,308.2 | 1,405.2 | 1,507.3 | 1,609.0 | 1,722.0 |

| Real GDP growth (%) | 4.9 | 9.8 | 3.2 | 3.2 | - 5.2 | 1.6 | 4.9 | 7.2 | 4.3 | 4.6 | 3.0 | 3.1 | 3.3 | 3.5 | 3.6 | 3.8 |

| UAE government expenditure by activity, 2014 (AEDbn) | |

|---|---|

| Compensation of employees | 47.2 |

| Use of goods and services | 54.4 |

| Consumption of fixed capital | 3.7 |

| Interest | 3.1 |

| Subsidies | 19.8 |

| Grants | 21.9 |

| Social benefits | 54.7 |

| Other expenses | 241.3 |

| Net acquisition of non-financial assets | 34.7 |

| Total | 480.8 |

| Source: UAE central bank | |

Budgets for 2016

*=General and administrative expenses, capital expenditures and grants/subsidies. Source: Dubai Department of Finance

Dubai announced in its recently released budget that for 2016, it would spend AED46.1bn, a 12 per cent increase on 2015. The emirate contributes 10 per cent of the total UAE budget.

Abu Dhabi has yet to release its 2016 budget and there is some doubt about whether it will publicly announce it.

In the interim, US ratings agency Standard & Poors (S&P) has said the Abu Dhabi government is limiting its spending to 1/12th of the 2015 budget per month, the de-facto practice when a budget has yet to be approved and the year has already started.

Since Abu Dhabi accounts for two-thirds of the UAEs nominal GDP, the measures it has adopted or plans to adopt to address the effects of falling oil prices are of paramount importance to the entire economy.

Unlike Dubai, which earns negligible revenue from oil, the Abu Dhabi government derives more than 90 per cent of its revenues from petroleum-related royalties and other taxes. The US Fitch Ratings estimated the 2015 budget deficit in the capital to be 13.2 per cent of its GDP, while S&P forecast a deficit of about 5 per cent of GDP from 2016 to 2019.

The cancellation of the second phase of the Etihad Rail tender, which is designed to link Abu Dhabi with the planned GCC rail network, seems to have validated the capitals intention to adopt major austerity measures in 2016. The decision is seen as a strong indicator of the emirates intention to proceed only with the most essential schemes in 2016 and over the short-to-medium term, creating a strong sense of insecurity.

Source: Statistics Centre Abu Dhabi

| Figure 6: Distribution of Abu Dhabi government expenditures, 2014 (%) | ||

|---|---|---|

| Source: Statistics Centre Abu Dhabi | ||

| Curent expenditures | Salaries and wages | 12.4 |

| Goods and services | 10.9 | |

| Current transfers | 52.9 | |

| Capital expenditures | Development expenditures on government projects | 5.8 |

| Capital expenditures on goods and services | 0.2 | |

| Capital transfers | 17.8 | |

Fiscal buffers

Monica Malik, chief economist at Abu Dhabi Commercial Bank, however, argues that the capital in particular began introducting fiscal reforms ahead of the recent oil price decline and that such strategic decisions would help the UAE economy to stay afloat.

The fact that Abu Dhabi started progressing with reforms, including reducing subsidies on fuel and utilities, is positive for fiscal sustainability, she says. Fiscal consolidation would continue to be a key objective for Abu Dhabi for 2016 and over the medium term.

The UAE central bank, for instance, has said the removal or reduction of subsidies on transport fuel and utilities alone will save the government an estimated $1.85bn in 2016.

The strong fiscal buffers, including strong foreign exchange reserves and low debt levels, are key supports to Abu Dhabis economy, according to Malik, who expects continued capital spending with a focus on critical infrastructure, such as those in oil and gas production, and airports.

However, unlike the global downturn in 2009, when the oil price recovered quickly, the current oil price is expected to stay lower for a longer period of time.

Alternative revenues

Fitch Ratings has said it expects the Abu Dhabi government to finance its 2016 and 2017 deficits through a combination of transfers from Abu Dhabi Investment Authority [ADIA], the dividends from Abu Dhabi National Oil Company [Adnoc], issuance of bonds and some further draw-down of general government deposits.

The ratings agency predicts Abu Dhabi will issue AED40bn of bonds in the local market in 2016, and a further AED60bn in 2017, which would effectively replace the AED100bn certificates of deposits issued by the central bank and held by local lenders. This measure, the ratings company said, will help stem the depletion of ADIA assets, which are likely to have a higher expected rate of return compared to local debt.

Malik agrees, saying the measures prescribed by Fitch Ratings, in addition to the ongoing fiscal reforms, will help Abu Dhabis economy stay afloat over the long term.

It is generally agreed these measures, primarily the reduction of fuel subsidies to keep a lid on expenditure and measures to maintain low debt levels, constitute a strong, long-term framework to combat some of the key vulnerabilities that an oil-dependent economy has created.

With such measures in place, Malik is confident that Abu Dhabis foreign assets, estimated by Fitch Ratings to be worth in excess of $500bn as of the end of 2014, could last multiple decades.

You might also like...

Iraq oil project reaches 70% completion

26 April 2024

Samana announces $272m Dubai Lake Views project

26 April 2024

Iraq signs deal to develop the Akkas gas field

25 April 2024

Emaar appoints beachfront project contractor

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.