Increasing violence and shifting territories may force oil companies to cut investment

Escalating violence and territorial gains by Houthi fighters are making maintaining oil operations in Yemen increasingly difficult and are weighing on oil production as new deals have to be forged with local power-brokers.

Over recent weeks, Houthi rebels have been engaged in fierce battles with both government troops, in the city of Amran and the surrounding area, and with Sunni tribesmen in the countrys north.

Adding to difficulties for oil companies, the 438-kilometre Maarib pipeline was bombed by tribesmen on 12 July, disrupting supplies from the interior to the Ras Isa export terminal on the Red Sea. The attack came just weeks after the pipeline was repaired in late May following a previous attack.

The pipeline has been regularly targeted by attacks since 2011, when long-serving President Ali Abdullah Saleh was forced to step down, and was most recently repaired in May. Tribesmen use the threat of attacks to push for jobs and other benefits from the government.

For oil companies such as [Austrias] OMV and [Frances] Total, the upheavals in Yemen have created not only new security risks but also a new map of local power, says Khaled Fattah, a non-resident scholar at the Lebanon-based Carnegie Middle East Center.

Fattah says oil companies can only operate in the country as long as they are able to purchase the loyalty of key local tribal leaders, senior military officers and local government officials, and the continuing power struggles make it harder to know who those key figures are.

International oil companies such as OMV, which operates Yemens Habban oil field, and Total, the countrys largest foreign investor, are familiar with the uncertain security situation. However, increased turmoil and shrinking exports is fuelling speculation that they may at some point consider pulling out of the country.

Yemen has 3 billion barrels of proven oil reserves, but since peaking in 2002 at 439,000 barrels a day (b/d), production has steadily declined. In recent months, output has been about 100,000 b/d, which is about half of the output in 2012.

The situation in Yemen appears to be worsening, says Richard Mallinson, North Africa analyst at UK-based Energy Aspects. The signs are that foreign companies and even diplomatic missions are reconsidering their presence in the country in light of the security situation. It might not take much more for companies to suspend their operations in the most vulnerable regions and then it could be a long time before there is enough improvement for them to return.

Total led the project to build the $4.5bn Balhaf gas export terminal, Yemens largest ever industrial project, between 2005 and 2009. Since its construction, the facility has experienced fewer disruptions than the Marib pipeline, but it has not been immune to the deteriorating security situation. An attack in December forced the company to evacuate some foreign workers and earlier in the year, attacks on pipelines feeding the facility disrupted exports.

Total will certainly be watching the situation closely given their heavy investment in Yemen over the past decade, says Mallinson.

When asked about the current security situation and its impact on operations in the country, Total declined to comment. Speaking on 14 July, a spokesman for OMV said the recent bombing of the Marib pipeline caused some short-term interruptions to exports, adding that normal production and delivery had since resumed.

Recent events are likely to have a lasting and destabilising impact on government operations. As well as supplying a floating export terminal in the Red Sea, the Maarib pipeline provides crude to the Aden refinery in Yemens south.

Deprived of supplies via the pipeline, it is likely the refinery will have to suspend operations, forcing the government to import expensive fuel from outside the country, something that will exacerbate its financial problems.

Foreign reserves have shrunk to $4.6bn, the lowest level since the end of 2011, and the country is struggling to implement economic reforms in an effort to secure a long-discussed loan from the Washington-based IMF.

The government earned just $671m from exporting crude in January-May, according to a statement released on 9 July, nearly 40 per cent less than in the same period last year.

As the government struggles with its fiscal crisis, it can spare little funds to support its troops, which are fending off attacks from a separatist movement in the south, and from Al-Qaeda militants, as well as the Houthi rebels.

Over recent months, the Houthi rebels have made gains in Saada, a governorate on the border of Saudi Arabia and have expanded southward to the capital Sanaa, seizing the city of Amran after a fierce three-day battle.

Further expansion of Houthi fighters into the neighbouring provinces of Mareb and al-Jawaf, where the central nervous system of the countrys energy sector is located, will ignite fierce tribal militias confrontations, which if escalated will push oil companies to reduce their activities and even move out, says Fattah.

Sanaa cannot afford to be drawn into a long and expensive conflict and if Houthi rebels continue to spread into new territory, it is likely to cause more disruption to oil operations, further damaging government revenues.

You might also like...

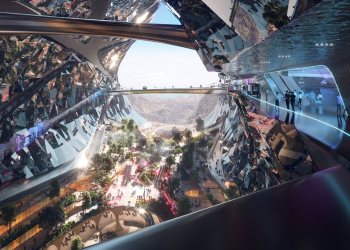

Neom seeks firms for the Vault at Trojena

06 May 2024

Acwa Power signs 5GW Uzbek deal

06 May 2024

Dana Gas restores production at Iraqi gas field

06 May 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.